As an analyst with over two decades of experience in the financial markets, I have seen my fair share of price surges and subsequent corrections. The recent spike in Dogecoin (DOGE) to a three-year high has piqued my interest, but the on-chain data suggests a potential short-term correction is looming.

On November 12, Dogecoin (DOGE) reached a three-year peak of $0.43, but then fell back slightly to $0.38. Despite this minor setback, it still saw a 3% growth for the day.

Conversely, it appears that the surge in price is causing long-term investors to cash out their earnings. If this pattern continues, Dogecoin could potentially lose a significant portion of its recent growth in the near future.

Dogecoin’s LTHs Sell For Profit

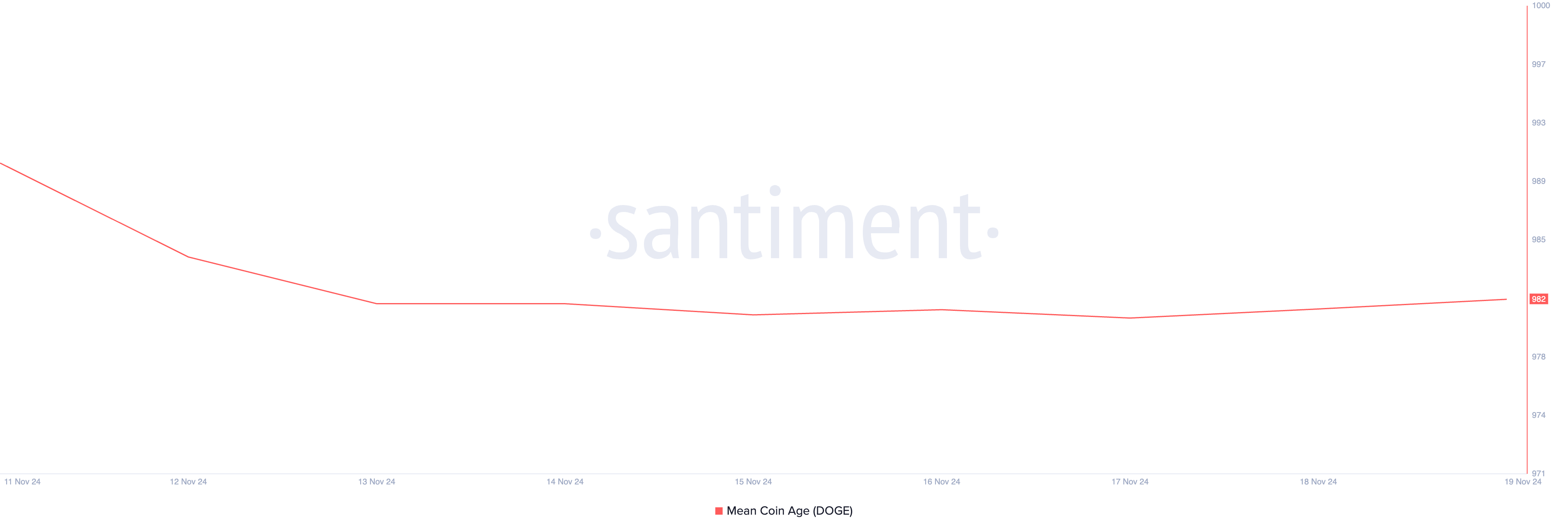

According to BeInCrypto’s analysis, there’s been a decrease in Dogecoin’s Average Coin Age during the last week. As reported by Santiment, this drop amounts to about 1% over the past seven days.

The average lifespan of the coins in circulation, also known as “mean coin age,” provides information about how long individuals have possessed their coins before they decide to transfer or sell them. A decrease in this measure suggests that older coins are being traded or moved more frequently. This trend is typically interpreted as a bearish signal, indicating that Long-Term Holders (LTHs) may be liquidating their profits.

