They told us it was the future. The revolution. A new dawn for ownership in the digital ether. And what have we? A chilling echo of tulip mania, a frantic grasping at phantoms, now… diminishing rapidly. CryptoSlam’s instruments, infallible as the State itself, report a plunge of 27.65% in NFT sales, down to a paltry $62.58 million. Once, just last week, it was $88.29 million. A generation’s wealth, evaporating like morning mist. 👻

- The volume, you see, has fled. Almost 28% vanished. As if ashamed. The buyers, the sellers… they have scattered like mice before a cat. More than 75% fewer of them squinting at glowing screens.

- Ethereum remains, for now, the favoured hovel for these digital trinkets. Bitcoin, however, well, Bitcoin has suffered a most… emphatic decline. A collapse of over 65% in NFT sales. A clear sign, comrades, of the inherent instability of these speculative bubbles.

- The CryptoPunks, those pixelated relics, cling to the top, a testament to the enduring power of… well, of nothing much, really. A collective delusion, propped up by whispered promises and anxious hopes.

The market participation, the very lifeblood of this digital trading post, has withered. Buyers – a meager 60,985, down 82.75% – cautiously receding. Sellers – a mere 56,228, having descended 77.69%. Transactions, those frantic clicks and confirmations, have dwindled by 23.64%, down to 690,550. It is a silence, a void where once there was a feverish chatter.

And lo, amidst this crumbling facade, Bitcoin (BTC) stubbornly holds at $90,000. A temporary reprieve, no doubt. Like a condemned man granted a last cigarette. The illusion of stability before the final reckoning. 🚬

Ethereum (ETH), that fickle mistress, has abandoned the $3,100 mark, falling back into the mire. The global crypto market cap, a swollen corpse, stands at $3.09 trillion. A marginal increase from last week. A pathetic, meaningless twitch.

