🚨💸 The Canine Cryptocurrency’s Descent into Darkness 💸🚨

- The memecoin market and Dogecoin have been inexorably bearish since December

//ambcrypto.com/wp-content/uploads/2025/03/MD-4-DOGE-price.png”/>

The 1-day price chart of Dogecoin tells a tale of woe, with a clear downtrend evident since late January. The price has plummeted to near its November lows at $0.142, leaving investors wondering if they’ll ever see the good old days again. The OBV may not be diving lower, but the downtrend is as clear as a Russian winter.

AMBCrypto delved into the metrics to uncover if investors should take a chance on buying near the $0.14-$0.15 lows from November, hoping for a rally in the coming months. Because, as the saying goes, “a bird in the hand is worth two in the bush.”

Whale accumulation: a glimmer of hope in the darkness

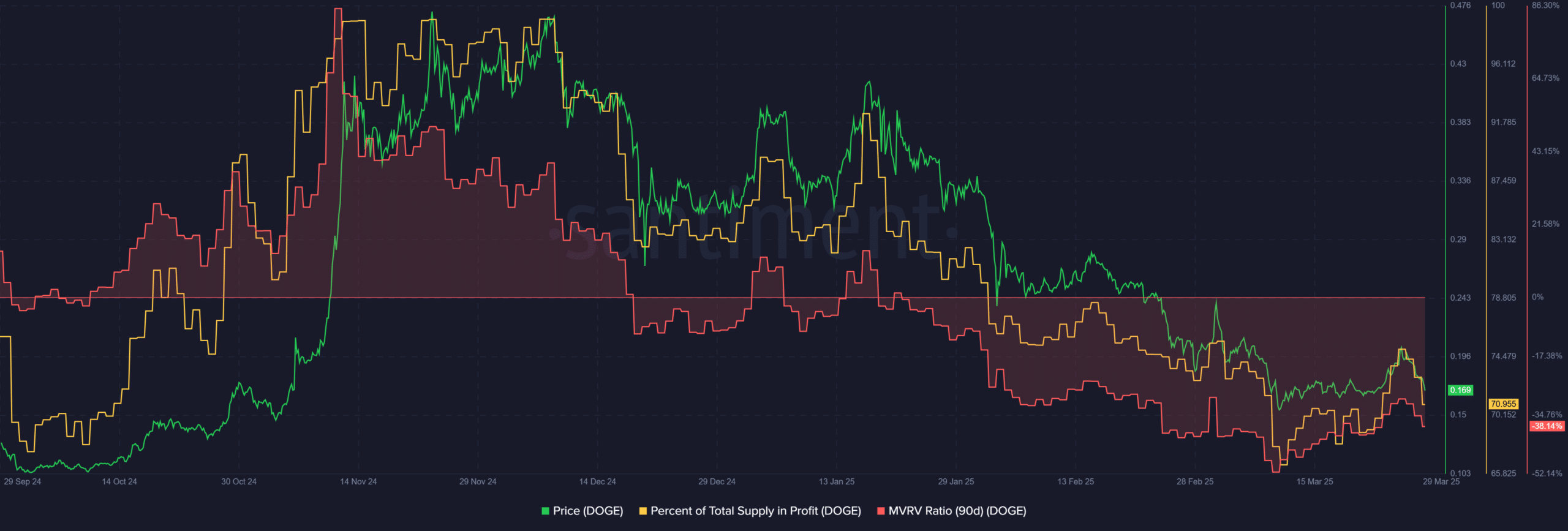

The supply in profit (as a percentage) has been on a downward spiral since December, mirroring the price action. It’s a grim reminder that even the whales are not immune to the market’s whims. The metric has fallen from 99.44% on 8 December to 70.95% at press time, a staggering decline of nearly 30 percentage points.

The 90-day MVRV ratio was equally dismal, with a reading of 38.14%. Together, the metrics paint a picture of a market in dire straits, with the price chart serving as a grim harbinger of things to come.

