Ah, January 28, 2025. A day that will live in infamy—or at least in the annals of memecoin history. Bitwise has decided to throw its hat into the Dogecoin ring, potentially allowing institutional investors to dip their toes into the chaotic waters of Dogecoin. Because who wouldn’t want to invest in a coin that started as a joke? 😂

Bitwise’s Move Toward a Dogecoin ETF

In a move that can only be described as “bold” (or perhaps “desperate”), Bitwise registered a Dogecoin Trust in Delaware just days before this filing. Matt Hougan, the Chief Investment Officer at Bitwise, claims this is all about the “growing demand” for Dogecoin. I mean, who wouldn’t want to invest in a coin that’s basically a Shiba Inu meme? 🐶

“The reality is that there are a lot of people that want to invest in Dogecoin. It’s the sixth-largest crypto asset in the world by market cap and it trades over $1 billion a day,” Hougan stated. Yes, because nothing screams “financial stability” like a coin that fluctuates more than my mood on a Monday morning.

Growing Interest in Memecoin ETFs

But wait, there’s more! Bitwise isn’t the only one trying to cash in on Dogecoin’s fame. Osprey Funds and Rex Shares are also jumping on the bandwagon, hoping to introduce ETFs focused on Dogecoin and other high-profile memecoins. Because why not? If you can’t beat them, join them, right? 💸

With the current U.S. presidential administration being pro-crypto, it seems like the stars are aligning for Dogecoin. Even the establishment of D.O.G.E. (Department of Government Efficiency) featuring the Dogecoin logo has sparked speculation that a Dogecoin ETF might just breeze through regulatory approval. Who knew government efficiency could be so… cute? 🐕

However, let’s not get too carried away. The speculative nature of meme coins is still a concern. Some analysts have likened investing in memecoins to gambling. I mean, if you’re betting on a Shiba Inu to pay your mortgage, you might want to rethink your life choices. 🎲

Dogecoin’s Market Performance and Risks

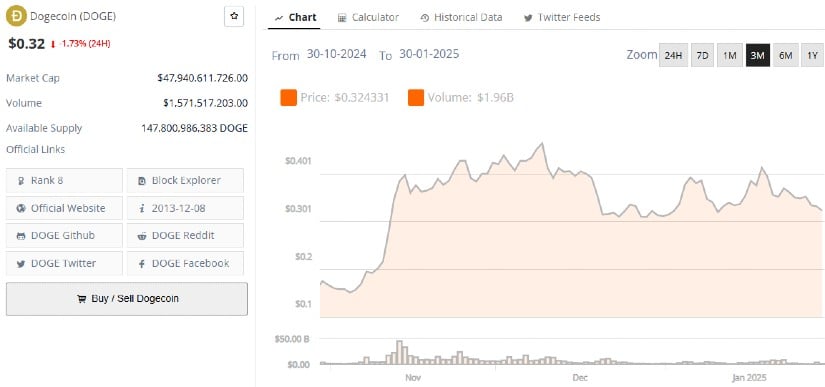

After the news of Bitwise’s ETF filing, Dogecoin’s price took a 4% nosedive. It’s like watching a rollercoaster designed by a toddler—exciting yet terrifying. Technical analysis suggests DOGE is currently in a descending triangle pattern, which sounds more like a yoga pose than a financial strategy. 🧘♂️

If Dogecoin breaks the lower boundary of this pattern, analysts predict a sharp decline of about 37%. That’s right, folks! You could be looking at a price drop to around $0.1905. But hey, if it holds above its support levels, we might just see a recovery. Fingers crossed! 🤞

Indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) are showing bearish momentum. Meanwhile, the Stochastic Oscillator suggests Dogecoin might be oversold. So, it’s like a clearance sale at your local thrift store—great deals, but you might end up with a lot of junk. 🛍️

Regulatory Outlook and Market Implications

The Commission’s decision on the Bitwise Dogecoin ETF will be closely monitored. With this administration’s friendlier stance toward digital assets, we might just see some movement. If approved, this ETF could create a regulated investment vehicle for retail and institutional investors. Just think, you could invest in Dogecoin without actually holding it! What a time to

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-01-31 01:37