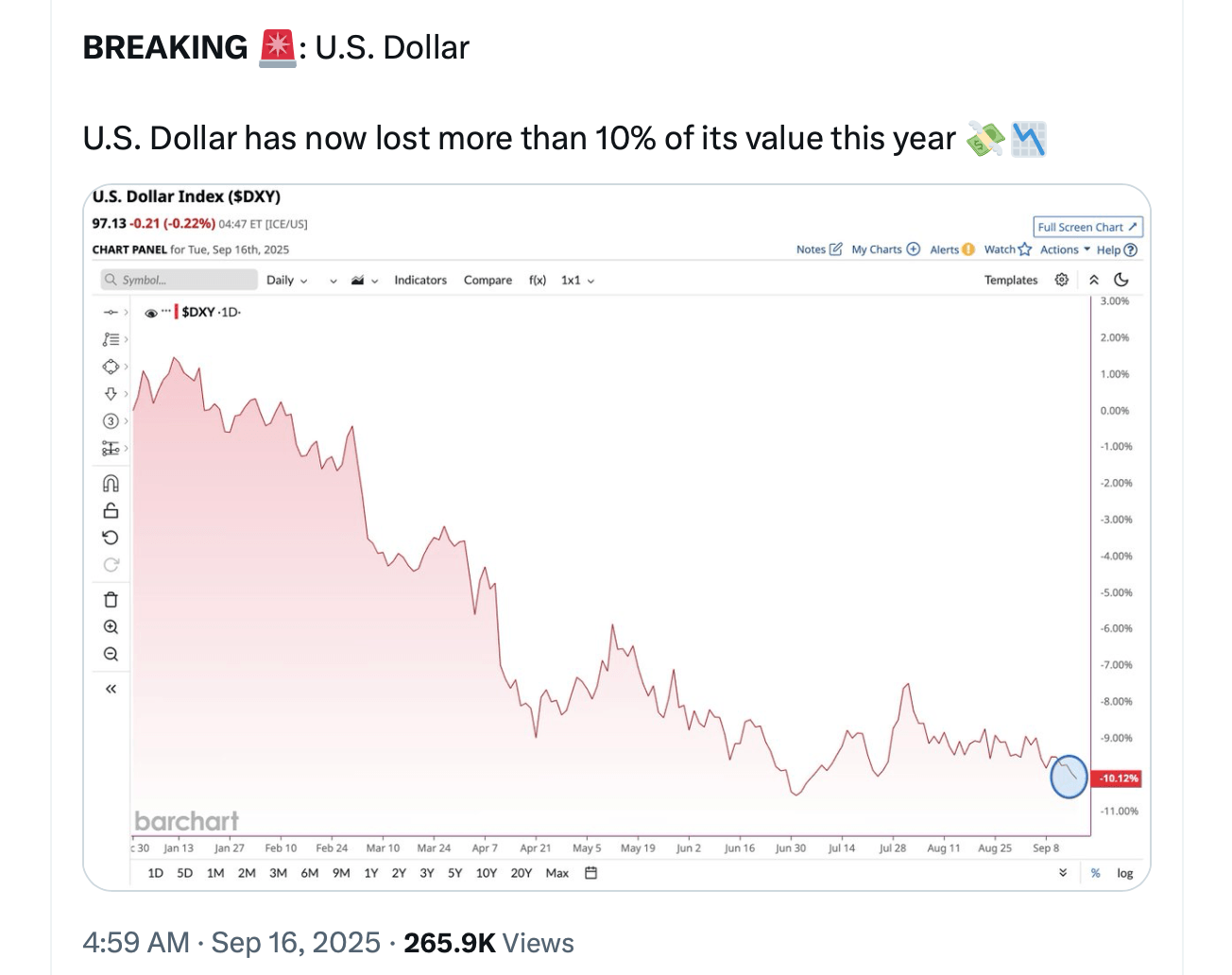

Breaking news: The U.S. dollar just took a nosedive of over 10% in 2025! It’s like the Federal Reserve decided to give it a little midweek shave-just a quarter point, they say. Who’s signing them up for this financial comedy show? 🎭

Fed and Tariffs Tag-Team the Greenback-Traders Are Sweating, Everyone Else Is Googling “What’s a DXY?”

Over on Wall Street, they call it a “rotation.” Meanwhile, Main Street is yelling “Hey! Why is my sandwich now mortgage-worthy?” The DXY index, that infamous scoreboard of dollar muscles, is showing off one of the sharpest slides since someone said “Trust me, it’s fine” to the economy. Exporters are beaming like they just got free snacks; importers? Well, they’re recalculating faster than you can say “tariffs.”

What’s causing this breakup? The usual suspects: soft data, restless fiscal policy, tariff gossip, and the Fed hinting at rate cuts like a shy suitor at a dance. When the Fed waves its magic wand for easier money and Europe just stands there looking regal, the dollar’s once-mighty moat turns into a kiddie pool. Traders see that puddle and think: “Splash zone!” 💦

Citizens feel it in their wallets first-imports, snacks, airline tickets, and foreign fuel are suddenly VIP guests at Inflation’s wild party. The cappuccino abroad costs extra-a real tragedy for the caffeine-addicted tourist. At home, retailers play a glamorous game of “pass the price along” or “eat the cost,” neither of which sounds good unless you’re a professional juggler.

Corporate America? Split! Multinationals cheer as their overseas sales magically turn into more dollars-ka-ching! Meanwhile, import-heavy companies are grumbling louder than a late-night diner. Equity strategists dust off their crystal balls and say, “Go cyclicals, gold, and foreign stocks!” because they’re always ready to make hay when the dollar throws a tantrum.

The markets? Total chaos! Non-U.S. assets suddenly get VIP treatment, emerging markets breathe easy like they just found a loophole, and gold gleams brighter than your aunt’s bad jewelry collection. Bonds watch anxiously, hoping the Fed’s story about taming inflation doesn’t turn into a tragicomedy.

The big picture: This isn’t a dollar revolution, folks. It’s just the hangover from 15 years of the greenback being King Kong. The dollar’s still the world’s cash register, but confidence isn’t a birthright-it’s a mood swing. If the Fed keeps its cool and the economy grows strong, maybe the slide slows down. If not, central banks and portfolio managers will diversify faster than you can say “meltdown.”

What’s next? Watch for inflation numbers, Fed chatter at tomorrow’s meeting-brace yourself, it’s like financial theatre-and tariff shots that might rattle supply chains like maracas at a mariachi party. Investors are hedging bets, trimming home bias, and letting the weaker dollar do some stealthy portfolio gymnastics. Stay tuned-this rollercoaster has more twists than a pretzel factory! 🎢🇺🇸💰

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

2025-09-16 23:29