Let me confess: I’ve never met a pizza I didn’t like. Unless it’s cold, soggy, or served with a side of regret (looking at you, 2019 crypto experiment). But here’s the thing-pizza, when done right, is a universal language. Thin crust? Thick crust? Gluten-free? Who are we to judge? The global pizza market? It’s not just a slice of the pie-it’s a $269.5 billion feast by 2034. And if Warren Buffett is on the menu, I’m bringing the napkins.

Buffett, that sage in the pinstripe, has a soft spot for companies that combine durability with dynamism. Enter Domino’s. With 21,500 stores across 90 countries and 99% of them franchised, this isn’t just a pizza chain-it’s a lean, mean, dough-making machine. Their secret sauce? A mobile app so good it could probably replace your therapist. Eighty-five percent of sales come from digital channels. Ordering via Alexa? CarPlay? Facebook Messenger? Domino’s isn’t just keeping up with the times-they’re sprinting ahead in Crocs.

Now, let’s talk logistics. Domino’s has struck gold with Uber and DoorDash partnerships. Imagine: your pepperoni arrives faster than your ex’s apology. Their COO, Joe Jordan, probably says things like “leveraging robust delivery networks” in board meetings. Meanwhile, I’m over here Googling “how to invest in pizza without owning an oven.”

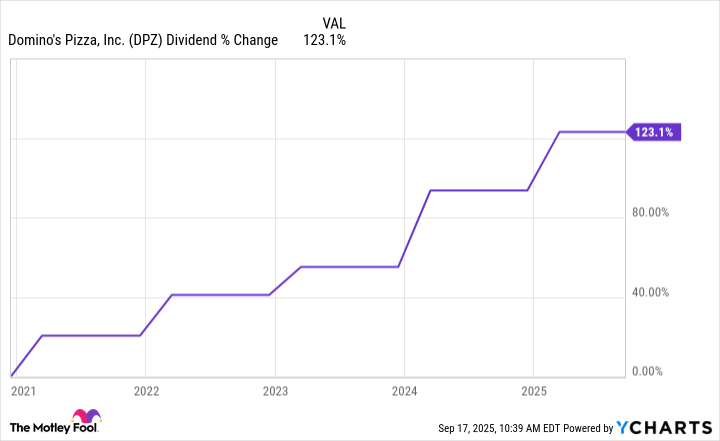

Here’s the kicker: Domino’s isn’t just about hot boxes and cheesy slogans. They’ve grown same-store sales by 3.4% this quarter, thanks to a Parmesan-stuffed crust that’s basically a flavor fireworks show. Revenue? Up 4.3% to $1.14 billion. And while net income dipped slightly due to investments in China, the dividend story is where it gets spicy. A 123% growth over five years, with a payout ratio of 36%? That’s not just a dividend-it’s a financial fireworks show.

Berkshire Hathaway owns 7.8% of Domino’s, valued at $1.16 billion. Buffett’s not in the business of throwing darts at dartboards. He’s looking for companies that build moats-preferably with a side of pepperoni. Domino’s has moats, margins, and a mobile app that could probably outsmart my dating profile. And yes, I know I’m comparing a pizza company to my love life. It’s a low bar, but someone’s got to clear it.

So, what’s the takeaway? Domino’s checks every box: scalable franchise model, digital dominance, and a dividend that’s growing faster than my Netflix queue. It’s the investment equivalent of a perfectly crisp crust-deliciously reliable. And if history teaches us anything, it’s that Buffett’s bets are worth a second slice. Or three. 🍕

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Why Nio Stock Skyrocketed Today

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

2025-09-21 12:52