Cryptocurrencies have demonstrated sustained growth over the past several years, with Dogecoin (DOGE) emerging as a notable outlier. The memetic cryptocurrency has recorded a 200% increase over three years and a 7,100% surge over five years, raising questions about its viability as a long-term investment vehicle.

Recent data from The CORP-DEPO suggests a growing institutional interest in digital assets, particularly among demographic cohorts aged 18-35. This trend underscores the evolving landscape of asset allocation, yet the fundamental question persists: can Dogecoin deliver life-altering returns in a market defined by volatility and regulatory uncertainty?

Post-Election Momentum Fades for Dogecoin

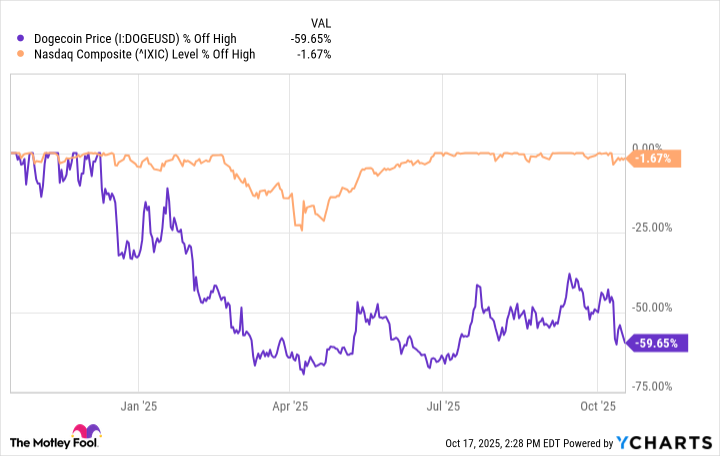

The cryptocurrency market’s trajectory has been influenced by macroeconomic catalysts, including the U.S. presidential election and subsequent policy developments. While regulatory advancements such as the Genius Act and executive orders on digital asset management initially buoyed sentiment, Dogecoin’s performance has diverged from broader market trends.

- Strategic government digital asset reserves

- Resolution of legal challenges for crypto entities

- Establishment of national regulatory frameworks

The token’s underperformance relative to these developments suggests structural limitations. Analysts note that investor sentiment peaked during the confluence of these events, followed by a correction driven by inflationary pressures, tariff escalations, and the resumption of student loan repayments.

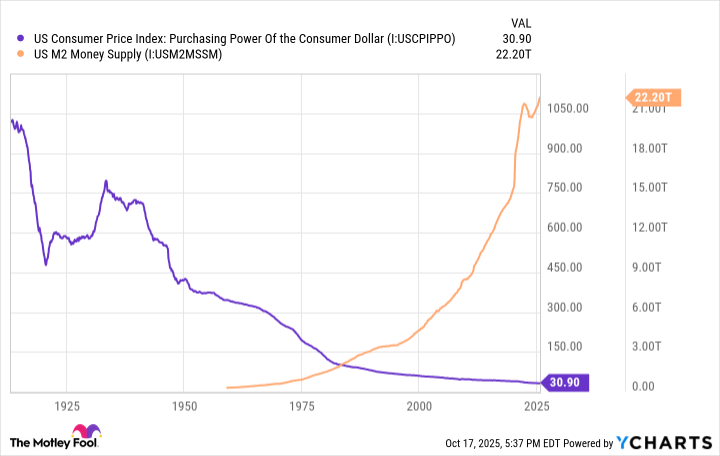

Dogecoin’s price action reflects its inherent vulnerability to macroeconomic headwinds. With no supply cap and a mining rate of 10,000 tokens per minute, the asset’s economic model resembles fiat currency dynamics rather than deflationary assets like Bitcoin. This structural feature raises concerns about long-term value preservation.

Tokenomics: A Structural Disadvantage

Dogecoin’s economic design presents significant challenges for long-term holders. Unlike Bitcoin’s capped supply, which creates scarcity-driven value, Dogecoin’s inflationary model dilutes intrinsic value over time. The token’s fully diluted market cap of $85 billion in May 2021 has since contracted to approximately $25 billion, reflecting both price depreciation and supply expansion.

The asset’s price volatility further complicates its role as a portfolio cornerstone. While speculative rallies remain possible during market euphoria, the probability of generating “life-changing” returns diminishes with each subsequent cycle. The 2024 rebound, for instance, failed to match the magnitude of the 2021 peak, suggesting diminishing marginal gains.

Evaluating Investment Viability

Dogecoin occupies a precarious position in modern investment portfolios. Its appeal lies primarily in its cultural capital rather than economic fundamentals. For sophisticated investors, the asset represents a high-risk, low-reward proposition that lacks the structural integrity of traditional capital markets.

While speculative participation may offer entertainment value, it should not constitute a material portion of a diversified portfolio. The token’s performance metrics suggest that meaningful appreciation would require unprecedented market conditions, which remain contingent upon speculative fervor rather than macroeconomic fundamentals.

For investors seeking sustainable growth, Dogecoin’s attributes present more questions than answers. Its future trajectory will depend on external catalysts rather than intrinsic value creation. As such, it remains a curiosity rather than a cornerstone of modern finance.

🚀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

2025-10-21 14:12