As a seasoned crypto investor with a knack for spotting trends and patterns, I find myself intrigued by the current state of the Dogecoin (DOGE) vs Bitcoin (BTC) chart. My personal journey in this digital gold rush has taught me to never underestimate the power of meme coins, and Dogecoin is no exception.

On the monthly scale, the comparison between Dogecoin (DOGE) and Bitcoin (BTC) has hinted at an intriguing trend suggesting that Dogecoin might be poised for a price surge. Notably, in instances where Bitcoin’s value decreases relative to Dogecoin, it often results in Dogecoin attaining new peak prices.

As I stand here analyzing the latest trends in the crypto market, at this very moment, Dogecoin is trading at approximately $0.44. Currently, it’s about 40% shy of reaching its all-time high. But considering the current trajectory, it appears that Dogecoin could potentially break through and surpass that record level.

Dogecoin Stays Strong Against the Number One Coin

Examining the Dogecoin (DOGE) to Bitcoin (BTC) graph reveals the emergence of a bullish pennant. A bullish pennant is a common progression pattern in an uptrend, which is marked by a short spell of sideways movement followed by a significant price jump upwards.

On a graph, a bullish flag is often depicted as a narrowing triangle or rectangle (resembling a flag), which indicates decreasing trading activity as investors lock in their positions. As the range becomes tighter, a breakout — commonly referred to as a bullish pennant — usually follows, pushing the price upwards and suggesting the uptrend is continuing.

Looking at the Dogecoin vs Bitcoin graph, it appears that the popular meme coin has managed to break free from its period of stagnation. If this upward trend persists, the value of one DOGE could potentially increase in relation to BTC, possibly reaching up to 0.000014.

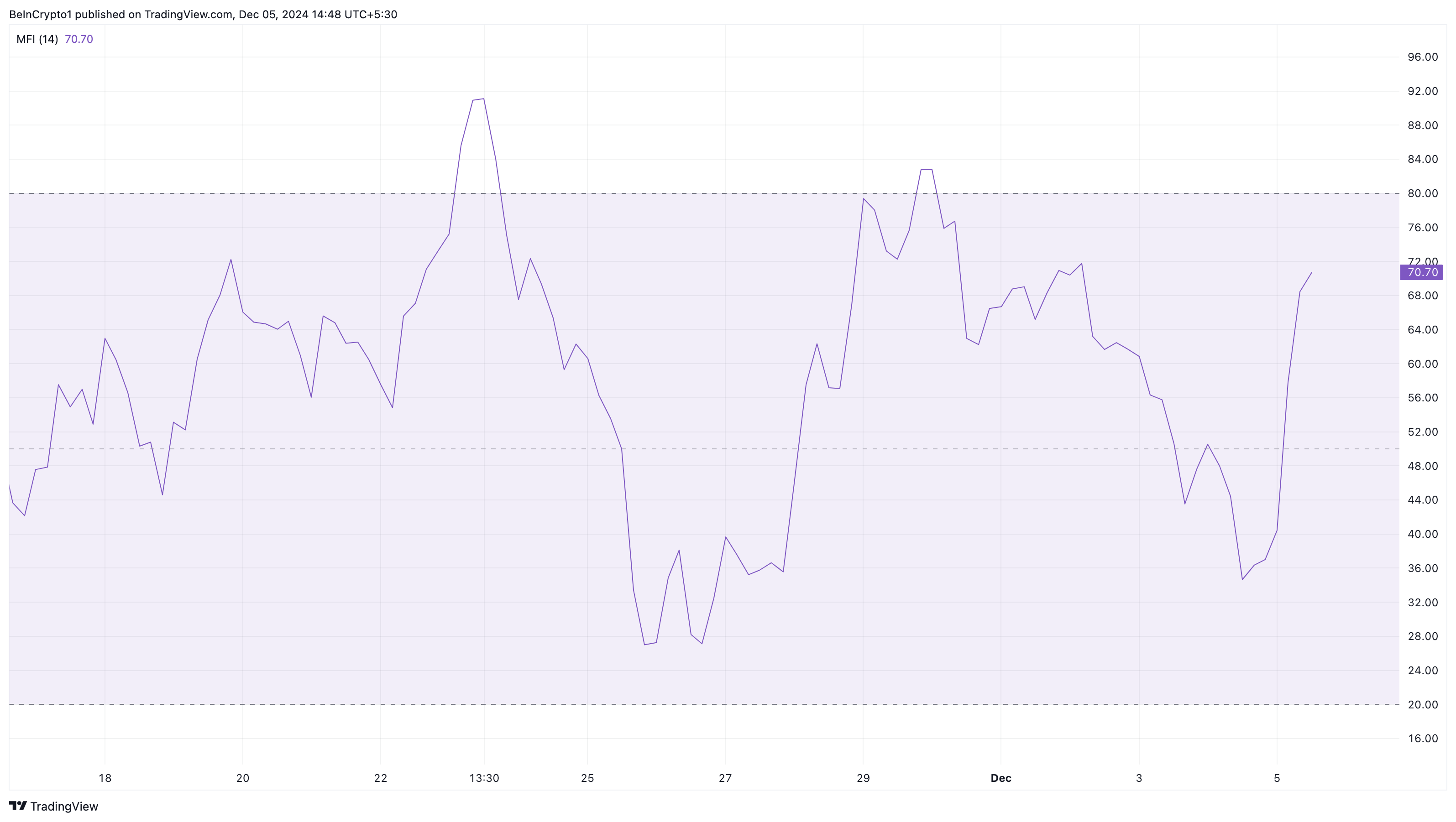

Additionally, the 4-hour Dogecoin (DOGE) to US Dollar (USD) chart supports a positive forecast as the Money Flow Index (MFI) increases to 70.70. This index measures the amount of capital flowing into a cryptocurrency, providing insights on market dynamics and momentum.

An increasing Money Flow Index (MFI) shows stronger buying activity, suggesting that buyers are in control, whereas a decreasing MFI indicates more sellers are in charge. The surge in Dogecoin’s MFI implies growing interest and demand, which could potentially propel its value towards the $1 mark.

As a crypto analyst, I too am leaning towards a bullish perspective, particularly with regards to Dogecoin. Notably, it has recently tested the upper limit of an ascending triangle on the daily chart, which suggests a potential major breakout could be imminent.

According to Rekt Capital, Dogecoin has mimicked Bitcoin’s movements up until now and is currently testing the upper boundary of an Ascending Triangle as potential support. A successful test at this level would pave the way for a verified breakout.

DOGE Price Prediction: Still Bullish

On the day-to-day graph, Dogecoin’s price is currently higher than its 20-day and 50-day Exponential Moving Averages (EMA). This moving average serves as a technical tool to identify trends in the cryptocurrency market.

When the price is above the EMAs, the trend is bullish. On the other hand, if the price is below the trend, the trend is bearish. Therefore, Dogecoin’s price might continue to rise and possibly hit $0.48 in the short term.

Should the meme coin get validated, it could potentially surge towards a dollar value, as long as the Dogecoin versus Bitcoin graph continues its upward trend. Conversely, if the meme coin’s value decreases against Bitcoin, it may not reach that level, and instead, drop down to around $0.32.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2024-12-05 14:42