As a seasoned crypto investor with over a decade of experience in this volatile market, I’ve learned to read between the lines when it comes to indicators like Open Interest (OI) and Mean Dollar Invested Age (MDIA). The current decline in both these metrics for Dogecoin (DOGE) is a clear sign that traders are reducing their exposure and investors are growing cautious.

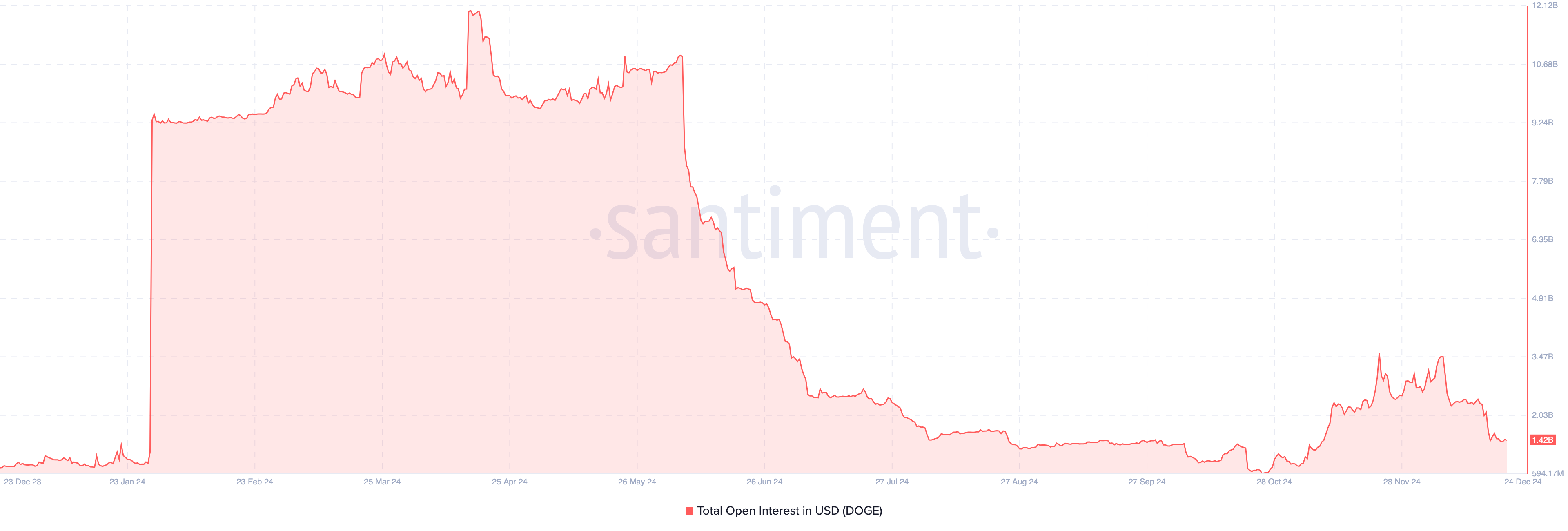

In April, the open interest for Dogecoin (DOGE) hit an annual peak of $12 billion. However, it plummeted significantly from that high between then and October. It increased again recently but is currently on the brink of falling back to its lowest point since November 10.

As an analyst, I’ve observed a downturn in Open Interest (OI) that mirrors Dogecoin’s (DOGE) recent price movement, which has dipped by approximately 20% over the past seven days. Given this trend, I find myself pondering about DOGE’s future trajectory within the cryptocurrency market.

Dogecoin Traders Reduce Exposure, Investors Cautious

At the moment, the Open Interest for Dogecoin stands at approximately $1.42 billion. Open Interest (OI) refers to the combined number of open contracts – either long or short positions – in a futures or options market at a specific point in time. An increase in OI suggests that new positions are being established, showing increased involvement and faith among traders regarding the potential price fluctuations of Dogecoin.

Instead, when the indicator drops, it indicates that traders are closing their positions, which could signal waning confidence among them or a lack of optimism towards the asset. Thus, the significant decrease in Dogecoin’s Open Interest implies that traders do not anticipate substantial profits from short-term price fluctuations.

Should this pattern persist, with Dogecoin’s price potentially dropping to around $0.32, its value might undergo a prolonged adjustment or correction.

