As an analyst with over two decades of experience in the financial markets, I have witnessed numerous market cycles and trends unfold before my eyes. The recent reversal in Dogecoin (DOGE) is a reminder that no asset is immune to volatility.

After reaching a significant milestone by exceeding the market value of Porsche in early December, the price of Dogecoin (DOGE) has suddenly changed direction. Following an intense surge, DOGE is now retreating and has dropped approximately 20% over the last day and around 30% over the past week.

This sharp drop suggests that negative market forces are growing stronger, as various technical signals warn of potential additional losses. With Dogecoin’s price approaching crucial resistance points, investors are on high alert for any indications of stability or possible rebound during these turbulent times.

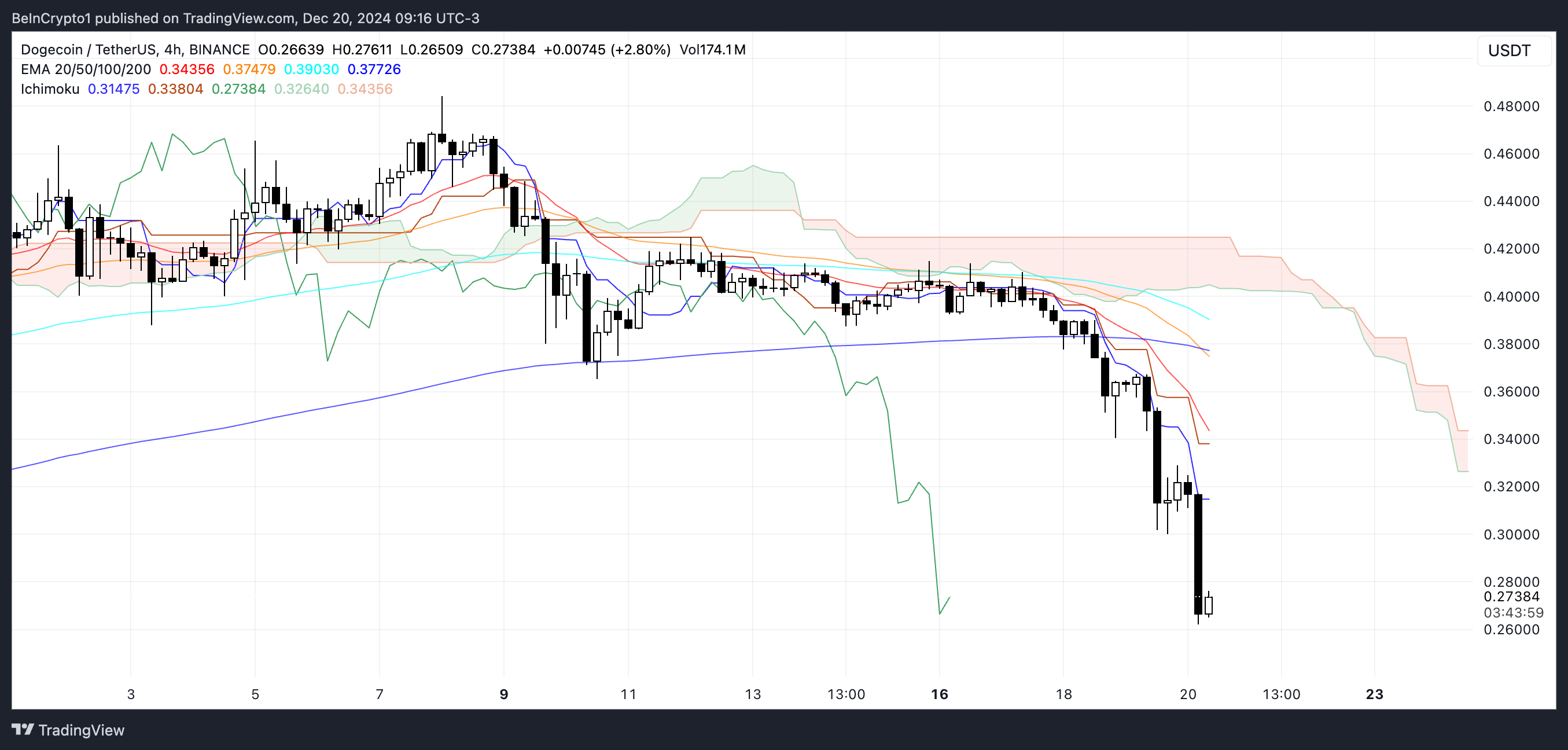

Ichimoku Cloud Shows a Bearish Setup for Dogecoin

As a researcher examining Dogecoin’s Ichimoku Cloud chart, it’s evident that the trend is decidedly bearish. The current trading price sits significantly below the Ichimoku Cloud, with the Senkou Span A (represented by the red line) and Senkou Span B (the green line) creating a substantial, downward-sloping construction. This arrangement indicates substantial resistance at higher prices and underscores the influence of bearish forces.

