The stock market, that grand old ballroom of financial revelry, finds itself executing a particularly sprightly quadrille this year. The S&P 500, ever the eager debutante, has pirouetted to a 10% gain year-to-date, with a positively operatic 57% swell in three years and a full-throated 100% crescendo over five. But lo! Enter our hero Altria Group (MO), puffing its way through the ballroom like a particularly determined chimney, having vaulted 25% thus far – quite the performance for a chap in the declining-cigarette trade.

Pricing Wizardry and the Cigar Smoke Gambit

One might reasonably expect a tobacco company in 2024 to be about as fashionable as a monocle in a Zoom meeting. Yet Altria, bless its enterprising soul, has turned the art of selling smoke into something resembling a chess match where the pawns occasionally become queens. The Marlboro man, you see, has discovered that when consumers insist on quitting like tiresome party guests abandoning a particularly dreary canapé, the solution is not despair but rather price increases delivered with the finesse of a maître d’ adjusting his waistcoat.

Witness their quarterly performance: a 10.2% drop in cigarette volume met with the equanimity of a man finding an extra shilling in his waistcoat pocket, resulting in flat revenue and a 4.4% operating income swell. The cigars segment, bless its plucky heart, positively outdid itself with Black & Mild – quite the overachiever at this year’s cigar family reunion.

On! Nicotine Pouches and Other Modern Adventures

Now, every self-respecting tobacco magnate must dabble in modernity, much like a country squire adopting a motorcar while secretly longing for his trusty mare. Altria’s foray into nicotine pouches with On! has proven moderately successful – volume up 26.5% like a particularly sprightly debutante at her first ball. Alas, this enthusiasm couldn’t quite compensate for the melancholy decline of Copenhagen, which is apparently going through its own version of a midlife crisis.

But cheer up! A government crackdown on illicit vaping devices (those ne’er-do-wells of the nicotine world) might prove just the chaperone needed to keep proper business ventures flourishing. It’s rather like having a strict aunt at a garden party – annoying at the time, but potentially excellent for propriety.

The Dividend Dance: A Capital Affair

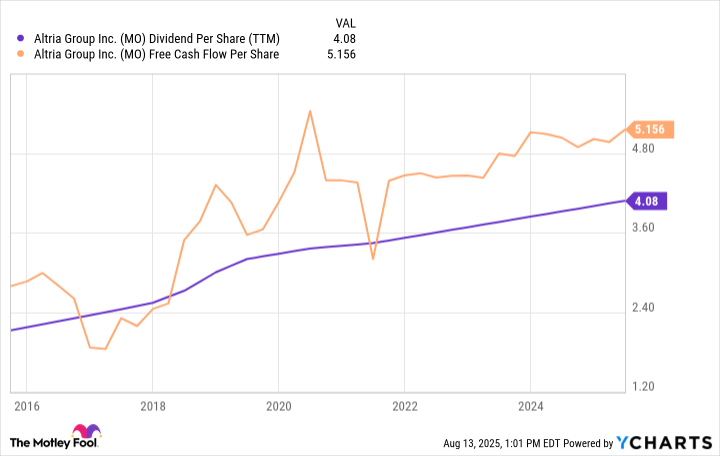

Now to the matter of dividends, which Altria dispenses with the regularity of a Swiss clock and the generosity of a particularly tipsy philanthropist. Their $4.08 annual dividend sits rather comfortably beneath the $5.16 free cash flow umbrella, like a well-dressed guest at a garden party. With shares retiring at a 14% discount from their former selves over the past decade, one suspects management has taken up stock buybacks with the enthusiasm of a bachelor auctioning off his collection of moths.

Will this merry dance continue? With pricing power sharper than a new pair of spats, margin expansion smoother than a perfectly poured gin martini, and just a soupçon of help from nicotine pouches, Altria seems determined to keep its dividend streak alive. At 6.2%, the yield practically winks at investors like a rogueish butler with a heart of gold. 🚬

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-08-17 16:03