DigitalOcean (DOCN +0.34%) is, in essence, a small provider of computational space. It caters to those businesses too modest to command the attention of the larger cloud monopolies. They offer the same tools – storage, software development platforms – but on a scale appropriate to enterprises that do not require, or cannot justify, the vast resources demanded by the industry leaders. It is a niche, and one that has, until recently, remained largely obscured.

The company has, with some haste, begun to offer artificial intelligence tools. This is not innovation, precisely, but adaptation. The current fervor surrounding AI presents an obvious opportunity, and DigitalOcean is attempting to position itself as a provider of affordable access for smaller businesses. The claim is that demand is “through the roof,” and revenue has indeed doubled in the last five quarters. Such figures, however, must be viewed with a degree of skepticism. The entire sector is inflated, and a doubling of revenue from a small base is hardly conclusive proof of long-term viability.

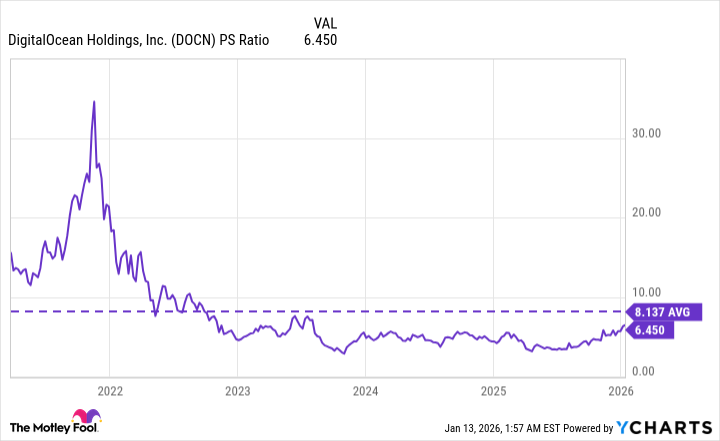

The stock price has risen – 41% in the last year, 13% at the beginning of this one – but remains significantly below its 2021 peak. This suggests a belated correction, rather than genuine growth. Wall Street analysts, predictably, are largely optimistic, assigning a “buy” rating to the stock. Such consensus opinions are rarely to be trusted. Analysts are, after all, incentivized to maintain a positive outlook, and often lack the courage to voice dissenting opinions.

A Limited Offering

DigitalOcean distinguishes itself through simplicity and transparent pricing. This is a shrewd strategy, aimed at attracting customers intimidated by the complexity and hidden costs of the larger providers. They offer a streamlined dashboard, and a personalized service, which appeals to businesses with limited technical expertise. It is, in effect, a compromise – a less powerful, but more accessible, alternative.

The company operates data centers equipped with AI chips from Nvidia and Advanced Micro Devices, offering computing capacity to its clients. This is a necessary investment, but hardly a unique selling point. The larger providers possess far greater resources, and can offer a more comprehensive range of services. DigitalOcean’s advantage lies in its ability to cater to smaller businesses, allowing them to scale their operations gradually, rather than committing to large, upfront investments.

The company has also developed an AI platform called Gradient, providing access to large language models from OpenAI and Anthropic. This allows businesses to integrate AI into their applications without the need to develop their own foundation models. It is a pragmatic solution, but one that relies heavily on the innovations of others.

Revenue and Expenses

DigitalOcean generated $659 million in revenue during the first three quarters of 2025, a 14.5% increase year over year. The acceleration of growth is noteworthy, but it remains to be seen whether this trend will continue. The company’s AI business is, undeniably, driving this momentum, but the sector is subject to rapid change and intense competition.

Management anticipates that AI revenue will double again in the fourth quarter. Such projections should be treated with caution. The current enthusiasm for AI is bordering on hysteria, and a correction is inevitable. It is entirely possible that the company’s growth will slow significantly in the coming months.

Despite the increase in revenue, the company has managed to reduce its operating expenses. This is a positive sign, but it is unlikely to be sustainable in the long term. The cost of maintaining and upgrading data centers is substantial, and the company will inevitably need to invest further in its infrastructure.

Wall Street’s Optimism

Fifteen analysts currently cover DigitalOcean stock, and eight have assigned it a “buy” rating. This is hardly a ringing endorsement. The majority of analysts are, by nature, cautious, and rarely take bold positions. The fact that only eight have assigned a “buy” rating suggests that the stock is, at best, considered moderately attractive.

The stock price has risen above the analysts’ average price target of $54.33. This is not uncommon in a bull market, but it does suggest that the stock is becoming overvalued. It is unlikely that the price will continue to rise at the same rate, and a correction is possible.

The price-to-sales ratio of 6.4 is below the average of 8.1 since the company went public in 2021. This suggests that the stock is relatively cheap, but it does not necessarily mean that it is a good investment. The company’s future prospects are uncertain, and the stock is subject to significant risk.

The price-to-earnings ratio of 25.4 is lower than that of the S&P 500 (25.7) and the Nasdaq-100 (32.6). This suggests that the stock is undervalued, but it does not necessarily mean that it is a good investment. The company’s earnings are volatile, and the stock is subject to significant risk. It is, in conclusion, a speculative investment, suitable only for those willing to accept a high degree of risk.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Top 15 Insanely Popular Android Games

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Best Actors Who Have Played Hamlet, Ranked

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

2026-01-16 15:22