The Dow, that venerable index, has breached the fifty-thousand mark. A round number, naturally, inciting the usual flurry of excitement amongst those who mistake correlation for causation. It’s a peculiar human habit, this fetish for neatness, as if the market, a creature of capricious impulse, were somehow obliged to acknowledge our fondness for decimal symmetry. One recalls the year nineteen ninety-nine, a vintage of exuberant, if ultimately illusory, prosperity, when ten thousand seemed a Himalayan peak. And then, the rather more recent spectacle of thirty thousand, achieved amidst the peculiar resurrection following the unpleasantness of 2020. Now, fifty. The question, of course, is not merely what happens next, but how predictably we shall misinterpret the signals.

Milestones and the Mirage of Tops

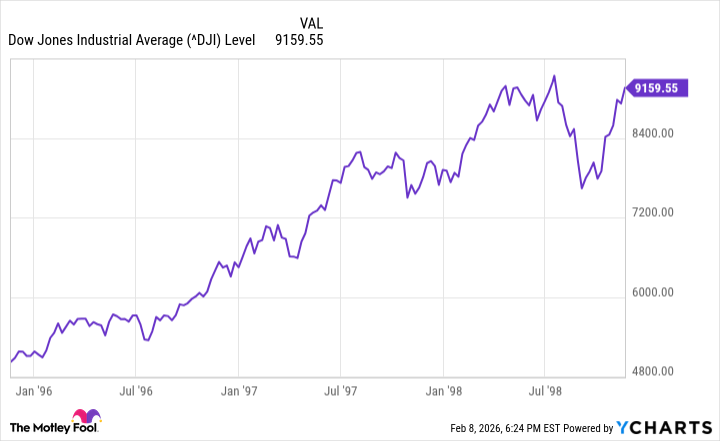

The naive observer, primed by sensational headlines, anticipates a correction. A letting of breath, a pause for reflection. But history, that often-misunderstood mistress, suggests otherwise. Consider the ascent to five thousand in ’95. Within a year, a further 28% was added – a rather impudent flourish, wouldn’t you agree? Three years hence, the Dow had soared a breathtaking 82%. One begins to suspect a certain momentum, a delightful disregard for the expectations of the cautious.

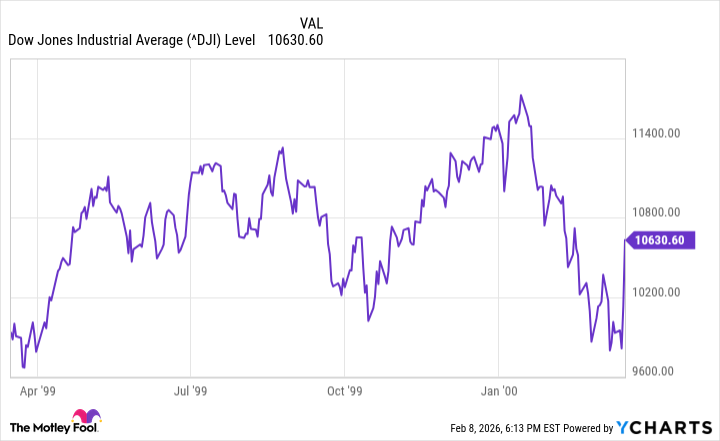

The breach of ten thousand in ’99, while ultimately preceding a period of regrettable exuberance and its inevitable deflation, did not, in itself, signal an immediate collapse. The index continued to climb for a time, a final, defiant gesture before the inevitable reckoning. And the advance to thirty thousand in 2020? A year later, a further 19% was added. Five years on, a substantial 54%. The pattern, though not immutable, is suggestive. One might almost believe in a certain…persistence of bullishness.

Of course, there are exceptions. The decline following the breach of one thousand in ’72, a period of stagflation and general economic malaise, serves as a cautionary tale. A reminder that even the most persistent trends can be interrupted by the vagaries of circumstance. But, on balance, the evidence suggests that these round numbers are more often catalysts for further gains than harbingers of decline. A rather comforting thought for those of us interested in a steady stream of dividends, wouldn’t you agree?

Why the Ascent May Continue

The explanation, while lacking the dramatic flair of a conspiracy theory, is rather prosaic. The factors that drove the market to fifty thousand remain largely intact. Corporate earnings, the lifeblood of any investment, continue to grow, albeit at a rate that demands careful scrutiny. And macroeconomic conditions, while not without their challenges, remain broadly supportive. Inflation, while occasionally mischievous, has not yet spiraled out of control. Interest rates, while rising, have not yet choked off economic growth. And GDP, while fluctuating, remains positive. A rather unexciting, but undeniably reassuring, combination.

The current preoccupation with artificial intelligence, and the attendant anxieties about a potential bubble, is, in my view, somewhat overblown. While the valuations of some AI companies may appear…optimistic, the Dow is not, for the most part, dominated by these speculative ventures. Amazon, Microsoft, and Nvidia are present, certainly, but they are balanced by more established, dividend-paying stalwarts like Goldman Sachs and Caterpillar. The index, in essence, is a rather more diversified and resilient creature than the technology-heavy indices that currently capture the public’s imagination.

Preparing for Dow 60,000 (and Beyond)

It is, of course, possible that the market will stumble. A resurgence of inflation, a sharp rise in interest rates, or a bursting of the AI bubble could all trigger a correction. Consumers, burdened by tariffs or other economic headwinds, might curtail their spending, leading to a decline in corporate earnings. But, on balance, I suspect that the most likely scenario is a continuation of the current trend. The demand for AI, far from waning, appears to be growing. And the underlying fundamentals of the economy, while not perfect, remain broadly supportive.

Prudence, naturally, dictates a diversified portfolio and a reasonable allocation of cash. But, for those of us with a longer-term perspective, the prospect of Dow 60,000 – and beyond – is not entirely implausible. The market, after all, has a remarkable capacity for defying expectations. And, for a dividend hunter such as myself, the prospect of ever-increasing payouts is a particularly enticing one.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- DOT PREDICTION. DOT cryptocurrency

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-02-09 11:53