Oh, the irony of markets! DraftKings (DKNG) missed estimates by a single penny-a financial “snipe hunt” if ever there was one. Yet, here we are, watching shares tumble like a knight’s hat in a strong wind. But fear not, dear reader: sometimes, the market forgets to check its notes. Let’s peek behind the curtain.

The second-quarter report? A feast, not a famine. Revenue hit $1.51 billion, EBITDA danced to $301 million, and net income? A princely $0.38 per share. Compare that to last year’s $0.22, and you’ll see why I’m grinning like a dragon who just found a gold coin in its soup.

But the analysts? Oh, those scribes of spreadsheets! They demanded $0.39 per share-a penny more than the moon demands of the tide. Investors briefly cheered the revenue beat, then panicked when Flutter Entertainment’s shares wobbled like a jester on a tightrope. Yet here’s the rub: this could’ve been a rallying cry, not a dirge.

Buying DraftKings isn’t just about numbers-it’s about buying into a business premise. And the numbers? They’re the heralds of a coming kingdom.

Four Reasons to Raise Your Tankard for DraftKings

1. Growth That Makes a Dragon Jealous

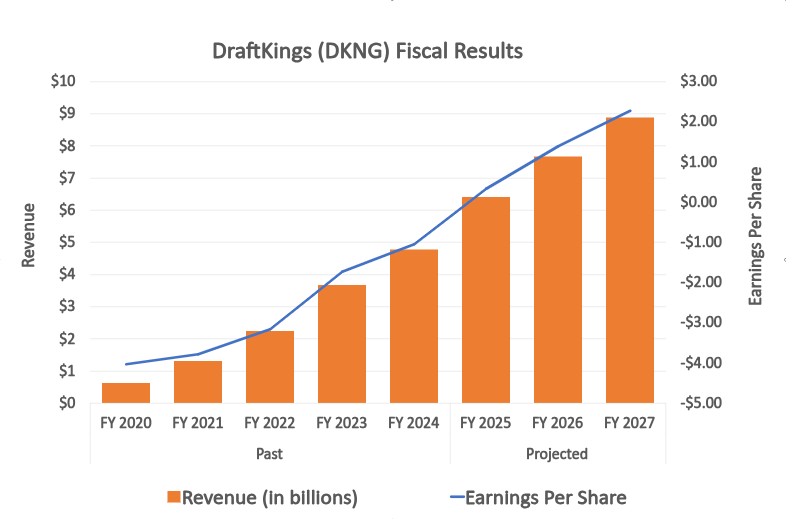

Quarterly revenue growth of 37%? Some might call it a fluke. I call it the work of a company that’s been hoarding treasure for years. This isn’t a one-trick pony-it’s a full-blown treasure trove with a golden goose attached. Still skeptical? Look at the chart. It’s not whispering “sell”; it’s shouting “buy” in all caps.

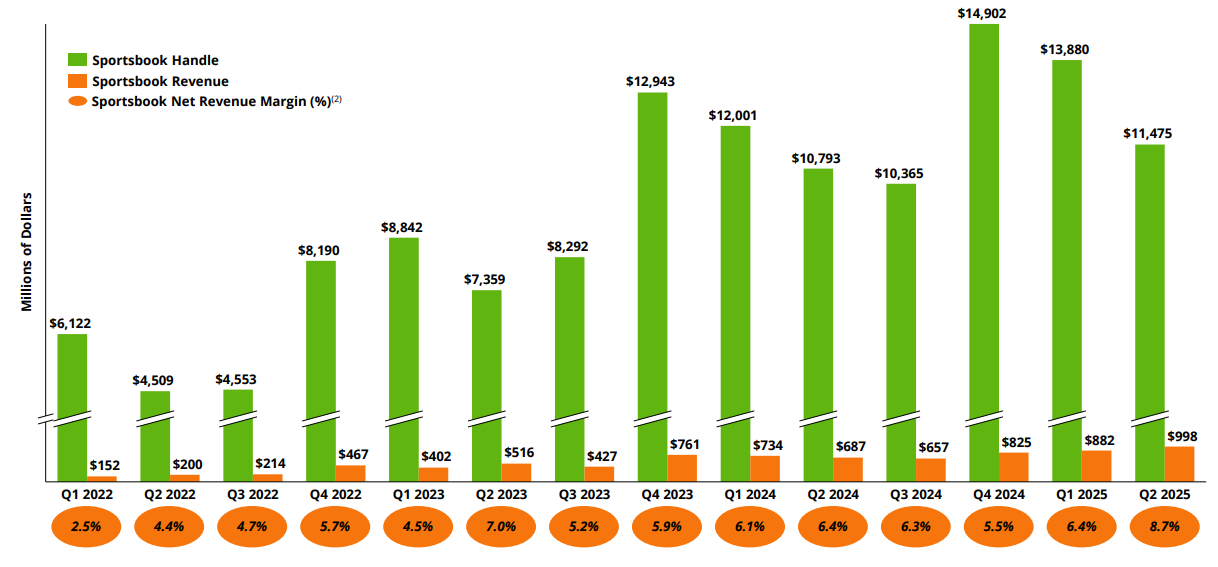

2. Profit Margins That Stretch Like a Stretchy Dragon

While others watch margins shrink like socks in a dryer, DraftKings is turning its sports book into a money-printing mill. Two-thirds of its business? Those margins are widening like the gap between a peasant’s purse and a king’s treasury. Efficiency, my friends, is the new alchemy.

