If you’ve ever dreamed of sittin’ on the porch, whittlin’ a stick, and countin’ your Bitcoin while the world bays at your feet, listen up. Cryptocurrency, particularly Bitcoin (BTC), has often been hailed as a magical money tree that could make you rich as a king—or at least rich enough to retire and spit tobacco in peace. Now, some folks reckon it might even be the secret to gettin’ out of the rat race early, before your knees give out.

With its impressive growth, like a polecat in a henhouse, Bitcoin promises to fatten your wallet faster than a country preacher on Sunday. Several wise men (and a few fools) have laid out plans to get ya to retirement with Bitcoin—if you’re brave enough to listen and smart enough not to get cleaned out first.

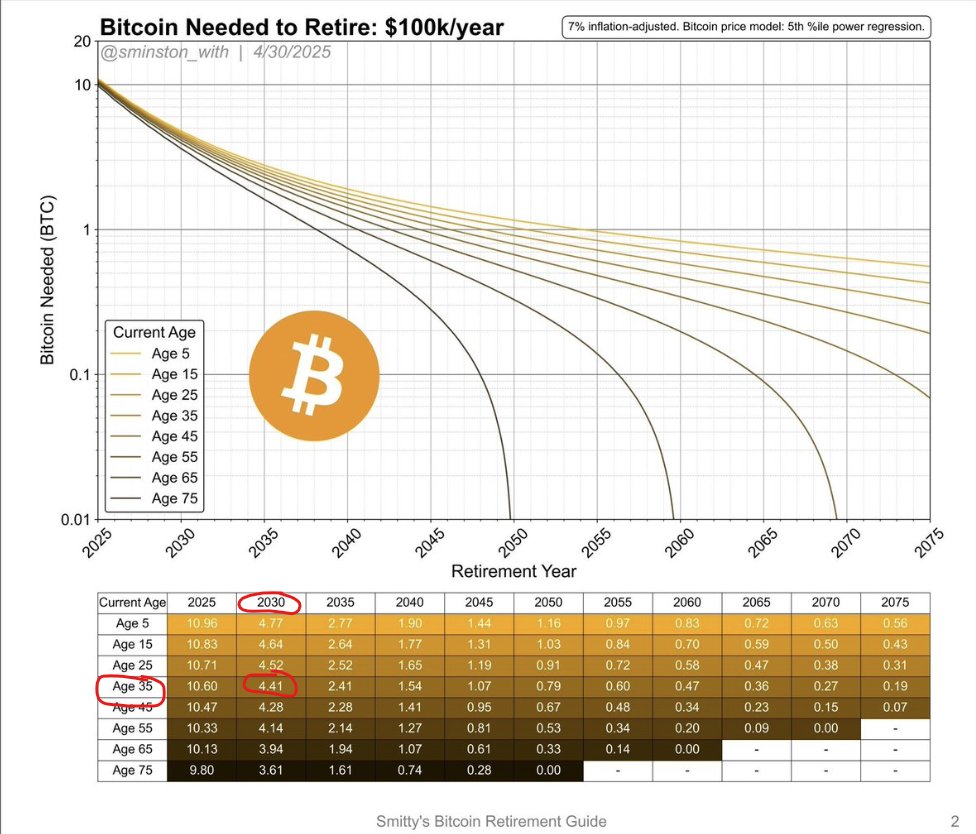

How Much Bitcoin Do You Need to Retire with $100,000 a Year? (Hint: Lots, but maybe not as much as you think)

David Battaglia, an analyst so confident he probably sleeps in a bed filled with Bitcoin, recently offered his wisdom on X—what folks around here call Twitter if they’re feeling fancy. He crunched numbers and says you’ll need about 4.41 BTC if you wanna retire in 2030 making $100,000 a year, provided you ain’t got a spare kidney to sell. That’s around $460,000 at today’s prices—rounding up for good measure. 🤑

The lesson here is: The earlier you wanna kick back, the more Bitcoin you’ll need—unless you’re okay with eatin’ beans and sleepin’ in a barn. Battaglia figures that in 2030, one Bitcoin better be worth a boatload—a cool $584,112—that’d make even a miser grin.

“This means that in 2030, four Bitcoin might be worth enough to keep you livin’ like a noble by spendin’ a little each year,” he says all serious-like.

He warns that if you only take out 4% a year (what grown folks call ‘living off the land’), those 4 BTC should total over two million dollars. Better start hoardin’, I tell ya. 💰

“Inflation and Bitcoin’s wild price swings are the main games here. The model shows that while your dollar buys less over time, Bitcoin might just make up the difference—if you play your cards right,” he adds like a preacher in a revival.

His ideas? Either sell bits slowly, or entrust your stash to some outfit claiming they won’t run off with it. But beware, partner—trusting strangers with your gold can be as risky as hitchin’ a ride with a rattlesnake. And don’t forget Uncle Sam—tax strategy’s just as important. Hunt down a zero-tax hideout, like Paraguay, if you want to keep what you earn.

“Folks, we’re creepin’ closer to the day when Bitcoin can set you up for life, but if you don’t act soon, there might not be enough to go around. And I’ve seen the projections—they’re modest, to keep expectations in check,” he warns with a wry grin.

Then there’s Hornet Hodl, a pseudonymous genius, who’s cooked up a fancy calculator based on those FIRE plans folks talk about—Financial Independence, Retire Early. It lets you fiddle with growth rates, retire dates, and figure out how much Bitcoin you’ll need without fixin’ to run out of coin before the hair on your head falls out.

“This here’s a handy tool for folks plannin’ their golden years in the crypto world,” Fred Krueger—no relation to the nightmare—says confidently.

The calculator balances out the wild swings of Bitcoin’s price with some fancy math—called CAGR, or Compound Annual Growth Rate. It keeps things realistic and helps you plan without chokin’ on your own greed.

So, if you’re dreamin’ of early retirement, this tool might just be your best friend—so long as you don’t go spendin’ it all on moonshine and fool’s gold.

Can Bitcoin Really Beat the System and Get You Out Early? Mark Moss Has a Plan—And a Smile 😊

Now, Mark Moss, a fellow with a grin as wide as the Mississippi, has a plan—five years to be exact—using taxes, loans, and good old-fashioned ambition. He believes if you gather enough Bitcoin, borrow against it without payin’ Uncle Sam, you might just be sittin’ pretty in half a decade.

“The rich leverage debt to make more money, while the rest of us just buy shiny things and lose it all. Well, I say forget that—Bitcoin’s your cheat code,” Moss declares, hitchin’ his wagon to the crypto star.

Moss claims this method can turn you into a retiree faster than you can say “jackrabbit,” with your Bitcoin growing like corn after a wet spring—meaning, it should be worth about as much as gold someday. He believes in a future where Bitcoin and gold are about neck and neck—each worth twenty trillion bucks!

But not everyone’s singing the same tune. Sibel, a lady acquainted with the crypto trade, says you ain’t retiring from crypto—no sir. It’s more like being caught in a never-ending poker game where the house always wins. She reckons once you get a taste of that digital gold, you’re forever hooked, chase after one more winning hand, and never truly leave the table.

“You can’t escape crypto, no matter how much you make or how fancy your wallet gets. It’s a gambler’s paradise,” she quips with a wink.

In Summation: Bitcoin might just be the ticket to an early retirement if you play your cards right and watch your step. But beware—the tempting siren call of quick riches might keep you forever in the game, spinning your wheels in a digital casino where the house always wins if you ain’t careful.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-06-05 16:12