Investors chase what’s hot. Artificial intelligence. Tech stocks. The usual suspects. Markets love them. Investors love them. But here’s the rub: Love is blind. And blind investors often fall into traps. So it goes.

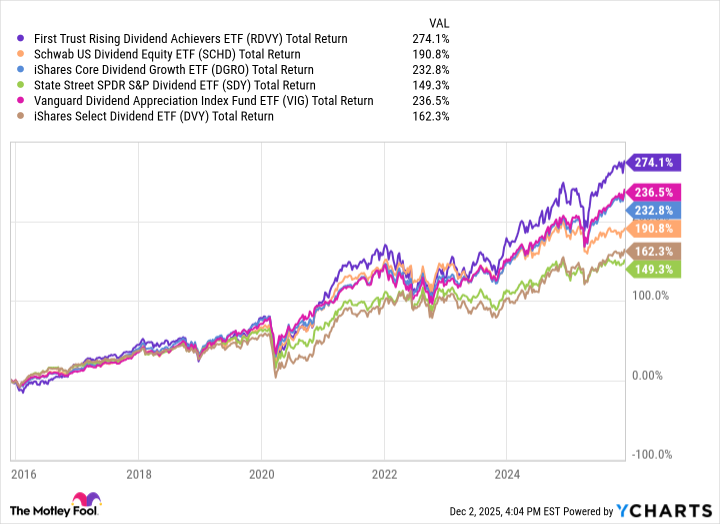

Consider the First Trust Rising Dividend Achievers ETF (RDVY). It’s not flashy. It doesn’t wear a cape or scream “I’m the future!” Instead, it hums along like a well-oiled dividend machine. At twelve years old, this ETF has aged like a fine wine-assuming the wine was a bit more conservative and less prone to corking disasters. Still, the numbers don’t lie. $18.21 billion under management. A track record that outpaces many of its peers. Not bad for a fund that refuses to play dress-up in the AI ballroom.

This isn’t your grandfather’s dividend ETF

Rules. They’re the unsung heroes of value investing. RDVY’s rules are brutal. Companies must raise dividends year after year, prove earnings growth, and keep their debt in check. Cash-to-debt ratios above 50%. Payout ratios below 65%. It’s like asking a teenager to clean their room without complaining. Most wouldn’t qualify. But those that do? They become the quiet stars of this show.

Past performance isn’t a crystal ball. But methods matter. RDVY’s playbook is simple: Quality over quantity. Sustainability over spectacle. It’s the investing equivalent of eating your vegetables. Boring? Perhaps. Effective? Undeniably.

And then there’s the twist. A dividend ETF with Alphabet and Nvidia in its top six holdings. The universe tilts. Dividend funds typically avoid tech like it’s a black hole. But RDVY? It dances with the stars. Why? Because great companies with rising dividends are worth their weight in gold-even if they’re occasionally caught coding in pajamas. So it goes.

For the value investor, this fund is a paradox wrapped in a bow. It’s a reminder that the best investments often live in the shadows of the spotlight. They don’t shout. They don’t trend. They just… work. Like a clockmaker who never checks the time. You trust them. You let them do their thing. And when the music stops, you’re still dancing. 🚀

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-12-07 22:03