Right. So, cloud computing. It’s everywhere, isn’t it? Apparently, it’s how businesses do…everything these days. Honestly, I still mostly use it to store photos of my cat. But, apparently, it’s Serious Business. And there’s this company, DigitalOcean. It’s not Amazon, or Microsoft, which are, let’s face it, just…big. DigitalOcean is…smaller. More manageable, somehow. Like a sensible pair of shoes, compared to a pair of glittery platforms. And, well, I’ve been looking at the numbers, and it’s starting to look…interesting.

They focus on small and medium-sized businesses – SMBs, as the analysts call them. Which, frankly, sounds like a disease. But it’s smart. Everyone’s chasing the big fish, leaving the little ones floundering. DigitalOcean offers them, you know, actual service. Not automated menus and hold music. And they’re doing something clever with AI. Not the scary, world-domination kind, but the kind that might actually help a small business, say, sort through invoices. Or, you know, not go bankrupt.

Units of AI Potential Observed: Rising. Hours Spent Scrutinizing Quarterly Reports: 8. Number of Times I Questioned My Life Choices: 3. But their AI revenue has doubled in the last five quarters. Doubled. That’s…a lot. They’re releasing their Q4 results on February 24th, and I have a feeling…well, I have a feeling it might be good. I’m not saying it’s a guaranteed win, obviously. Nothing is ever guaranteed. Especially in the stock market. It’s like dating, really. You can have all the right signs, and then…disaster.

Granting Access to AI for Even the Smallest Businesses

The big cloud providers, they want the whales. The companies with the deep pockets. DigitalOcean, they’re after the minnows. And that’s…refreshing, somehow. They’ve made it easy. Simple. Clear pricing. No hidden fees. It’s almost…unheard of. It’s like finding a parking space in central London. A miracle. They’ve built this platform called Gradient, where SMBs can access these large language models – LLMs, apparently – from companies like OpenAI. It’s all very technical. I mostly just nod and pretend I understand. But the idea is, it helps them build AI applications without needing a team of PhDs. Which, frankly, most small businesses don’t have.

Apparently, 53% of SMBs who’ve used AI agents have saved time. Time! Imagine. And 44% say it’s unlocked new business capabilities. Which sounds…optimistic. But, hey, I’ll take it. And a third of those who haven’t started are planning to. Which means DigitalOcean is perfectly positioned. It’s like being a taxi driver outside a concert. You just wait for the crowds to emerge.

Revenue Growth is Accelerating, Thanks to AI

They generated $659 million in revenue in the first three quarters of 2025. A 14.5% year-over-year increase. Not bad. Not bad at all. And a lot of that growth is coming from AI. Which is…encouraging. I mean, I’m not expecting to retire to a tropical island anytime soon, but it’s nice to see some positive momentum. They’ve managed to grow revenue and reduce operating expenses. Which is…almost witchcraft. It’s like finding a dress that actually fits. A rare and beautiful thing.

Their operating income doubled to $118.2 million. Doubled! I’m starting to feel…hopeful. Which is dangerous. Hope is the enemy of rational investment decisions. But, still. It’s hard not to get a little excited.

Despite Significant Gains, DigitalOcean Stock Still Looks Attractive

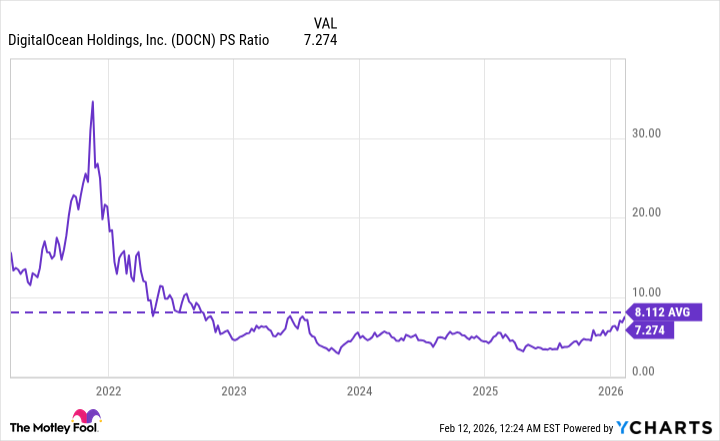

The stock soared 41% in 2025 and another 27% at the beginning of 2026. Which is…a bit scary, actually. I always worry about buying something after it’s already gone up. It feels like I’m missing the boat. But it still trades at a reasonable price-to-sales ratio of 7.2. Which is lower than its average since it went public. And its price-to-earnings ratio is 24.9, which is cheaper than the Nasdaq-100. Which is…surprisingly good. It means it’s attractively valued relative to other companies in the cloud and AI industries.

So, the stage is set for further upside. And the Q4 earnings report on February 24th could be the spark that ignites the rally. If their AI revenue doubles again, and management puts forward some bullish guidance, I think investors will pounce. It’s a gamble, of course. Everything is. But it’s a gamble I’m starting to think might be worth taking. Now, if you’ll excuse me, I need to go and obsessively refresh the stock ticker. And maybe have a lie down.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- Games That Faced Bans in Countries Over Political Themes

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-02-15 20:32