As a seasoned crypto investor with years of experience navigating the volatile and ever-evolving digital asset landscape, I find myself closely monitoring the ongoing regulatory developments affecting Tether (USDT) in Europe, particularly following Coinbase’s decision to delist it due to MiCA compliance concerns.

Having witnessed the Mt. Gox collapse in 2014 and several other regulatory battles over the years, I have come to appreciate the importance of adhering to compliance standards while maintaining innovation in this nascent industry. Coinbase’s conservative approach toward avoiding compliance risk seems prudent, given the potential consequences of non-compliance, as highlighted by industry experts.

On the other hand, I understand the strategic decision made by exchanges like Binance and Crypto.com to continue offering USDT in Europe while awaiting further clarity from regulators. However, I am cautiously optimistic about their approach, recognizing that the potential disruptions, increased costs for traders, and possible market liquidity issues could outweigh the benefits of continued trading.

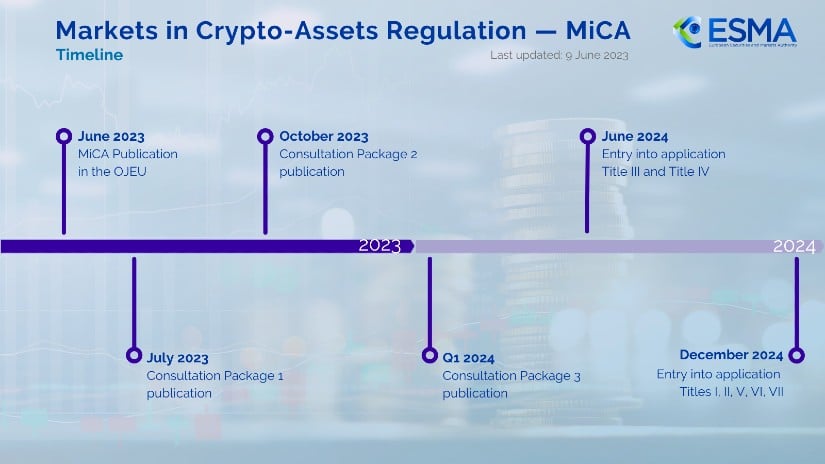

The MiCA regulation indeed marks a significant milestone in the European cryptocurrency market, aiming to promote transparency and consumer protection. However, I share Juan Ignacio Ibañez’s concern that the lack of clarity regarding key assets like USDT underscores the complexities of implementing such sweeping reforms. As an investor, I am eagerly waiting for the European Securities and Markets Authority (ESMA) to provide definitive guidance on USDT’s status under MiCA.

In a lighter note, I can’t help but chuckle at the irony of Tether’s situation. After all, it was once hailed as the digital equivalent of cash, yet now finds itself in a regulatory limbo, much like a joker in a deck of cards – always present but never quite fitting into its designated category! The road ahead for USDT in Europe remains uncertain, and I, for one, am looking forward to seeing how this plays out.

In early December 2024, Coinbase, a prominent U.S. cryptocurrency exchange, removed Tether (USDT) from its European services ahead of time due to concerns over compliance with MiCA regulations. In contrast, other significant platforms such as Binance and Crypto.com have chosen to keep USDT available in Europe.

Uncertainty Around USDT Compliance

Even though MiCA regulations are about to take effect, European authorities haven’t clearly said whether Tether (USDT) adheres to the new compliance standards. This lack of clarity has caused market participants to have differing opinions. Juan Ignacio Ibañez, a member of the MiCA Crypto Alliance’s Technical Committee, clarified that although no regulators have declared USDT as non-compliant, this doesn’t necessarily mean it is compliant.

By choosing to remove USDT from its platform, Coinbase demonstrates a cautious stance, aiming to steer clear of potential compliance risks at the eleventh hour. On the other hand, exchanges like Binance and Crypto.com continue to facilitate USDT trading, waiting for more definite guidance on the matter.

Potential Impact of Non-Compliance

Experts in the industry express caution that if Tether (USDT) fails to comply with regulations, it could cause substantial market disruptions. Jacob Kinge, a financial analyst, has noted that Tether has temporarily stopped issuing new coins, sparking worries about liquidity and trading expenses. “A ban on USDT could potentially boost trading costs and disrupt market fluidity,” Kinge stated.

Additionally, Joseph Hurtado, the founder of Granata Consulting, highlighted far-reaching effects: “Limiting USDT might undermine Europe’s status as a center for cryptocurrency innovation.

MiCA’s Transitional Measures

As a long-time financial services professional with extensive experience navigating regulatory changes across multiple jurisdictions, I find it encouraging that MiCA (Markets in Crypto-Assets) regulation includes a transitional phase for entities operating under national laws to adapt to the new framework. This “grandfathering” clause allows existing service providers, like myself, to continue operations until July 1, 2026, or until we obtain or are denied MiCA authorization.

However, it’s important to note that the length of this transitional period varies significantly by country, ranging from six months in the Netherlands to 18 months in France. This discrepancy could create challenges for companies like mine looking to provide cross-border services, as we may need to comply with different sets of rules depending on the jurisdiction we’re operating in during this transitional period.

In my opinion, a more uniform approach across countries would be preferable, as it would simplify compliance efforts and reduce operational complexities for companies like mine. Nonetheless, I appreciate the effort being made to provide a reasonable transition period and look forward to working within the new regulatory framework once it’s fully implemented.

Flexibility within the market may offer advantages to participants, but it can also lead to varying degrees of consumer protection throughout the EU. As Ibañez cautioned, delaying action could potentially pose risks over time. He underscored the significance of taking prompt and proactive steps.

The way Tether conducts its financial reviews has come under close examination. Critics such as Jason Calacanis of the All-In Podcast have raised concerns about Tether relying on assurance reports from BDO Italia instead of having audits done by well-known firms. In response, Tether’s CEO, Paolo Ardoino, has defended the company’s practices, emphasizing their work to increase the practical applications and collaborative partnerships for USDT (Tether’s stablecoin).

The Road Ahead for USDT in Europe

As the December 30th deadline nears, the fate of USDT in Europe is still unclear. Some digital platforms are choosing to take a “watch and wait” approach, while companies like Coinbase are focusing on compliance matters. The regulatory uncertainty highlights the complexities involved in striking a balance between rapid technological advancement and stringent oversight.

The European Securities and Markets Authority (ESMA) has not yet given a conclusive decision on the classification of USDT under MiCA. With exchanges and market participants moving through this transitional period, it’s essential now more than ever that regulators provide clear, consistent instructions to ensure smooth operations.

Conclusion

The MiCA regulation signifies a significant step forward in the European cryptocurrency sector, focusing on increasing transparency and safeguarding consumers. Yet, the uncertainty surrounding important assets such as USDT underscores the challenges involved in executing extensive regulatory overhauls. As the industry adjusts to these transformations, both market players and regulators face high risks in navigating a course that balances stability with continued innovation.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-12-29 15:54