Once upon a blockchain, in a time not too long ago, decentralized exchanges (DEX) like Raydium, Orca, and the wacky newcomer PumpSwap decided to take the meme coin phenomenon and sprinkle it with a generous dose of chaos. Faster transactions, low fees, and accessibility? Sign us up. Not like it could go wrong… right? 🤡

Meme coins, darling of every get-rich-quick hopeful, have erupted like fireworks at a pyromaniac’s birthday party. But are these digital giggles a golden goose or just the financial equivalent of shiny wrapping paper on an empty box?

Will DEXs Become Solana’s Meme Coin Petri Dish, or Just an Experiment Gone Wrong?

Picture this: the Solana blockchain, happy as a clam, zipping through 65,000+ transactions per second while charging you less than what you’d find in your couch cushions. Enter PumpSwap, a newborn DEX launched by the ever-optimistic Pump.fun—a name that absolutely isn’t trying too hard to sound upbeat.

In the quaint days of yore (read: five seconds ago), projects had to shell out a grand 6 SOL to debut on Raydium. PumpSwap comes barging in like a hero in a soap opera, cutting through fees and promising trading immediacy. Liquidity stays in-house, creating a meme coin breeder’s paradise. And apparently, all of this *breeding* pays off.

Not to be outdone, Raydium has now launched LaunchLab, a meme coin launchpad designed to counter Pump.fun. The blockchain drama thickens… 🍿

Using Automated Market Makers (AMMs)—basically the vending machines of crypto—PumpSwap and its peers kick those pesky liquidity pool fees to the curb. Trading fees are a breezy 0.25%, whispering to aspiring coin creators: “You too can do this! No collateral needed! Probably not a scam!”

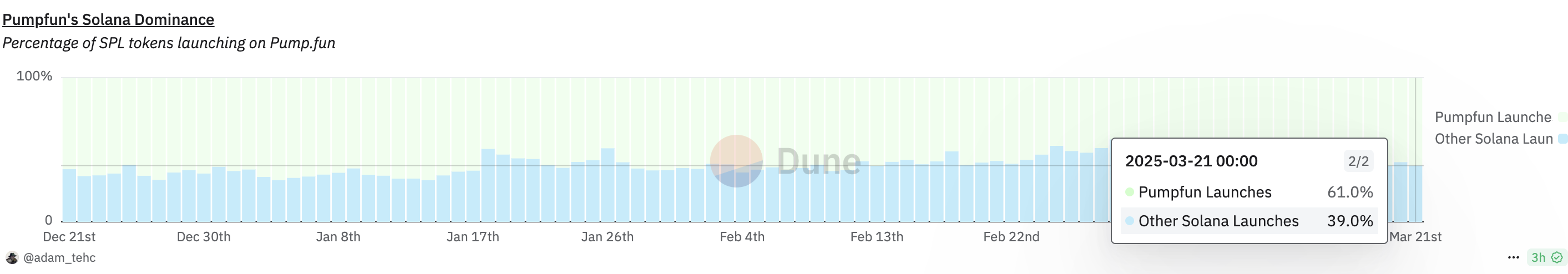

The result? An explosion so ridiculous it could be a Michael Bay movie. Dune data shows that over 8.7 million (!!) tokens now glut the blockchain, with Pump.fun birthing over 621,000 new tokens per month. Key question: do we need this many coins, or did someone leave the token factory stuck on “infinite mode”? 🛠️

PumpSwap also promises to share revenue with token creators—a subtle nudge to create more projects, many of which will either explode in success or implode spectacularly. Thanks to tools like Phantom Wallet, even your grandma can swap tokens now. Liquidity? Trading volume? Both are soaring higher than meme coin dreams.

