In the vast tapestry of modern finance, where the hum of algorithms drowns the whispers of human reason, stands the Invesco QQQ Trust-a vessel of ambition and folly alike. It mirrors the Nasdaq-100, that restless beast composed of the 100 largest Nasdaq-listed titans, excluding the scribes of finance. Yet, what is this fund but a mirror held up to the soul of an age obsessed with silicon and data? To invest in it is to stake a claim in the dreams of engineers and the hubris of monopolists.

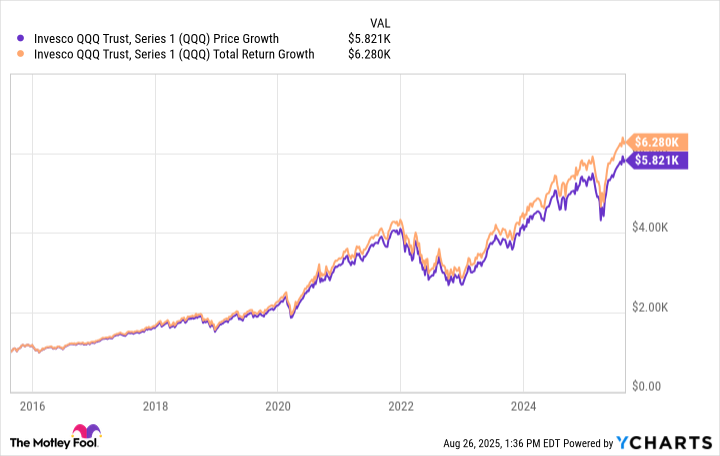

Consider the humble sum of $1,000 deposited in 2015, a year when the world still clung to the illusion of stability. By 2025, this seed had grown into a tree bearing $5,800 in fruit, its branches heavy with the weight of reinvested dividends-$6,200 in total, if one counts the crumbs tossed by the gods of quarterly earnings. Such is the alchemy of compounding, a process as old as time and yet as elusive as the philosopher’s stone. The dividend hunter, ever patient, would have watched these numbers rise not with glee, but with the quiet calculation of one who understands that true wealth lies in the arithmetic of reinvestment, not the fever of speculation.

What, then, shall the next decade bring for this fund of titans? The QQQ is a colossus built upon the backs of technocrats, its heart beating to the rhythm of artificial intelligence, cloud computing, and the ever-present drumbeat of digital surveillance. These are not mere trends; they are the new faiths of a generation that worships at the altar of efficiency. Yet, as Tolstoy might ask, what is progress if it strips man of his dignity? The same Nvidia that fuels the dreams of AI may also power the machines that replace the laborer’s hands. The same Apple that gifts us beauty may also chain us to its walled garden.

And yet, the QQQ marches on, carried by the names etched into its ledger: Microsoft, Alphabet, Amazon, Meta. These are the modern pharaohs, their pyramids built of code and capital. Their CEOs, like Hamlet in their boardrooms, ponder the existential dread of disruption while their dividends flow like the Nile-steady, predictable, and yet subject to the whims of market tides. The dividend hunter, ever the realist, knows that even these titans must bow to the arithmetic of profit and the caprices of inflation.

Is this growth a triumph of human ingenuity or a descent into mechanized servitude? The answer lies not in the numbers, but in the choices of those who wield them. For now, the QQQ remains a testament to the paradox of our age: that the pursuit of shareholder value often masquerades as the pursuit of progress. And so, the hunter watches, calculating not only the yield of shares but the cost of the world they help build.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- The Weight of First Steps

- Opendoor’s Stock Takes a Nose Dive (Again)

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

2025-08-28 22:18