The financial world, much like a smoke-filled poker room, thrives on speculation. Investors today chase AI stocks with the fervor of gamblers betting on a hot streak, their portfolios glittering with promises of hypergrowth. Yet, as any seasoned cardsharp knows, even the luckiest streak ends eventually. For those who prefer collecting dividends to chasing vapor, Altria Group (MO) offers a peculiar charm-a 6% yield wrapped in the aroma of Marlboro Reds and the quiet dignity of declining industries.

Let us not condemn the speculators. To gamble on moonshot stocks is as American as apple pie-or cigarettes. But when the bear market’s hangover arrives (and it always does), who will be left standing? The answer, dear reader, lies in the ashtray of economic history. Dividend aristocrats like Altria do not merely survive crashes; they thrive, puffing contentedly while tech darlings go up in smoke.

The Art of Profit in a Declining Market

Altria’s genius lies in its ability to monetize decline like a poet writing elegies for dying stars. Cigarette sales may fall, but prices rise-$8.7 billion in free cash flow materializes as if by magic. The company’s playbook reads like a capitalist’s manual: raise prices, slash costs, and transform nicotine into a cash cow. Even its Anheuser-Busch stake serves as a reminder that sometimes, owning a beer company during Prohibition isn’t the worst idea.

Yet Altria’s ambitions stretch beyond traditional vices. Its recent partnership with South Korea’s KT&G is a Hail Mary pass into the nicotine pouch frontier-a gamble as daring as betting your last ruble on a roulette wheel. Will it pay off? Perhaps. Or perhaps it’s merely rearranging deck chairs on the Titanic. Time will tell.

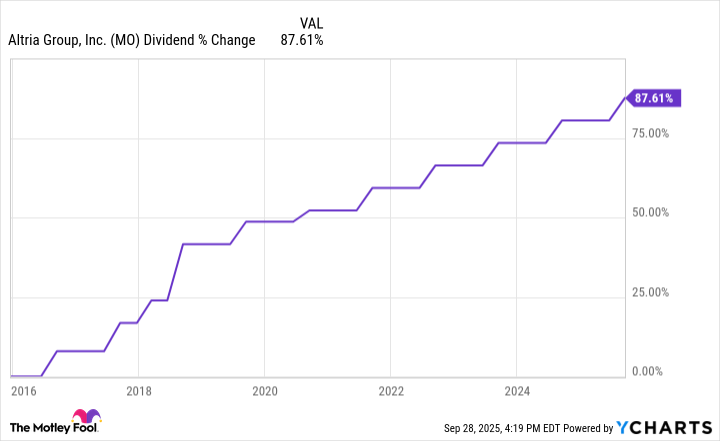

Dividends: The Gift That Keeps on Giving

Altria’s dividend, now a juicy 6.27%, grows like ivy on a crumbling wall-steady, persistent, and indifferent to fashion. With free cash flow outpacing payouts ($5.15 vs. $4.24 per share), the company could fund dividends until the cows come home. Or until the last cigarette is smoked, whichever comes first.

Buy or Hold Your Nose?

In times of crisis, tobacco stocks are the financial equivalent of a well-aged cigar: expensive, faintly vulgar, but oddly comforting. While AI fortunes vanish like smoke rings, Altria’s cash flows remain as reliable as a bureaucrat’s paperwork-eternal and inescapable. For the cautious investor, it’s a hedge against chaos, a way to collect rent while the world burns.

So, should you buy Altria? If your portfolio resembles a house of cards, this stock might be the steel beam you need. Just don’t forget to diversify-even Ostap Bender wouldn’t bet his entire fortune on a single hand. 😉

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Banks & Shadows: A 2026 Outlook

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-10-01 04:41