Alright, settle in, folks! 2026 is looming, and if you’ve got cash just lying around, like a forgotten prop from a silent film, you need to deploy it. I’ve been staring at these charts for so long, I’m starting to see Fibonacci sequences in my breakfast cereal. And I’ve pinpointed a few stocks that are practically begging to be doubled up on. Yes, doubled! It’s like a comedic twist – only with your portfolio!

First on my list, and believe me, I’ve got a list that could rival the guest list at a Roman orgy, are Nvidia (NVDA +1.37%), The Trade Desk (TTD 1.11%), and MercadoLibre (MELI 1.54%). These aren’t just stocks, they’re potential blockbusters! Each one’s got a tailwind strong enough to blow a toupee clean off a head. And let’s be honest, in this market, you need all the lift you can get.

Nvidia

Nvidia. The name alone sounds like a Bond villain, doesn’t it? And they’re acting like one – dominating the market! Now, some folks are saying, “But it’s already huge! It’s the biggest company since…well, since the last really big company!” And I say, poppycock! It’s like saying, “Don’t invest in oxygen, everyone already breathes it!” These GPUs, these little silicon brains, are the engine driving the AI revolution. And with data centers popping up faster than mushrooms after a rainstorm, the demand is only going to increase. It’s a runaway train…a very profitable runaway train!

Now, the naysayers are griping about the valuation. “It’s overvalued!” they cry. To them, I say, “Have you seen the price of a decent pastrami on rye these days?” Nvidia trades at 23 times next year’s earnings. Twenty-three! Big Tech companies are trading at 30, 35, even 40 times earnings! This isn’t just a good deal; it’s a steal! It’s like finding a first-edition Shakespeare for a nickel. So, if Nvidia keeps growing at this pace – and I have a sneaking suspicion it will – we’re looking at returns that’ll make your accountant do a double-take.

The Trade Desk

Ah, The Trade Desk. Now, this one had a bit of a rough 2025. Fell over 65%. Ouch! It was like watching a clown car crash into a pile of…well, you get the picture. But don’t panic! This isn’t a tragedy; it’s a temporary setback. It’s a pratfall! The Trade Desk runs an ad tech platform, matching advertisers with the perfect internet real estate. It’s a matchmaker for marketing! And despite the increasing competition, they’re still delivering solid results. Revenue was up 18% last quarter. Eighteen! That’s enough to buy a small island…or at least a really nice beach umbrella.

The reason for the dip? Political ad revenue. Or rather, the lack of it. Last year was a big election year, so the comparison is a bit skewed. But that’s all water under the bridge. In 2026, things will normalize, and the stock will take off like a rocket. Plus, it’s trading at only 16 times forward earnings. Sixteen! That’s practically giving money away! A rapidly growing company in a strong industry at a cheap discount? It’s a no-brainer! Double up, folks, before everyone else catches on.

MercadoLibre

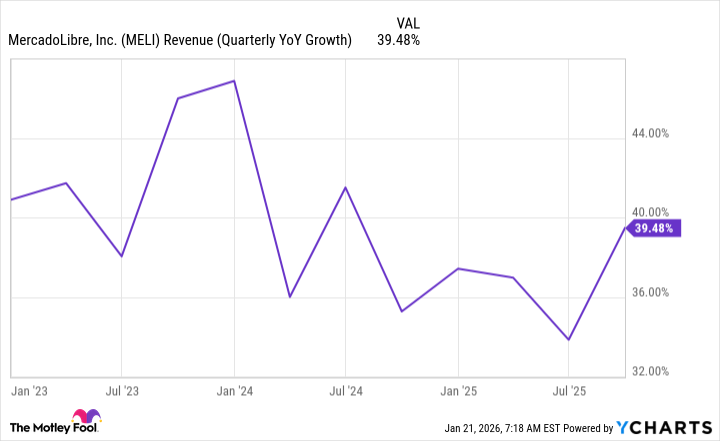

MercadoLibre. Now this is a company I can get behind. They’ve essentially cloned Amazon in Latin America, but with a little extra spice. They’ve got online shopping, fast delivery, but they’ve also added a fintech wing. Credit, payments, the whole shebang. It’s like Amazon had a baby with a Swiss bank! This gives them a piece of every transaction in Latin America. Every. Single. One! It’s like being the king of a very large, very profitable flea market.

The stock market often misunderstands it because it’s in Latin America. Any time it dips, it’s a fantastic opportunity. It’s down about 20% from its all-time high, but it’ll easily regain those levels in 2026. It’s one of my largest holdings, because it has a massive growth runway. It’s like going back in time and investing in Amazon before anyone knew what e-commerce was. Latin America’s population is even larger than the U.S., so MercadoLibre’s results could be even greater than Amazon’s. So, what are you waiting for? Get in on the action before the band starts playing!

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- DOT PREDICTION. DOT cryptocurrency

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- NEAR PREDICTION. NEAR cryptocurrency

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-01-23 23:33