The streets are bustling with weary shoppers, their wallets thin from the relentless grind of inflation. Yet, amidst the chaos, a glimmer of opportunity shines—discount retailers are gaining traction. For the astute dividend hunter, this is not merely a trend but a call to action. As the masses scramble for value, two stocks emerge as potential beacons of hope.

1. Target

Before us stands Target (TGT), a titan of retail, now humbled by a 61% fall from its 2021 peak. Theft and tepid same-store sales have marred its once-proud facade. Yet, beneath the surface, resilience persists. Last year, it clawed $4 billion in net profit from $105 billion in revenue.

Notably, Target has raised its quarterly dividend by 1.8%, marking 54 years of consecutive increases. With dividends consuming less than half its trailing earnings, the path forward remains clear. Its digital business surges, with same-day deliveries growing 35% last quarter, offering a lifeline in an otherwise stagnant sea.

Management’s optimism is palpable. Adjusted EPS is projected between $7 and $9, comfortably covering dividends. With a forward yield of 4.38% and a P/E ratio of 14, Target stands on the precipice of recovery, a bargain for those bold enough to seize it.

2. TJX Companies

In the shadows of consumer frugality, TJX Companies (TJX) thrives. Its off-price empire—T.J. Maxx, Marshalls, Sierra—caters to the thrifty soul. A $10,000 investment in 2005 now yields $279,000, testament to its enduring allure.

TJX’s mastery lies in sourcing quality goods at steep discounts, a feat enabled by its global network and supply chain prowess. Each segment, from TJX Canada to TJX International, posted sales growth in the tumultuous first half of 2025.

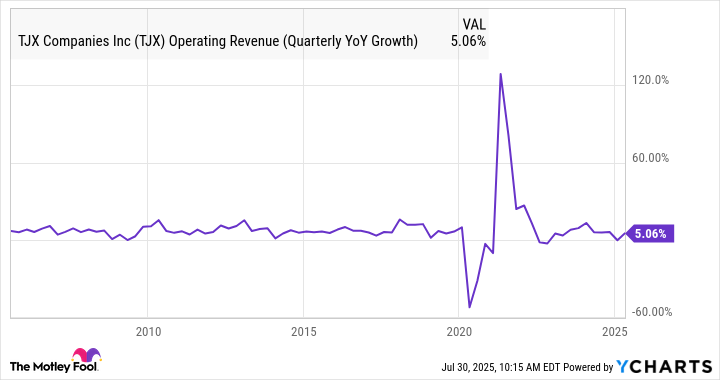

Quarterly sales growth has been a constant for 25 years, interrupted only by the pandemic. Its talent development program fosters internal promotions, ensuring continuity and performance. Though the stock is not cheap, its trajectory promises substantial returns.

In a world of uncertainty, TJX remains steadfast, a haven for those seeking both value and growth.

The hunt for dividends is not merely a pursuit of wealth—it is a quest for stability in an unstable world. 🏷️

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR Fate/stay night — best team comps and bond synergies

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- 9 Video Games That Reshaped Our Moral Lens

2025-08-02 12:13