So, 2025, huh? For Dow (DOW +1.44%) and LyondellBasell Industries (LYB 1.90%)? Let’s just say it wasn’t a banner year. More like a… banner falling year. Both took a tumble, a synchronized swan dive, plummeting 41.7%. Exactly! It’s almost… artistic. Like a bad vaudeville act. But don’t worry, folks, this isn’t a tragedy. It’s a potential comeback story. And as a value investor, I’m always on the lookout for a good comeback. Especially when there’s a dividend involved. And boy, are there dividends.

Now, 2026? Suddenly, sunshine and lollipops! Okay, not exactly sunshine and lollipops, but the materials and energy sectors are leading the charge. Dow and LyondellBasell are both up over 15% year-to-date. Fifteen percent! That’s enough to buy a decent hat. Or, you know, more shares.

And here’s the kicker: Dow’s yielding 5%, LyondellBasell a staggering 10.9%. Ten point nine percent! That’s not a yield; that’s a cry for help… or a fantastic opportunity. Let’s call it a fantastic opportunity. These aren’t just chemical companies; they’re income-generating machines… slightly dented, perhaps, but machines nonetheless. Let’s investigate why these two giants are potential turnaround stories for those of us who like a little risk with our passive income.

The Downturn: A Comedy of Errors

Dow and LyondellBasell, they make the stuff everything is made of. Packaging, industrial bits, the plastic in your garden gnome… you name it. Polyethylene, polypropylene, polyurethane… it’s a mouthful, isn’t it? They’re the building blocks of modern civilization… and right now, those blocks are a bit wobbly. The problem? Supply’s been outpacing demand. China’s building everything, everyone’s building everything, and suddenly there’s a surplus. It’s like a pie fight – a lot of filling, not enough eaters.

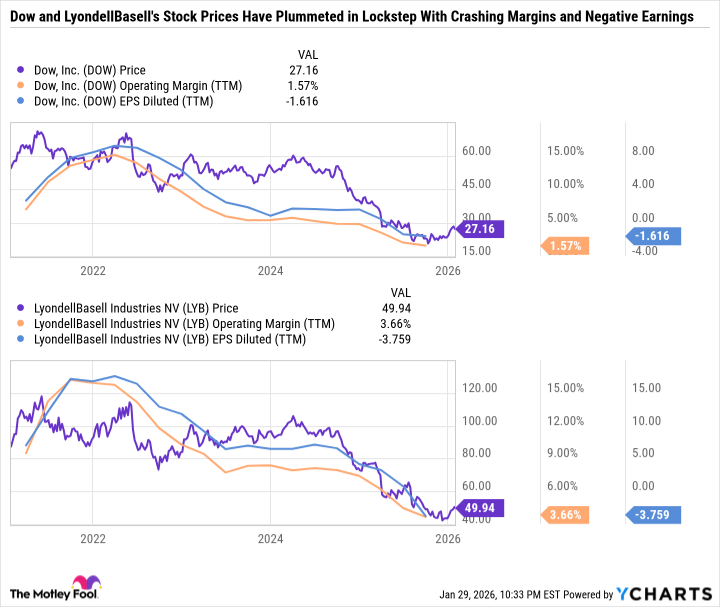

As you can see from the chart (and believe me, I’ve stared at this chart long enough to know its first name), earnings and margins are at multi-year lows. It’s not pretty. It’s like watching a clown try to juggle chainsaws. You know it’s going to end badly, but you can’t look away.

Dow, bless their heart, gave us some insight on their latest earnings call. The downturn’s dragging on, naturally. But they’re seeing glimmers of hope. Lower interest rates might help housing, packaging margins are improving… and auto sales are… well, let’s just say they’re not exactly roaring. It’s a mixed bag, folks. A very mixed bag. But hey, who needs a straight line when you can have a squiggle?

Dow’s slashing costs like a crazed tailor. They expect another $500 million in savings. They’re also trimming the workforce – 4,500 roles gone! That’s a lot of staplers. It’ll cost them, of course – $600 to $800 million in severance. But sometimes you have to break a few eggs to make an omelet… or, in this case, a slightly less wobbly chemical company.

LyondellBasell is in a similar boat. They’re finding ways to improve cash flow. But unlike Dow, they haven’t cut the dividend… yet. That 10.9% yield is tempting, isn’t it? But let’s be honest, folks. It’s a bit like a magician pulling a rabbit out of a hat. You know there’s something hidden, and you’re not entirely sure what it is.

I wouldn’t be surprised if LyondellBasell follows Dow’s lead and halves its dividend. It would still yield over 5%, and it would free up some much-needed cash. It’s not ideal, but sometimes you have to make tough choices. Like deciding whether to wear the polka dot tie or the striped one.

Two Value Stocks for the Slightly Reckless

When cyclical stocks are down, way down, traditional valuation metrics go out the window. Price-to-earnings? Forget about it. Price-to-sales? A joke. You’re basically trying to measure the weight of a feather in a hurricane. Analysts are predicting Dow’s earnings will remain negative in 2026, but they’re hoping for a slight improvement in 2027. LyondellBasell is expected to build on a positive 2025, with even better profitability in 2027. Optimistic, aren’t they? I like their style.

The good news is that these cost cuts and restructuring efforts might coincide with an industry-wide recovery. In the meantime, you’ve got high yields to boost your passive income. As earnings improve, these stocks could look dirt cheap. But some investors might still want to pass. They’re not comfortable with dividends that aren’t supported by free cash flow. They prefer companies that are a little less… adventurous.

All told, Dow and LyondellBasell are so out of favor, so beaten down, that some deep-value investors might want to take a closer look. But risk-averse investors might prefer to power their portfolios with more straightforward blue-chip stocks like Procter & Gamble and Coca-Cola. They’re safe. They’re reliable. They’re… a little boring. But hey, sometimes boring is good. Sometimes you just want a nice, predictable cup of tea.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

2026-02-02 16:12