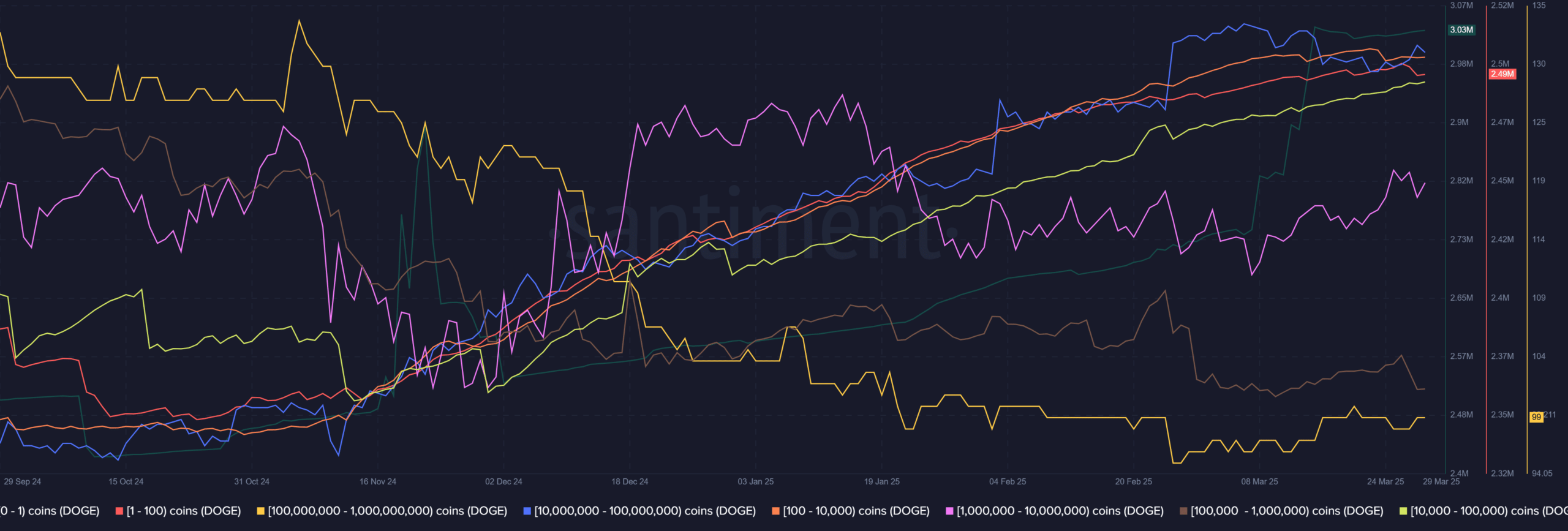

Examining the supply distribution reveals that the 100k-1M DOGE cohort has been on a slow downtrend in recent months. Figures for the same saw a minor uptick in March, but fell again over the past month. It’s a reminder that even the whales are not immune to the market’s capricious nature.

On the other hand, smaller wallets have been accumulating, a heartening sign for those who believe in the power of the little guy. More interestingly, the 1M-10M DOGE holding cohort has increased their DOGE holdings since 7 March, despite recording a minor dip in recent days. It’s a glimmer of hope in an otherwise bleak landscape.

But, alas, Dogecoin is an inflationary asset, meaning more of it is entering the supply over time. And yet, some accumulation among the whales is a slightly hopeful sign, a reminder that even in the darkest of times, there is always a glimmer of light.

