One hears a great deal these days about ‘Dividend Kings’ – companies who, with a sort of dogged persistence, have managed to increment their payouts for half a century. Rather like a particularly stubborn aunt, one supposes. The list, naturally, is touted as a haven of stability, but one always wonders if such longevity isn’t merely the triumph of inertia over acumen.

Nevertheless, we are assured that Sherwin-Williams (SHW), Pentair (PNR), and McDonald’s (MCD) are all poised to join this rather exclusive club within the next five years. Whether they will do so, and whether it will actually *matter*, remains to be seen. One approaches such pronouncements with a healthy dose of cynicism, naturally.

Sherwin-Williams: A Question of Hue

Scott Levine informs us that Sherwin-Williams, purveyors of paint to the masses (and the professionals, presumably), have been rewarding shareholders for 46 years. An admirable performance, one concedes, particularly in an industry hardly known for its dynamism. A forward yield of 0.93% hardly sets the Thames on fire, but one understands the attraction – a dependable, if modest, trickle.

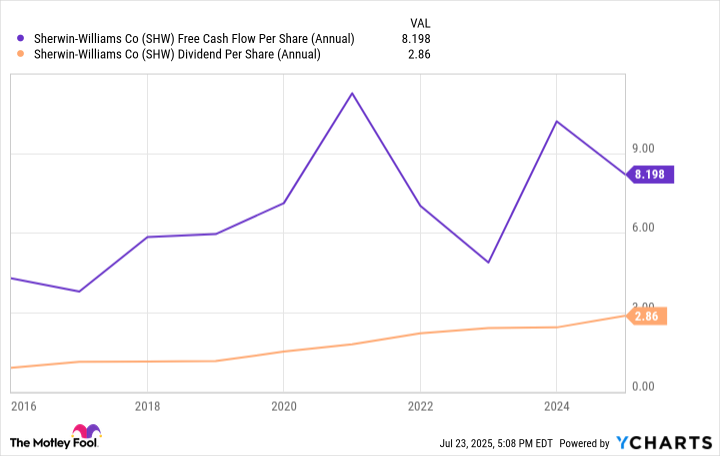

The company itself, dating back to 1866, has a history of… well, being there. A comforting thought, perhaps, if one is easily rattled by market fluctuations. They produce paints and coatings for everything from automobiles to yachts, which sounds very grand, doesn’t it? And they boast over 5,400 stores and 140 manufacturing facilities. Quantity, it appears, is their forte. A payout ratio of 26.6% strikes one as admirably conservative, and the free cash flow is, thankfully, sufficient to cover these disbursements. Though one wonders if a bit more daring mightn’t yield more exciting results.

A compound annual growth rate of 14.6% is certainly respectable, and clearly appeals to those of a nervous disposition. One must, however, remember that the housing market – and indeed, industrial demand – are rather capricious mistresses. Comfortably riding out the ‘temporary volatility,’ as they so blithely put it, requires a degree of fortitude few possess.

Pentair: Plumbing the Depths

Lee Samaha posits that Pentair, a manufacturer of water-related products, is on the cusp of dividend royalty, having increased its payout for 49 consecutive years. The real question, of course, is *why*. Solid end markets, apparently: fluid treatment, pump products, water solutions, and even pools. One pictures rather languid afternoons by the pool, funded by increasingly incremental dividends.

The demand for maintaining and improving water infrastructure, along with the growth of residential developments, seems… unavoidable, one supposes. And management’s initiatives – targeted pricing, lean manufacturing, the 80/20 rule – are all rather sensible. Driving operating margins from 18.6% to 26% sounds positively miraculous, and the 45% increase in the stock price since 2022 is certainly gratifying. One just hopes it can be sustained without resorting to trickery.

McDonald’s: A Golden Opportunity?

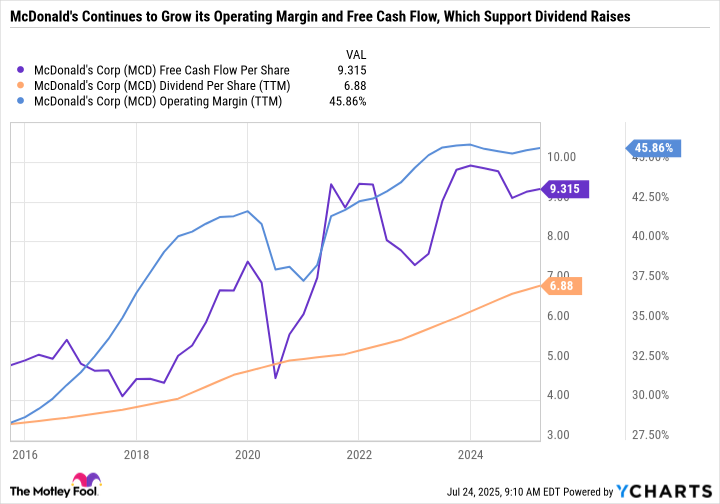

Daniel Foelber notes that McDonald’s recently raised its dividend for the 48th consecutive year. Remarkably consistent, if utterly predictable. The franchise model – 95% of restaurants owned by franchisees – appears to be the key. Rent and royalties, it seems, are a remarkably reliable source of income. A rather clever arrangement, one must admit.

The arrangement with franchisees varies – some pay rent, some don’t, some receive equity-based earnings. But the result is a steady stream of free cash flow and, consequently, a highly predictable capital return program. A high operating margin, due to the capital-light nature of the business, is also rather appealing. Essentially, they’re paid to let other people do all the work. Astute, really.

All in all, McDonald’s appears to be a remarkably high-quality dividend stock. A foundational holding, they say. One might well agree, though one does occasionally tire of the golden arches. Still, a bit of dependable income in a rather turbulent world is, at least, something to be thankful for. 🧐

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Weight of Choice: Chipotle and Dutch Bros

- 9 Video Games That Reshaped Our Moral Lens

2025-07-31 14:38