The shimmer of artificial intelligence has caught the light of the market, and for a time, everything seemed lifted, buoyed. But a man who’s seen a few seasons knows that what rises quickly often falls harder. This isn’t about dismissing the promise—it’s about looking past the shine, past the pronouncements, and seeing what endures. The cloud providers, they build their empires, of course, and the companies peddling these new tools see their coffers swell. That’s the way of things. But the ground shifts underfoot, and the winners won’t necessarily be those shouting the loudest.

I’ve been watching these currents for a while now. The easy gains, the broad lift? Those days are likely numbered. A sorting will come. Some will flourish, yes, but many more will find themselves stranded when the tide goes out. Still, there’s work to be done, and a few stones worth turning over, if you know where to look. These aren’t recommendations to chase a frenzy, but observations for those who prefer to build a foundation, not a sandcastle.

1. Nvidia: The Toolmaker’s Burden

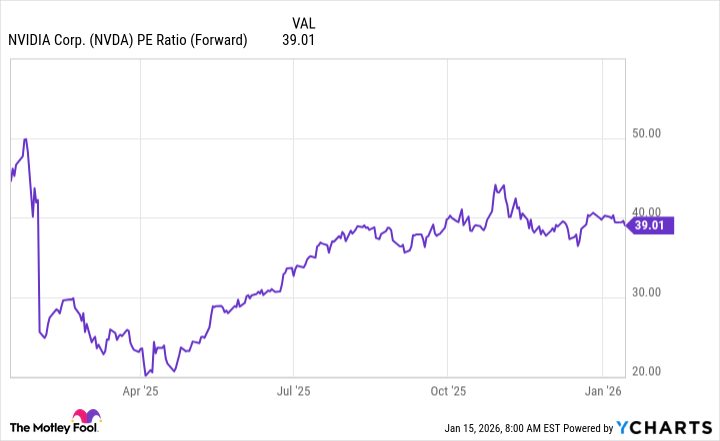

Nvidia, they’ve become the blacksmith of this new age, hammering out the chips that power it all. And for a time, that’s a good place to be. They’re selling shovels in a gold rush, and that’s rarely a bad business. But a blacksmith is only as good as the demand for his tools. And the price of steel, of silicon, can turn quickly. They dominate now, yes, but dominance breeds complacency, and complacency invites challenge. It’s a heavy crown they wear.

They innovate, certainly, and that’s to their credit. But innovation is a treadmill. You must keep running just to stay in place. And they’ve been acquiring, partnering, spreading their reach. That’s a sign of strength, but also of a certain… unease. They know the ground isn’t solid. Still, in this era of building, of relentless expansion, they’ll likely find enough work to keep the forge burning.

2. Taiwan Semiconductor: The Quiet Power

Taiwan Semiconductor Manufacturing, they’re the ones who actually make the tools. The unseen hands, the quiet engine. They don’t get the fanfare, but they benefit from everyone else’s success. Nvidia, Advanced Micro Devices, Broadcom – they all rely on TSMC. That’s a good position to be in. A steady, reliable position. They aren’t chasing the spotlight, they’re simply ensuring the lights stay on.

They beat expectations, of course. Everyone’s doing well in a rising tide. But listen to what they say. They’re talking about strong demand, about the cloud providers building more capacity. That’s not a prediction, it’s a report from the front lines. They see the building, the spending. And they’ll profit from it, quietly and steadily.

3. Amazon: The Old Gardener

Amazon, they’re a different breed. They were building their garden long before anyone else even knew there was a field. They don’t need AI to survive. They’ve got their e-commerce empire, their cloud business, their rivers of revenue. They’re not dependent on this new bloom. They’re simply… adapting.

They’re using AI to make their operations more efficient, to squeeze a little more juice from the orange. And their Amazon Web Services is offering AI tools to others. They’re not betting the farm on this new technology, they’re simply adding another row of crops. It’s a sensible approach, a pragmatic approach. And it’s likely to serve them well.

Their price reflects that stability. They’re not cheap, but they’re not wildly overvalued. They’re a solid tree, weathering the storm.

4. Alphabet: The Mapmaker

Alphabet, much like Amazon, they’ve built a lasting foundation. Advertising, cloud computing – these are businesses that endure. They don’t need AI to thrive. But they’re not ignoring it, either. They’re developing their own tools, offering them through their cloud business. They’re expanding their reach, diversifying their holdings.

They recently hit a milestone – $100 billion in revenue. That’s a testament to their long-term vision, their steady execution. They’re not chasing the latest fad, they’re building a lasting empire. And they’re doing it with a quiet dignity, a subtle grace.

Their price is reasonable, almost… understated. They’re not shouting from the rooftops, they’re simply… existing. And in a world of noise and frenzy, that’s a rare and valuable quality.

5. CoreWeave: The Gambler’s Hand

And now, a risk. CoreWeave. They’re offering capacity, renting out the power of those Nvidia chips. It’s a good business, if you can get it. But it’s a fragile business. They’re relying on debt, on heavy investment. And any slowdown in AI spending could cripple them.

They’re the first to offer the latest Nvidia systems, and that’s a good sign. But it’s also a sign of desperation. They need to stay ahead of the curve, to attract customers. It’s a high-stakes game, and the odds are stacked against them. But if AI continues to soar, if demand remains strong, they could score a major win. It’s a gamble, a long shot. But sometimes, the long shots pay off.

Read More

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-18 20:23