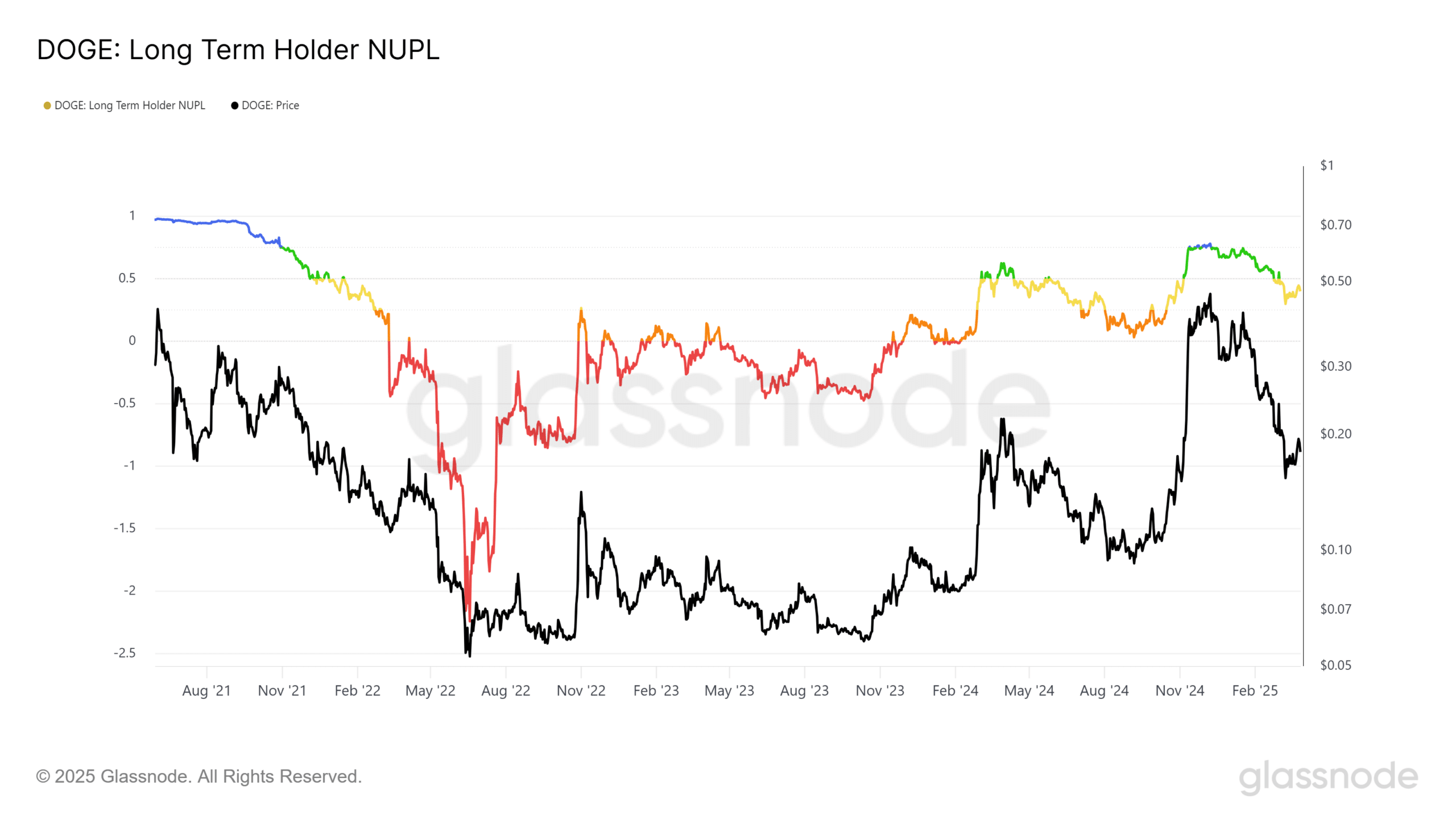

On the other hand, the long-term holder net unrealized profit/loss (LTH NUPL) was rather bleak at press time, with a value of 0.4, translating to “anxiety” according to the chart. The metric roughly went along the same trends as the first half of 2024, a grim reminder that the market is not immune to the whims of fortune.

If the same continues, it could see Dogecoin slump below $0.15 and continue lower in April. A consolidation phase over the summer could be necessary before the bulls have the strength to drive another rally. This was what occurred in July/August of 2024, and something similar might play out in 2025.

The price action and the NUPL showed that the downtrend has remained in place. Long-term investors need to bide their time and wait for a consolidation phase, one that stretches at least for a few weeks. After all, as the saying goes, “patience is a virtue.”

Read More

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2025-03-30 08:11