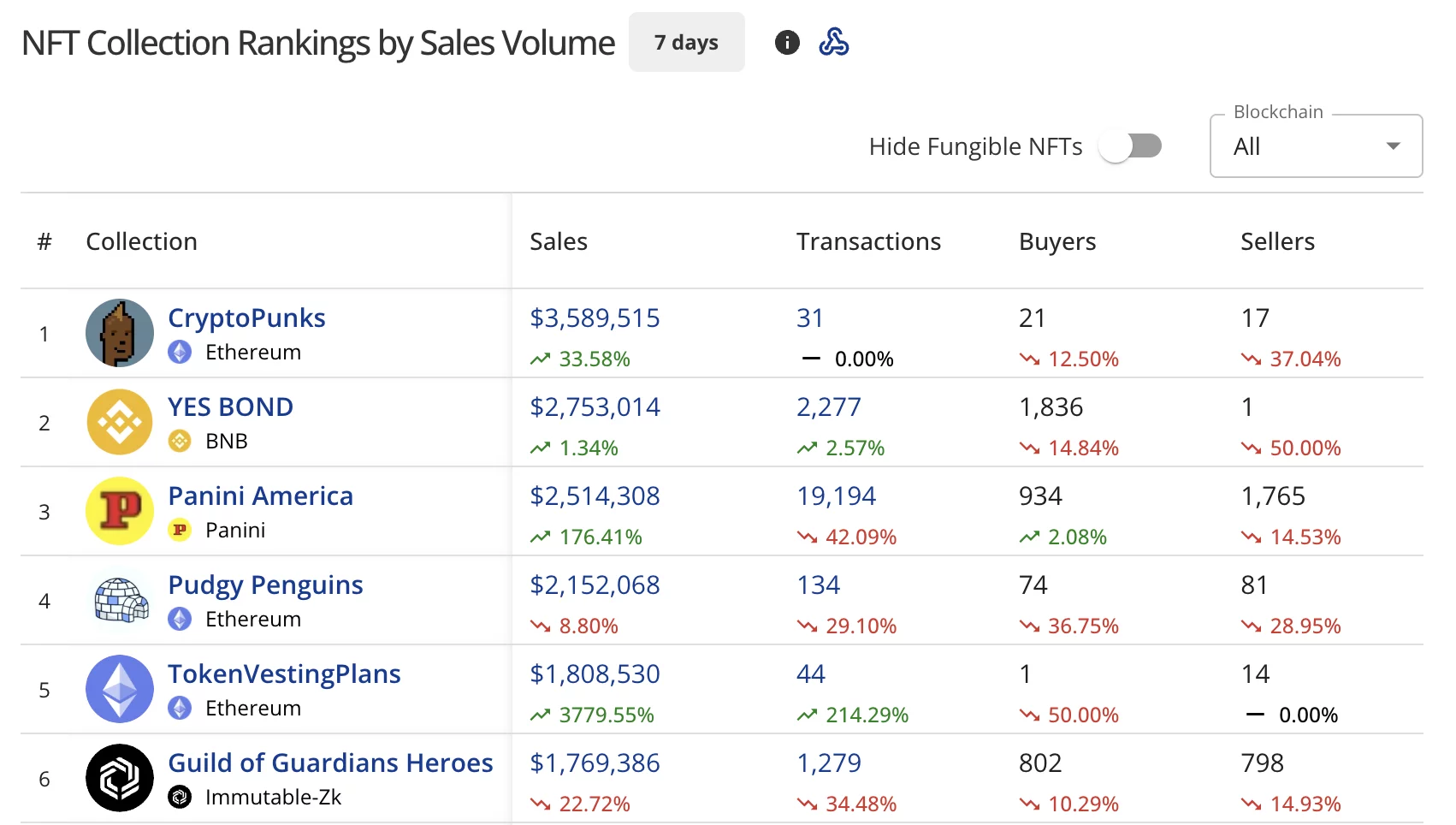

CryptoPunks: The Last Bastion?

CryptoPunks, yes, those… interesting faces, have risen to first place with $3.59 million in sales, a nominal increase of 33.58%. Thirty-one transactions, twenty-one buyers and a mere seventeen sellers. A small, desperate circle trading amongst themselves. Like prisoners exchanging crumbs.

YES BOND, a name that evokes the promise of… well, something. Holds second position at $2.75 million, a growth of a pathetic 1.34%. Two thousand two hundred and seventy-seven transactions, a staggering 1,836 buyers and a single, lonely seller. 😔

Panini America, on the Panini blockchain. Panini. The manufacturer of trading cards. Now elevated to third with $2.51 million, a surge of 176.41%. Nineteen thousand one hundred and ninety-four transactions, 934 buyers and astonishingly, 1,765 sellers. The absurdity, comrades, is breathtaking. 🤣

Pudgy Penguins tumbled to fourth at $2.15 million, a decline of 8.80%. One hundred and thirty-four transactions, seventy-four buyers and eighty-one sellers. A slow, agonizing descent.

TokenVestingPlans, with a surge of 3,779.55%… but let us not be deceived by such inflated numbers. Forty-four transactions, one buyer, fourteen sellers. A mirage. A puff of smoke. 💨

Guild of Guardians Heroes on Immutable-Zk, with $1.77 million. Down 22.72%. A mere 1,279 transactions. Notice, readers, the relentless pressure downwards.

