Ah, dear reader, gather ’round as we unveil the latest dalliance in the world of decentralized finance! Bracket, that illustrious platform, now graced by the benevolent hand of Binance Labs, has unfurled its strategy management platform like a peacock displaying its resplendent feathers. This marvel shall bestow upon the holders of liquid staking tokens (LST) the delightful prospect of higher staking yields on the grand stage of Ethereum. 🦚

Dubbed ‘ETH+,’ this enchanting feature promises to remedy the lamentable inefficiencies that plague traditional LST liquidity pools—those fragmented pools that resemble a jigsaw puzzle missing half its pieces, preventing the seamless optimization of yields. Oh, the tragedy! 🎭

Bracket: The Dandy of Liquid Staking on Ethereum

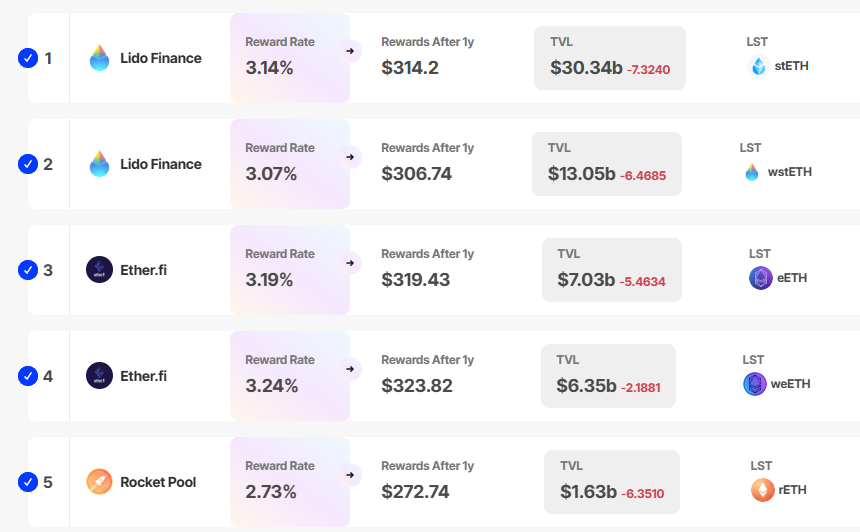

At the very heart of Bracket’s platform lies the illustrious brktETH, a non-rebasing token, as noble as a knight, backed by a treasury of diverse LSTs and liquid restaking tokens (LRTs). It is the very essence of simplicity, aggregating assets from illustrious providers such as Lido, Rocket Pool, and Ether.fi, thus creating a harmonious symphony of yield generation. 🎶

“The launch of our strategy management platform is a defining moment for Bracket. Phase II takes us closer to our vision of creating a secure, user-friendly platform where DeFi participants can maximize their yields without compromising transparency or safety,” proclaimed Mike Wasyl, the esteemed CEO of Bracket, in a moment of unrestrained enthusiasm, as if he had just discovered the secret to eternal youth. 🧙♂️

Unlike those conventional staking tokens that multiply like rabbits, brktETH gains value through a rising conversion rate relative to ETH. A clever trick, indeed! 🐇

Alas, the platform must exclude users from the US and sanctioned regions, a consequence of the ever-watchful regulatory eye. One must wonder if the regulators are merely jealous of the fun! 😏

In a previous tête-à-tête with BeInCrypto, Wasyl noted a burgeoning interest in passive investment strategies centered on LSTs. The DeFi sector, it seems, has embraced these tokens with open arms, as investors now prefer stable returns over the wild whims of speculative trading. Lido, the reigning monarch of this realm, continues to lead the charge, basking in the glow of liquid staking solutions. 👑

The Curious Trends and Trials of Ethereum Staking

In the year of our Lord 2024, Ethereum achieved a remarkable feat: 24% of its total supply was staked, a testament to the community’s preference for passive income over the fleeting allure of immediate liquidity. 🏦

The Shapella upgrade, a veritable gift from the heavens, further enhanced flexibility by allowing withdrawals of staked ETH, yet the fervor for staking has only intensified. How curious! 🤔

Despite this growth, Ethereum’s staking rewards have taken a nosedive to a mere 3% in Q3 2024, leading to a decline in validator interest. Queue times for staking have shrunk from a torturous 45 days in mid-2024 to less than a day—oh, the irony! ⏳

The Ethereum Foundation now finds itself in a state of introspection regarding its stance on staking ETH. Previous hesitations were rooted in regulatory concerns and the noble quest to maintain neutrality amidst contentious hard forks. ⚖️

Vitalik Buterin, that sage of the blockchain, recently suggested that regulatory risks have waned. Yet, the specter of neutrality continues to loom large. 👻

Bracket’s platform launch, coupled with the ongoing evolution of Ethereum staking, underscores the pressing need for innovative solutions to address inefficiencies and enhance returns for the ever-hopeful DeFi participants. Let us raise a glass to progress, dear friends! 🍷

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-01-28 20:28