The market has a way of testing a man, doesn’t it? A little shiver, a dip in the sun, and folks start talking ruin. But a few down days don’t make a drought. The S&P, for all the worry, is barely scratched. This isn’t a collapse, not yet. It’s more a sifting, a winnowing of the brittle from the strong. The tech sector feels the wind more keenly, of course, but beneath the surface, there’s a quiet strength building. I’ve been looking at the land, so to speak, and I see three holdings that might weather this lean season, and even thrive. They aren’t promises, mind you, but a careful man can find opportunity even when the dust is blowing.

Microsoft

Microsoft. It’s a name that used to echo with the promise of a new age, a digital frontier. For a time, they were the clear leaders in this new realm, particularly with their cloud work and the rise of artificial intelligence. Azure powered much of what we now call ‘thinking machines’, including those chat programs everyone’s talking about. They’re still delivering, still growing—revenue up 17%, income climbing a respectable 21% to $81.3 billion. But the market, it seems, wants more than respectable. It wants miracles. It’s a greedy beast, the market, always wanting a bigger harvest than the land can yield.

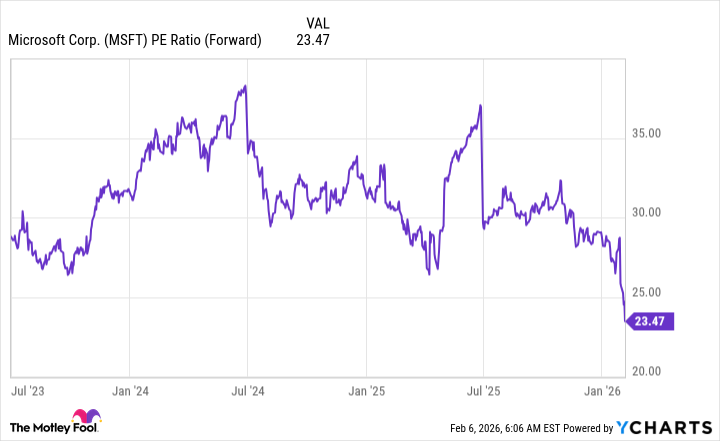

This is a time for prudence, for recognizing value. Microsoft is trading at its lowest price-to-earnings ratio in three years. A careful investor doesn’t chase rainbows; they pick up solid ground when it’s offered at a fair price. It’s a simple thing, really, but often overlooked in the frenzy.

Nvidia

If Microsoft seems a sturdy oak, Nvidia is a lightning strike—a sudden burst of power. They trade at a mere 24 times forward earnings, not much higher than the broader market. Some might see that as a sign of slowing growth, but I see a chance to acquire something truly potent. The world is building, and building fast. Amazon, Alphabet, Meta – they’re pouring capital into the future, over $500 billion between them. And where does that money flow? Into the chips that power it all. Nvidia will receive a significant share, and Wall Street analysts predict a 52% growth rate for fiscal 2027.

It’s a rare thing, to find a company growing at that pace, trading at a reasonable valuation. A good farmer doesn’t pass up fertile land. This is an opportunity, and a man should recognize it as such.

Taiwan Semiconductor Manufacturing

Those hyperscalers, those giants building the future, they need more than just designs. They need someone to forge the silicon, to breathe life into the blueprints. That’s where Taiwan Semiconductor Manufacturing comes in. They’re the world’s leading chip foundry, the heart of the machine. Nvidia designs, but Taiwan Semiconductor builds. Their revenue dwarfs the competition. They are the essential foundation, the unseen labor that makes it all possible.

They’re projecting strong growth in 2026, nearly 30% in U.S. dollars. And artificial intelligence chips are expected to lead the way, growing at a compound annual rate of 60% between now and 2029. That’s not just good for Taiwan Semiconductor; it’s good for Nvidia, and for the entire ecosystem. We’re still in the early days of this revolution, and these three companies are well-positioned to benefit. The land is being prepared, the seeds are being sown. A careful man invests in the tools, and in the hands that wield them.

The world is changing, and it always will. There will be lean years and bountiful harvests. But a man can find stability, even in times of uncertainty, by investing in the things that endure—in the companies that build, that innovate, that power the future. These three stocks aren’t a guarantee, but they’re a good place to start.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-12 17:22