Furthermore, the blue Tenkan-sen line continues to stay beneath the red Kijun-sen line, indicating a bearish pattern due to ongoing short-term and medium-term weakness. The green lagging span (Chikou Span) is located below both the cloud and current price movement, providing additional evidence of the prevailing bearish outlook.

Looking at the falling pattern of the red (Senkou Span A) and green (Senkou Span B) bands in front, it seems the downward trend may continue unless we see a substantial shift or reversal.

If the trend keeps going downwards, the Doge price might experience additional drops, potentially reaching levels close to its recent lows. For a change in direction, the price needs to surge beyond the cloud and have the blue Tenkan-sen line cross over the red Kijun-sen line, which doesn’t seem likely at present.

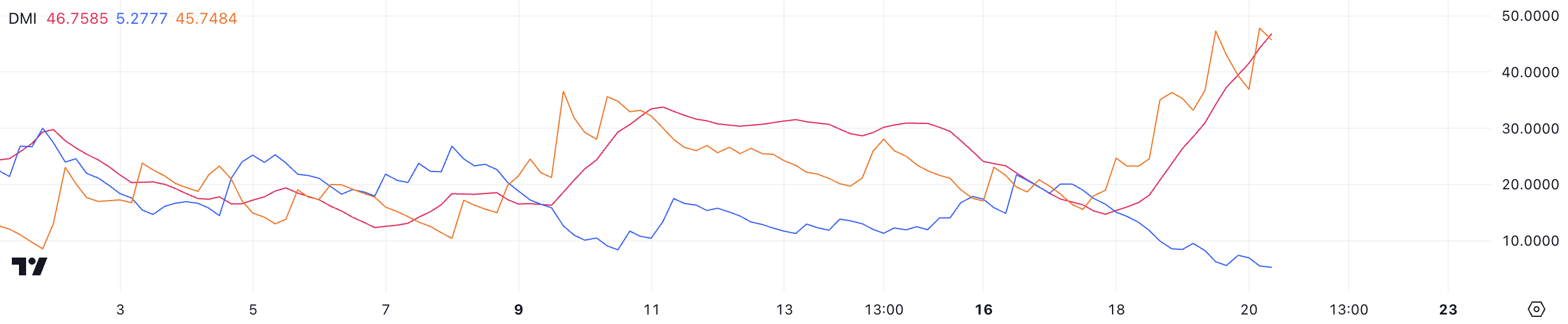

DOGE Current Downtrend Is Strong

The DOGE DMI chart indicates a robust bearish momentum in the ongoing market trend. Over the last three days, the ADX value has surged dramatically from 14.7 to 46.7, suggesting that the intensity of the trend’s overall direction, whether bullish or bearish, has significantly increased.

The orange D- line, representing negative directional movement, is currently at 45.7, significantly higher than the blue D+ line, which is at 5. This imbalance suggests that the downward trend is dominating, with sellers overwhelmingly in control of the market.

As a researcher, I’d rephrase it as: In my analysis, the Average Directional Index (ADX) serves to quantify the strength of a market trend. Notably, an ADX below 20 points towards a feeble or indecisive trend, while values between 20 and 40 indicate a more moderate trend. If the ADX exceeds 40, it signals a robust trend. In this particular case, with the ADX at 46.7, I find that Dogecoin’s ongoing downtrend is gathering momentum, underscoring its strength in the market.

For a while, the market might exhibit more downward trends due to the presence of a strong selling force, indicated by a high ADX, a dominant ‘D’ line, and a weak ‘D+’ line. This implies that there is currently insufficient buying pressure to challenge the prevailing selling pressure.

Dogecoin Price Prediction: A Further Correction Ahead

If the ongoing drop in DOGE’s price continues, it might further decline towards the significant support point at approximately $0.219. This region serves as a potential spot for buyers to try halting the descent; nevertheless, if selling pressure remains high and this support is breached, the price could potentially dip down to around $0.14.

Making such a move would signify an additional 48% drop from current prices, demonstrating how intensely bearish the market is. With sellers in control and a clear downward trend supported by recent technical signals like the DMI, this potential outcome seems likely, unless there’s a surge of buying activity that counters it.

If the price of DOGE starts to gain positive traction again, it may aim for a rebound to approximately $0.34, which serves as a significant resistance point. Overcoming this level could potentially lead to an increase towards $0.43, representing a potential growth of around 59% from its current value.

Reaching this recovery might necessitate a change in attitude, accompanied by increased purchasing activity and a decrease in the influence of pessimistic views.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- 30 Best Couple/Wife Swap Movies You Need to See

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

2024-12-20 18:29