3. A Balance Sheet That Could Teach a Castle a Lesson

High-growth companies often hide debt like a court jester hides turnips. Not DraftKings. It’s got $1.3 billion in the bank-more than enough to outlast the next bear market. Yes, they added $200 million in long-term liabilities, but they also shrunk short-term obligations by $300 million. Capitalization? Clean as a monk’s conscience.

4. A Market Still Half-Untapped, Like a Kingdom Waiting for a Conqueror

Only half the U.S. population has legal access to DraftKings’ sports book. Ten percent for casino? That’s the financial equivalent of finding a kingdom where only half the lords have been crowned. By 2033, online sports betting could hit $58 billion. DraftKings? It’s already got its sword and shield.

5. Analysts: The Unsung Heroes of the Bull Case

Analysts love this stock. A $55.08 price target-27% above current levels-isn’t just a number; it’s a prophecy. While the market panics, Wall Street’s soothsayers are chanting “buy, buy, buy.” Sometimes, the crowd’s right. Especially when they’re holding spreadsheets.

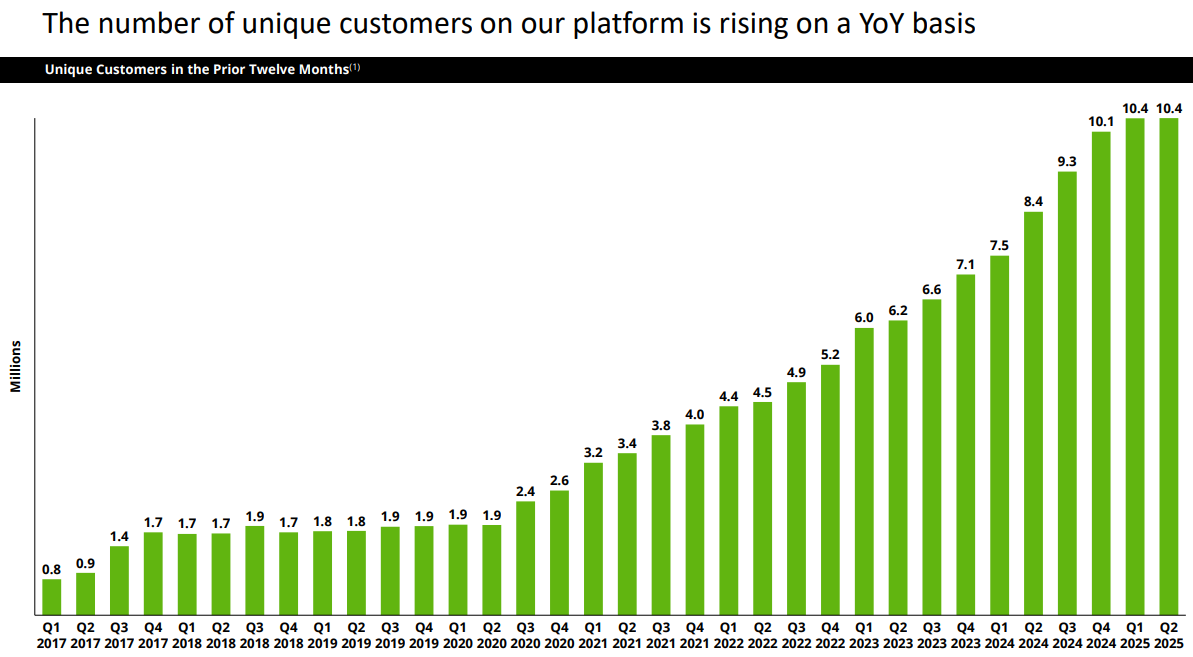

The Bigger Picture: More Than Just a Penny Miss

Yes, DraftKings didn’t add new users between Q1 and Q2. But let’s not conflate a single stumble with a fall. Revenue and ARPU still climbed like a dragon ascending a mountain. And in an industry where growth is the new holy grail, DraftKings is the grail itself.

So, dear reader, while the market frets over a penny, DraftKings is building a legacy. This isn’t a stock for the impatient-it’s for those who understand that value investing is less about timing and more about… well, values. And if you can’t see the castle in the fog, maybe it’s time to polish your spectacles. 🏰

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Top 15 Insanely Popular Android Games

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

2025-08-16 12:49