Portfolio adjustments by prominent investors often attract considerable scrutiny. Such movements, while not necessarily predictive, can offer insights into evolving strategic perspectives and risk assessments. This analysis examines the recent trading activity of Stanley Druckenmiller’s Duquesne Family Office, specifically the complete divestment of Eli Lilly shares and concurrent establishment of positions in several artificial intelligence (AI) focused entities.

Dissecting the 13F Filing

Quarterly Form 13F filings provide a snapshot of institutional investment holdings. While these filings are inherently backward-looking and subject to reporting delays, they represent a publicly available data point for assessing investor behavior. The recent filing reveals a notable shift in Duquesne’s portfolio allocation.

- Eli Lilly (LLY): Complete liquidation of 100,675 shares, previously constituting 1.9% of the portfolio. The initial acquisition occurred in the fourth quarter of 2024.

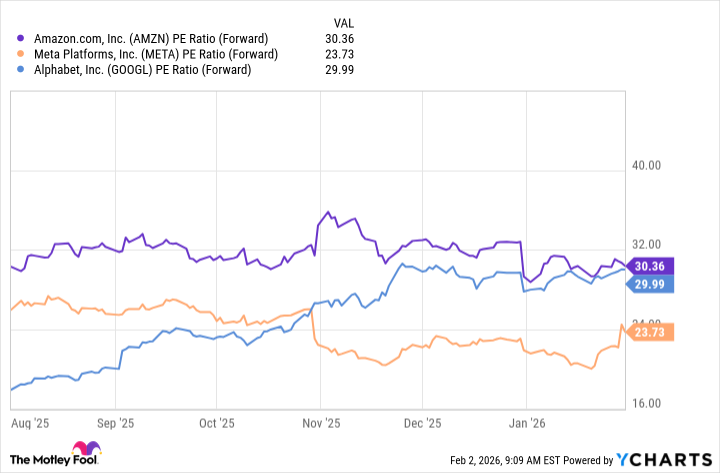

- Amazon (AMZN): Establishment of a new position with the purchase of 437,070 shares, representing 2.3% of the portfolio.

- Meta Platforms (META): Establishment of a new position with the purchase of 76,100 shares, constituting 1.3% of the portfolio.

- Alphabet (GOOGL/GOOG): Establishment of a new position with the purchase of 102,200 shares, representing 0.6% of the portfolio.

Strategic Rationale and Market Context

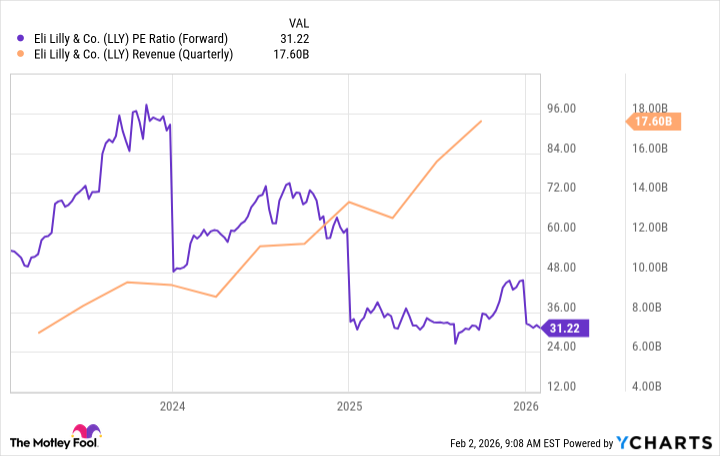

The decision to exit Eli Lilly, a leading player in the rapidly expanding weight loss drug market, warrants consideration. While the projected growth trajectory for this sector remains substantial – estimates suggest a potential $100 billion market valuation – the complete liquidation of the position suggests a more nuanced assessment than simply dismissing the opportunity. A potential explanation lies in the prevailing market valuation. It is plausible that Duquesne determined the risk-reward profile, given prevailing multiples, no longer aligned with its investment criteria.

The concurrent establishment of positions in Amazon, Meta, and Alphabet indicates a strategic emphasis on established technology platforms with demonstrable capacity for AI integration. These entities possess the scale, resources, and existing infrastructure to effectively monetize AI applications across diverse revenue streams. The move appears less a bet on nascent AI technologies and more a conviction in the ability of these established players to capitalize on the transformative potential of AI.

Prior Portfolio Adjustments and Valuation Discipline

It is relevant to note that Duquesne previously reduced or eliminated positions in Nvidia and Palantir Technologies. These actions, coinciding with significant valuation increases for both companies, suggest a consistent adherence to valuation discipline. In a public statement, Druckenmiller articulated concerns regarding Nvidia’s valuation, even while acknowledging the company’s fundamental strengths. This pattern reinforces the notion that portfolio adjustments are driven by a rigorous assessment of risk-adjusted returns, rather than solely by bullish or bearish sentiment towards specific technologies.

Concluding Remarks

The recent portfolio adjustments by Duquesne Family Office do not necessarily imply a negative outlook on the weight loss drug market or emerging AI ventures. Rather, they reflect a strategic shift towards established technology platforms with demonstrable capacity for AI integration, coupled with a consistent emphasis on valuation discipline. The move appears calculated to balance growth potential with downside risk, positioning the portfolio for sustained returns amidst evolving market dynamics. The complete liquidation of Lilly may represent a tactical decision to reallocate capital to opportunities offering a more compelling risk-reward profile, given prevailing market conditions.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- The Weight of Choice: Chipotle and Dutch Bros

2026-02-04 14:23