Picking stocks is like trying to pick a Netflix show that doesn’t end up being a disaster. You think you’ve got it figured out, but then the third episode drops and you’re stuck with a show that’s just… meh. Enter the Schwab US Dividend Equity ETF (SCHD), the financial equivalent of a personal assistant who does all the work, sends you a weekly report, and never asks for a raise. Here’s the lowdown.

What does the Schwab US Dividend Equity ETF do?

It’s an index-tracking ETF, which means its managers are basically just following a recipe. The recipe? The Dow Jones U.S. Dividend 100 index. Think of it as a dating app for stocks: only companies with a 10-year history of raising dividends get a profile. REITs? Out. It’s like a VIP lounge for financially stable, dividend-friendly corporations.

The index then ranks these stocks using a mix of metrics-cash flow, return on equity, dividend yield, and five-year growth. It’s like a job interview, but the company is the one doing the asking. The top 100 get a spot in the ETF, which is basically a financial “best of” list. And yes, it’s updated annually. Because nothing says “commitment” like a yearly check-in.

Is the Schwab US Dividend Equity ETF right for you?

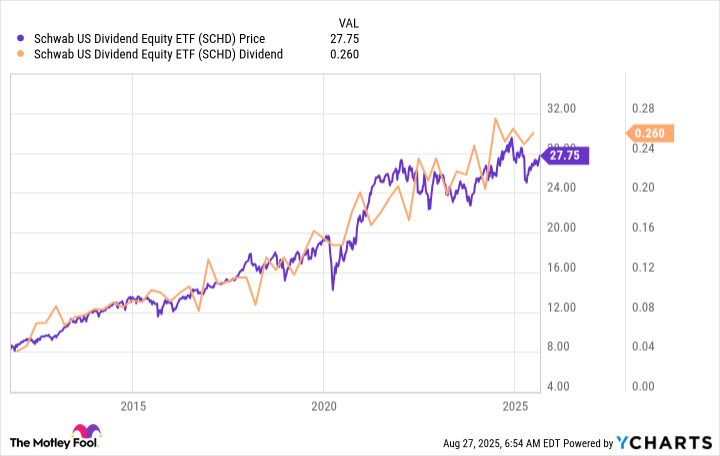

If you’re a growth investor, this might as well be a yoga manual. But for everyone else? It’s like a buffet of stability. Sure, its 3.9% yield isn’t the flashiest, but it’s the financial equivalent of a reliable friend who always pays their share. Plus, it’s diversified, so you’re not betting your future on a single stock’s “moment.”

The real kicker? It’s giving you both income and growth. It’s like getting a raise and a bonus in the same paycheck. And with a 0.06% expense ratio, it’s cheaper than your gym membership. (But don’t tell your trainer.)

Of course, it’s not perfect. Right now, it’s lagging the S&P 500. But let’s be real-most of the S&P’s gains are from tech stocks that pay dividends like a broke college student. If you’re looking for a stress-free way to build a dividend portfolio, this ETF is the financial version of a “takeout” option. No thinking required.

The Schwab US Dividend Equity ETF is good, but not perfect

It’s not a miracle worker, but it’s not a scam either. If you’re tired of micromanaging your investments, this is like hiring a butler to handle your finances. You’ll still have to pay taxes, but at least you won’t have to worry about which stock to buy next. And honestly? That’s worth the price of admission.

📈

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

2025-08-30 14:07