The market…a swirling vortex of greed and delusion. Everyone chasing the NEXT BIG THING, the overnight miracle. They’re all hopped up on growth stocks, mainlining volatility like it’s the elixir of life. Fools. Utter, predictable fools. While they’re busy riding the rocket, I’m digging in, fortifying the position. Because when the crash comes – and it ALWAYS comes – it’s the steady drip of dividends that’ll keep you from scavenging for bottle caps in the radioactive wasteland. Forget doubling your money, I’m talking about SURVIVAL. This isn’t about getting rich; it’s about not ending up completely BROKE when the whole damn thing implodes.

So, while the manic hordes chase phantom gains, let’s talk about something REAL. Something…reliable. We’re talking about the Dividend Kings. Companies that have been coughing up cash for FIFTY YEARS. Fifty years! That’s before color television, before the internet, before…well, before everything went completely insane. These aren’t just stocks; they’re life rafts in a sea of financial hysteria. They offer a pathetic glimmer of sanity in a world gone mad. And in 2026? You’ll be thanking your lucky stars you didn’t bet the farm on some tech bubble.

1. Abbott Laboratories: The Steady Hand

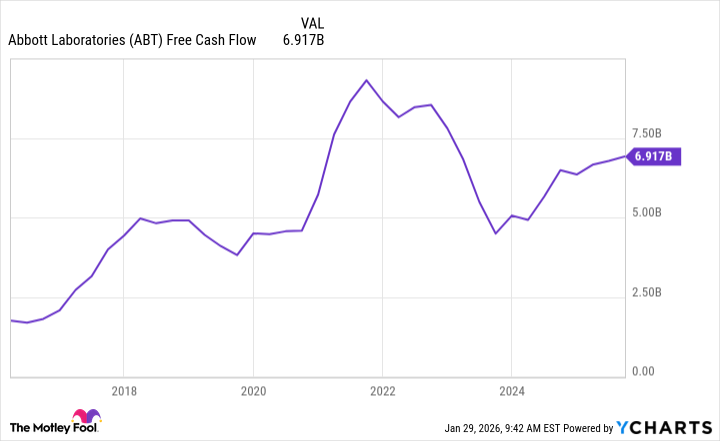

Abbott. A name that doesn’t exactly scream “REVOLUTION,” does it? No, it whispers “stability.” Fifty years of dividend increases. FIFTY. That’s a testament to a management team that understands one simple principle: pay the shareholders, keep them happy, and avoid getting vaporized in the next market correction. They’re handing out $2.52 a share, a measly 2.4% yield, but in this climate? It’s practically a FORTUNE. And they’ve got the free cash flow to keep the gravy train rolling. Diversified, boring, and utterly…essential. Four business units—medical devices, diagnostics, nutrition, pharmaceuticals—a buffer against any single catastrophe. A solid, unglamorous fortress of cash. I like it. I REALLY like it.

2. Target: The Wounded Beast

Target. Oh, Target. They had their moment, riding the pandemic wave of panic buying and boredom-induced consumerism. Then reality hit. Essentials are low margin. Theft is rampant. It’s a mess. But here’s the thing: they’re fighting back. An “enterprise acceleration office”? Streamlining processes? Sounds…clinical. But it’s a sign they haven’t completely given up. And a new CEO taking the reins in February? A potential turning point. This isn’t a guaranteed win, folks. This is a gamble. A desperate, last-ditch effort to claw their way back from the brink. But the potential payoff? A 4.5% dividend yield. A decent chunk of change while you watch the recovery unfold. It’s a wounded beast, yes, but a wounded beast can still bite. A calculated risk, and I’m feeling…reckless.

3. Johnson & Johnson: The Corporate Leviathan

J&J. A behemoth. A sprawling, multi-headed monster of a corporation. They spun off Kenvue—Tylenol, Band-Aids—because they wanted to focus on the “high-growth” stuff: innovative medicine, medtech. A calculated move. And it’s working. 6% sales increase. Earnings climbing. They’re claiming the “strongest commercial portfolio and pipeline in the company’s history.” Marketing hyperbole, probably. But the numbers don’t lie. They’re compensating for the loss of Stelara exclusivity—a blockbuster drug losing its patent—with growth in oncology, neuroscience, and other areas. They’re adapting. Evolving. Surviving. And they’re handing out a 2.3% dividend while they do it. Solid. Reliable. Predictable. The kind of corporate machine that will probably outlive us all. A safe harbor in a storm of financial chaos. I’ll take a piece of that, thank you very much.

So, there you have it. Three Dividend Kings. Not glamorous. Not exciting. But in a world spiraling into madness, they offer a glimmer of hope. A lifeline in the abyss. Forget chasing the next unicorn. Focus on surviving the inevitable crash. Because when the dust settles, it won’t be the high rollers who are laughing. It will be the ones who had the foresight to build a fortress of dividends. And that, my friends, is a lesson worth remembering. NOW, if you’ll excuse me, I need a drink.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- QuantumScape: A Speculative Venture

- Gay Actors Who Are Notoriously Private About Their Lives

2026-02-01 03:22