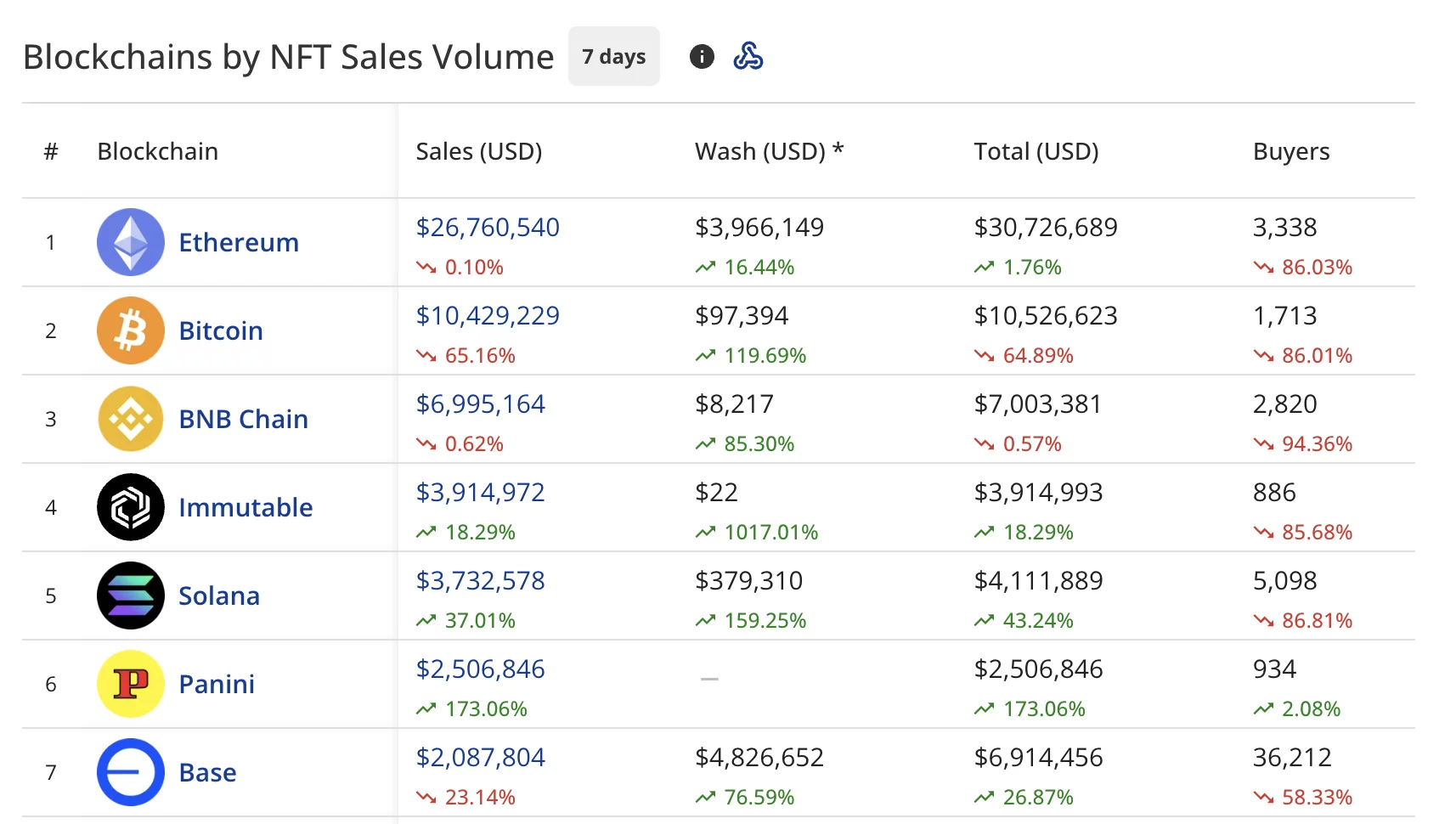

Ethereum’s Precarious Hold

Ethereum, that overworked beast, holds first position with $26.76 million. Essentially unchanged. A stalemate. $3.97 million in wash trading, a grim reminder of the artifice at play. Buyers have evaporated, reduced to 3,338-an 86.03% collapse. A ghostly echo of its former self.

Bitcoin, humbled, has fallen to second place with $10.43 million, a catastrophic 65.16% crash. $97,394 in wash trading. Buyers reduced to 1,713, a fall of 86.01%. A warning, perhaps?

BNB Chain (BNB), holding third at $7.00 million, nearly motionless. A mere 0.62% decline. $8,217 in wash trading. Buyers vanished, falling 94.36% to 2,820.

Immutable (IMX), securing fourth at $3.91 million, a temporary respite, up 18.29%. Buyers plummeted 85.68% to 886.

Solana (SOL), climbing to fifth with $3.73 million, surging 37.01%. $379,310 in wash trading. Buyers dropped 86.81% to 5,098. A fleeting moment of hope in a sea of despair.

Panini, yes, Panini again, placing sixth with $2.51 million. A surge of 173.06%. Just 934 buyers, a mere 2.08% increase. The market, it seems, has lost all reason.

Base landed in seventh at $2.09 million, down 23.14%. $4.83 million in wash trading. Buyers dropping 58.33% to 36,212. The scales are falling from our eyes, comrades. The truth, though bitter, is becoming clear.

Vanity and Echoes

A $X@AI BRC-20 NFT, a name as meaningless as the token itself, topped individual sales at $1.37 million, a pittance compared to last week’s excesses. A warning, perhaps, that these extravagant prices are unsustainable.

CryptoPunks #7892, #3112, #1831, #8691. The names blur together. The prices, though substantial, feel… empty. The echoes of a dying dream.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- QuantumScape: A Speculative Venture

- Gay Actors Who Are Notoriously Private About Their Lives

2026-01-10 10:11