Meanwhile, BNB Chain smugly dominates the market with its heavyweight title of 30%+ share in volume and fees. Who knew meme coins could box in the heavyweight category? 🥊

The Meme Coin Hangover—Welcome to Rug Pull City 🚨

Ah, but paradise isn’t perfect, my crypto comrades. The meme coin craze is also a carnival of risks. In case it wasn’t obvious: most of these coins have all the intrinsic value of a soggy tissue. The game here? FOMO and Twitter hype. But if the hype dries up, so does your investment. Poof. Gone. 💨

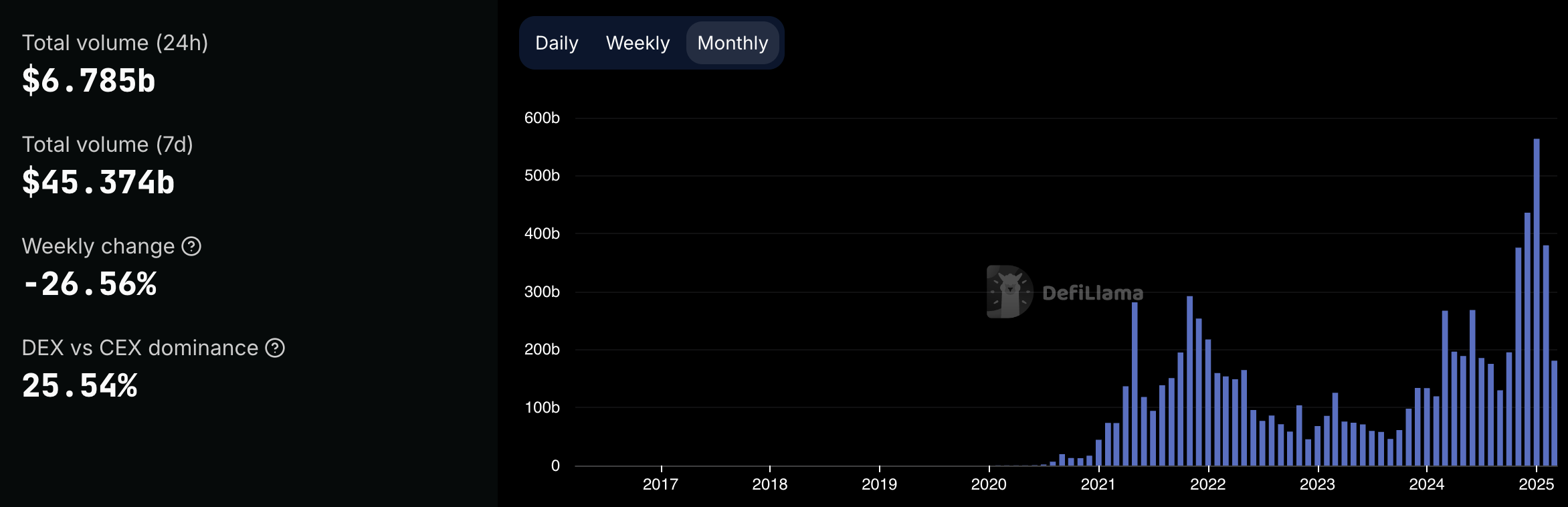

Take LIBRA, one of Solana’s meme coin darlings. Riding high with a market cap in the hundreds of millions, its bubble popped so dramatically in February 2025, it probably got whiplash. Trading volumes for Solana meme coins crashed from $206 billion to $99.5 billion—a drop that could make even rollercoaster enthusiasts feel dizzy.

Meanwhile, Pump.fun has also become scammer central. Rug pulls (honestly, how is this not a meme in itself?) are everywhere. Developers hype up coins, steal liquidity, and then vanish faster than a magician who owes you money. 🪄💸

If that’s not enough to kill the mood, regulatory watchdogs are circling. Meme coins and DEXs? They might have to start playing by rules soon—or risk being locked in crypto purgatory forever.

Make no mistake, DEXs like PumpSwap and Raydium have turbocharged the meme coin phenomenon. But underneath, it’s a field of landmines disguised as golden opportunity. As for whether this all ends in riches or ruin—you’d best bring popcorn. And maybe a helmet. 🎬🪖

Read More

2025-03-21 12:03