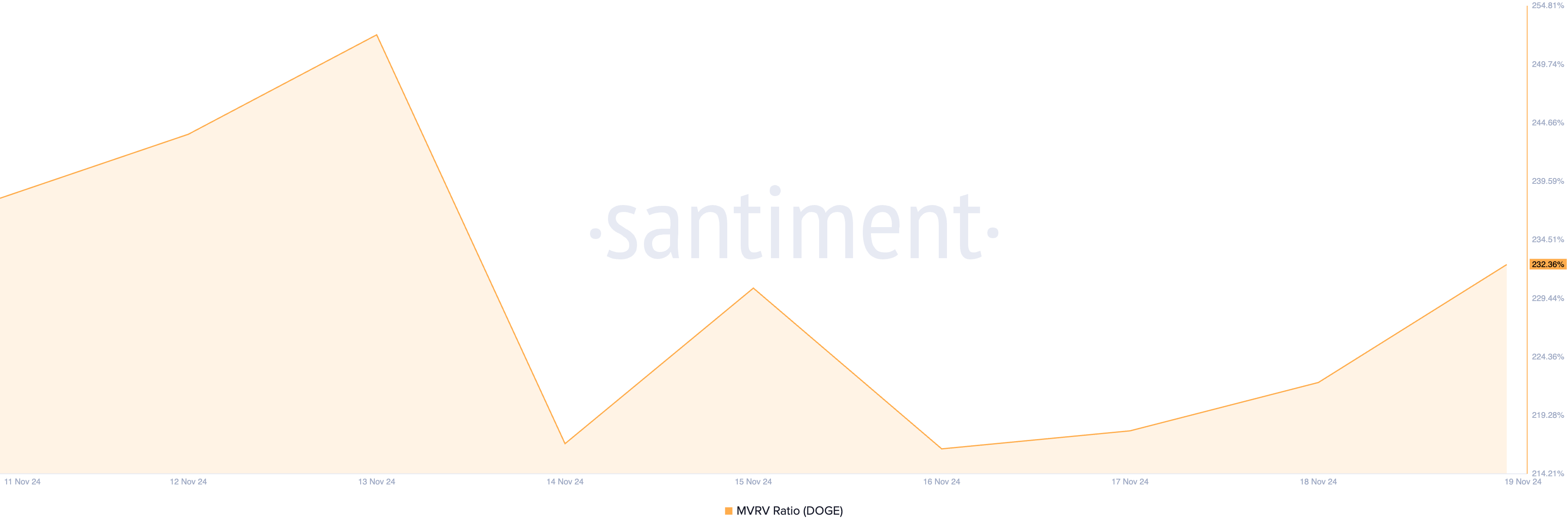

As a researcher examining the cryptocurrency market, I’ve noticed an intriguing trend in Dogecoin (DOGE). The Market Value to Realized Value (MVRV) ratio, which indicates whether a coin is over or undervalued based on its price relative to its historical average, is currently sitting at 232.36% for DOGE. This high reading suggests that the meme coin might be overvalued at the moment, potentially leading long-term holders (LTHs) to consider cashing out for a profit. These insights are derived from Santiment’s data analysis.

One way to rephrase the given sentence could be: The MRVR ratio is an essential tool for evaluating a cryptocurrency’s worth compared to its past price movements. It calculates this by comparing the market capitalization (the total value of all coins currently in circulation) with the realized value, which represents the price at which those coins were last transacted on the blockchain.

A higher Market-to-Realized Value Ratio (MRVR) implies that the market worth surpasses the asset’s actual worth. In other words, it may indicate that the asset is being overpriced in the market. Traditionally, this situation is often seen as a sign to cash out one’s investments for potential gains.

The MVRV (Market Value to Realized Value) ratio for DOGE currently stands at approximately 236.36%. This means that the current market value of DOGE is roughly 236% higher than its actual worth based on the cost at which it was previously realized by investors. In other words, if all its holders were to sell their Dogecoins, they could potentially see an average gain of 236%. Given such a high MVRV, there might be a prolonged period of price adjustment as more investors decide to cash out and realize their profits, possibly suggesting a potential correction in the market.

DOGE Price Prediction: Why LTHs Must Stop Selling

As a Dogecoin investor, I’m currently observing that we’re hovering around $0.38. The $0.39 mark seems like a tough nut to crack due to the resistance it offers. If selling pressure intensifies, there’s a possibility that the price might dip down towards our support at $0.31. I’ll keep a close eye on the market movements.

If we can’t maintain this current level, it could lead to a steeper drop, driving Dogecoin (DOGE) down below the $0.30 threshold and potentially towards $0.21. Such a fall would widen the gap between DOGE and any future surge past $0.47 and another climb to $0.50, a level last reached in May 2021.

should the market’s outlook brighten and long-term investors maintain their stakes, a surge in DOGE demand might propel its value above $0.47, potentially reapproaching the $0.50 price threshold once more – from my perspective as an analyst.

Read More

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-11-19 19:08