Let’s talk about reinvesting in what you already own. It’s like showing up to a party and buying another drink from the same bartender who spilled on you earlier-annoying, but sometimes you’re just thirsty. For dividend stocks, the rules are simple: ignore the sector like it’s an awkward small talk topic, and prioritize yield like it’s the last slice of pizza at a family gathering.

Here are three stocks to double down on now. Their recent dips are like that friend who yells “SALE!” at their garage sale-overly dramatic but maybe worth a glance.

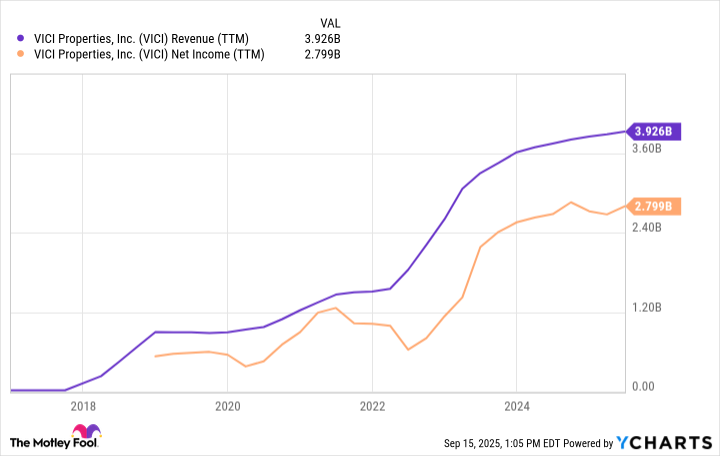

Vici Properties

Vici Properties (VICI) is the financial equivalent of a man who wears a three-piece suit to a casual Friday but still manages to make you feel underdressed. You’ve probably never heard of it, but you’ve likely stepped foot on its properties. It’s a REIT, which means it owns casinos, golf courses, and restaurants. Its tenants include MGM and Caesars, which is like having two neighbors who always pay their rent on time but might occasionally yell at you for parking in their driveway.

Vici’s triple-net leases are a masterclass in shifting responsibility. Tenants pay taxes, maintenance, and insurance-Vici just sits back and collects rent like a landlord who’s mastered the art of passive aggression. Its 100% occupancy rate is impressive, but let’s be real: if you’re investing in a company that owns 54 casinos, you’re betting on people’s inability to quit gambling. Still, the 5.4% yield is like finding a $20 bill in your couch cushions-unexpected but welcome.

Coca-Cola

Coca-Cola (KO) is the financial world’s version of your uncle who insists on wearing a tie to Thanksgiving. Over 60 years of dividend growth, yet it’s still somehow a “cliché.” But here’s the thing: clichés exist because people keep falling for them. Coca-Cola isn’t just a beverage company; it’s a cultural institution. You’ll find its logo on Christmas ornaments and gym shirts, which is either branding genius or a cry for help.

The stock’s 10% drop? Blame it on tariffs and the market’s collective panic over “economic weakness.” It’s like showing up to a buffet and worrying about the size of the silverware. Coca-Cola’s guidance wasn’t terrible-it just wasn’t terrible enough to satisfy investors who live in a spreadsheet-induced haze. The 3% yield is now back, which is like your favorite coffee shop finally lowering the price of a latte after a decade of price gouging.

NextEra Energy

NextEra Energy (NEE) is the utility sector’s answer to that guy who cleans up after everyone at a party. It’s not just selling power to 12 million Floridians-it’s also prepping for the AI-driven electricity boom like it’s reading the room. Over half its energy comes from renewables, which is either forward-thinking or a desperate attempt to stay relevant. Either way, it’s building energy storage like it’s prepping for a blackout caused by the entire world switching to cryptocurrency mining.

NextEra’s 3.2% yield is the financial equivalent of a polite but firm “no” to the idea of fossil fuels. The market’s obsession with AI-driven electricity demand is overblown, but NextEra’s got 30 gigawatts of projects in the pipeline. It’s like showing up to a BBQ with a cooler full of drinks-everyone’s happy, but you’re secretly annoyed someone spilled on your shirt.

Investing is a series of minor indignities. These stocks are just the least awkward ones you can sit through. 🤡

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-09-19 10:33