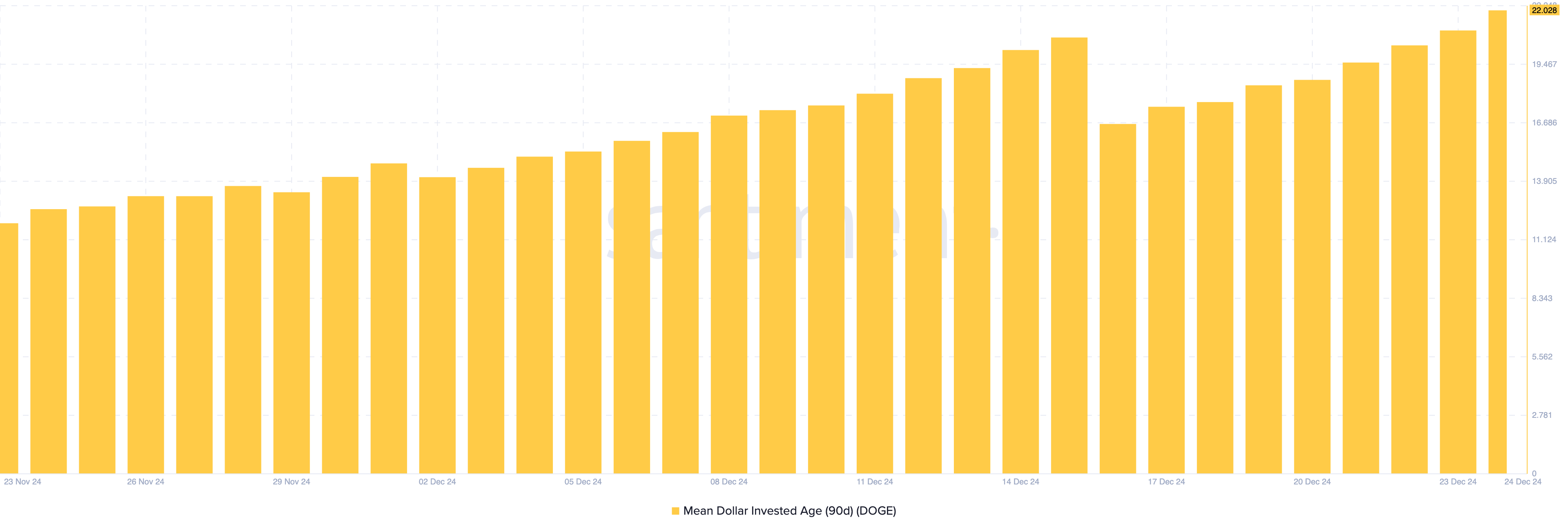

In simpler terms, the Mean Dollar Invested Age (MDIA) is an additional signal that suggests a potential drop in Dogecoin’s value. This term refers to the typical age of all coins across a blockchain, taking into account the price at which they were bought.

When the MDIA increases, it means more people are holding onto their coins without actively trading them, which can signal a slowdown and is often interpreted as bearish. On the other hand, a decrease in the MDIA implies that previously inactive coins are now being moved, suggesting increased activity or trading. This is generally viewed as bullish since it might indicate renewed enthusiasm and liquidity.

Based on data from Santiment, it appears that the number of Days to Move (MDIA) for Dogecoin over a 90-day period has risen. This suggests that most owners are holding onto their coins rather than selling or trading them actively. If this trend continues, it lends support to the idea that the cryptocurrency may experience a downturn in the near future.

DOGE Price Prediction: Correction Not Over

Looking at the daily view, Dogecoin is struggling to maintain important support zones. Significantly, the cryptocurrency has dipped beneath the $0.35 support area, as buyers were unable to keep it afloat in that region. Additionally, the Moving Average Convergence Divergence (MACD) indicates a downward trend, reinforcing this slide.

The Moving Average Convergence Divergence (MACD) indicates market momentum. When it’s positive, the momentum suggests a bullish trend; however, when it’s negative, the trend is bearish. As you can see in the chart, the MACD reading currently falls within the negative zone. If this continues, there might be a potential decrease in Dogecoin’s price down to approximately $0.27.

If bulls manage to hold onto the $0.35 support level and defend it effectively, there’s a chance we might see a shift in the current trend. Under such circumstances, Dogecoin (DOGE) may bounce back and potentially reach $0.48 again.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-12-24 12:24