Once upon a time, in a land not so far away, there existed a quaint little niche called Bitcoin mining. It was a curious affair, where machines, resembling something out of a mad scientist’s lab, raced against each other to solve cryptographic puzzles for the elusive digital gold. Fast forward to today, and what do we have? An industrial behemoth, with companies the size of small countries operating vast facilities that could probably be seen from space! 🌍

Now, if you fancy yourself an investor but don’t want to get your hands dirty with individual stocks, fear not! Enter the Grayscale Bitcoin Miners ETF (MNRS), launched on the 30th of January, 2025. This nifty little fund tracks the Indxx Bitcoin Miners Index, which is like a treasure map for those brave enough to venture into the mining sector.

Traded on the NYSE Arca, MNRS is your golden ticket to the Bitcoin mining extravaganza—without the hassle of figuring out how to store your digital assets. At the time of this writing, the fund is trading at a modest $20.45 per share, down 5.19% for the day, with a whopping $5.72 million in assets under management. It holds 28 companies that are the backbone of the Bitcoin network, from the miners themselves to the folks who make the shiny machines they use.

Betting on the Backbone of Bitcoin

Bitcoin mining is the magical process that validates transactions and keeps the network secure. Picture miners deploying high-powered computers, competing like children in a candy store for new Bitcoin, all while being rewarded for their tireless efforts. It’s a bit like a high-stakes game of musical chairs, but with more electricity and fewer chairs. ⚡️

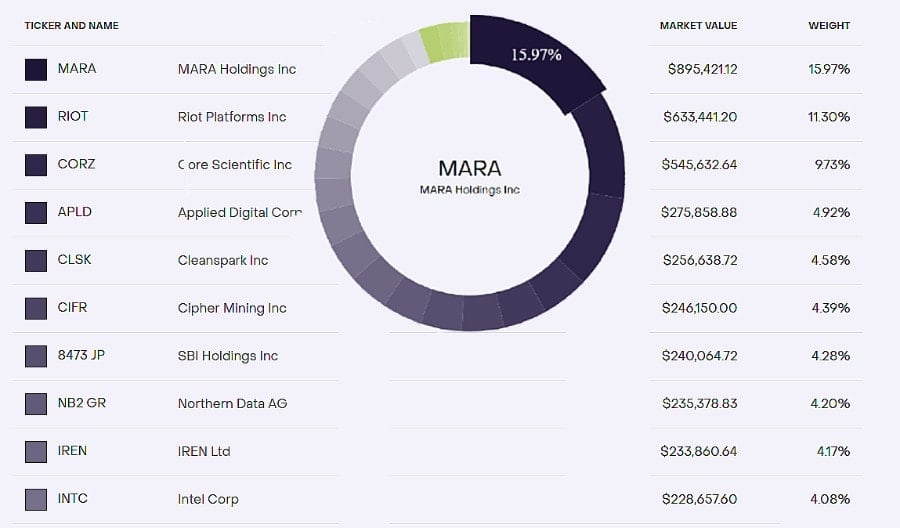

Component weighting of the Grayscale MNRS ETF

The largest holdings in MNRS are like the popular kids in school. Marathon Holdings Inc. (MARA) is the head of the class with a 16% weighting, followed closely by Riot Platforms Inc. (RIOT) at 11% and Core Scientific Inc. (CORZ) at nearly 10%. These companies run sprawling mining farms, many powered by renewable energy, because who doesn’t want to save the planet while making a buck?

Bitcoin’s price is like a rollercoaster, and the fortunes of these miners are strapped in for the ride. A surge in Bitcoin often means a party for revenues, while downturns can squeeze margins tighter than a pair of jeans after the holidays. Since its launch, the Grayscale MNRS has declined 23.7%, mirroring Bitcoin’s wild mood swings. The fund’s benchmark index, the Indxx Bitcoin Miners Index, has also shown a similar trajectory, down 18.21% in the same period.

While MNRS does tend to follow the price of Bitcoin, it won’t always do so.

The Risk and Reward of a High-Volatility Industry

The promise of MNRS is as clear as mud: targeted exposure to Bitcoin miners without the need to navigate the treacherous waters of individual stocks. But hold your horses! This ETF is not sector diversified, meaning its fate is tied to the performance of a single industry. Regulatory uncertainties loom like dark clouds, with policymakers scrutinizing mining’s energy consumption and its impact on financial stability. ☁️

Unlike direct Bitcoin investments, MNRS doesn’t hold digital assets or derivatives. Instead, it provides indirect exposure through publicly traded firms that either mine Bitcoin or supply critical infrastructure. This approach can shield investors from some of the risks associated with cryptocurrency custody, but it also means MNRS won’t always track Bitcoin’s exact price movements. For instance, Bitcoin’s recent 10% surge on March 2nd, following President Trump’s US Strategic Crypto Reserve Announcement, was not reflected in the MNRS price, which continued its downward trend. Talk about a party pooper!

Market Performance and Investor Sentiment

As of March 5, 2025, MNRS is trading at a slight premium to its net asset value (NAV), with a spread of just 0.02%. The median

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-03-05 11:46