Oh, Nvidia. You clever, calculating titan of tech. You’ve built an empire on the back of data center chips so essential they might as well be oxygen for AI developers. And yet here we are, dissecting your decision to sell off your stake in SoundHound AI (SOUN), a company that’s currently riding the conversational AI wave like it’s the last surfboard on Earth. Was this a stroke of genius or a colossal blunder? Let me tell you what I think-because, let’s face it, you’re probably not going to.

I’ll be honest: when I first heard about Nvidia’s little divestment, my portfolio-manager brain started spinning faster than one of their GPUs. Why would you dump shares in a company whose revenue has tripled in its most recent quarter and whose stock is up 40% in just a month? Are you mad? Or are you… smarter than all of us?

A Leader in Conversational AI, or Just Really Good at Small Talk?

Let’s talk about SoundHound for a second. They’re the life of the party when it comes to conversational AI. Need an autonomous drive-thru operator? Done. Want your car to tell you the weather while simultaneously judging your playlist? Sorted. Companies like Chipotle, Krispy Kreme, and Papa John’s have already signed up for their voice-activated wizardry. Meanwhile, automotive giants like Hyundai and Stellantis (yes, the ones behind Chrysler, Jeep, and Dodge) are embedding SoundHound’s Chat AI into their vehicles. It’s like having Siri, but with personality-and maybe even a bit of sass.

And then there’s Amelia. No, not some tragic love interest from a novel; I’m talking about another conversational AI specialist SoundHound acquired last year. Together, they launched Amelia 7, which lets businesses create custom AI agents controlled entirely by voice commands. Honestly, it’s impressive. But also slightly terrifying. What happens when these agents start demanding coffee breaks?

Revenue Is Skyrocketing, But So Are the Losses

Here’s where things get messy. SoundHound’s revenue exploded to $42.6 million in Q2 2025-a staggering 217% increase year-over-year. Management was so thrilled they bumped up their full-year guidance to $169 million, implying nearly 100% growth compared to 2024. That kind of momentum is intoxicating. If this were a rom-com, we’d call it “The Little Startup That Could.”

But-and here’s the part no one likes to talk about-they’re hemorrhaging cash. Like, burning-it-faster-than-a-Bond-villain-in-a-volcano lair levels of cash. Their GAAP loss hit $74.7 million last quarter, double what it was the year before. Even after stripping out a $31 million liability tied to an acquisition, they still lost $11.8 million. Ouch.

Now, they do have $230 million in cash and zero debt, so they’re not exactly living paycheck to paycheck. Still, sooner or later, someone’s going to ask how long they can keep this up without showing a profit. And if they need to raise capital? Well, let’s just say existing shareholders might find themselves holding slightly less valuable pieces of paper.

Why Nvidia Didn’t Make a Mistake (Probably)

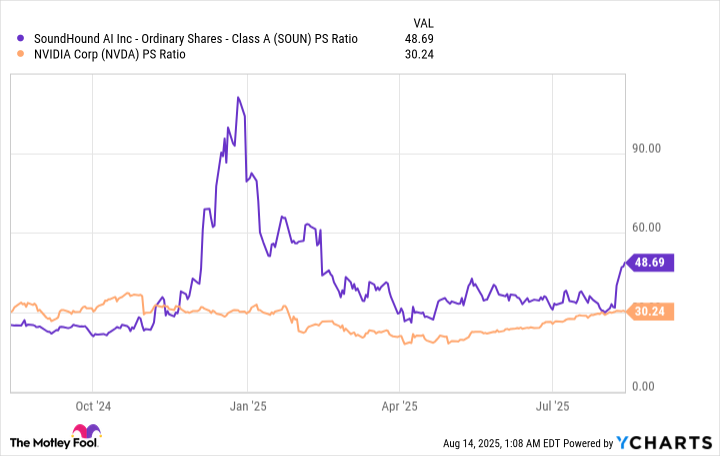

So, why did Nvidia bail? Officially, they haven’t said. Unofficially, I suspect it had something to do with valuation. At the time of sale, SoundHound’s price-to-sales ratio was hovering near 100. One hundred! For context, Nvidia’s P/S ratio is a comparatively modest 29.9. Even now, SoundHound trades at 48.6 times sales. It’s like paying $500 for a sandwich because you *think* it might taste better tomorrow.

Look, I’m not saying SoundHound won’t grow into its valuation. If their revenue keeps climbing at this pace, they might just pull it off. But early-stage companies are unpredictable. One misstep, and suddenly you’re explaining to your investors why their money vanished faster than a free croissant at a brunch buffet.

Besides, Nvidia doesn’t need the headache. With a market cap of $4.4 trillion, losing $27.7 million (the value of their 1.73 million shares at today’s prices) is practically pocket change. Sure, they could’ve held on and hoped for the best, but why take the risk? Sometimes, the smartest move is knowing when to walk away-even if it feels a bit anticlimactic.

In the end, I don’t think Nvidia made a mistake. Do I wish they’d stuck around to see how this story unfolds? Absolutely. But that’s just my greedy inner investor talking. The rest of me-the rational, slightly cynical portfolio manager-is giving them a reluctant nod of approval. Cheers to calculated risks and knowing when to fold ’em. 🎲

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- Here Are All the Movies & TV Shows Coming to Paramount+ and Apple TV+ This Week, Including ‘The Family Plan 2’

- Top 15 Insanely Popular Android Games

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-16 12:47