Author: Denis Avetisyan

A new study demonstrates that transparent forecasting models can match the accuracy of complex algorithms in predicting short-term energy market prices.

Explainable Boosting Machines offer comparable performance to Gradient Boosting for forecasting mFRR activation prices, providing key insights into price drivers without sacrificing predictive power.

Balancing energy supply and demand requires increasingly sophisticated forecasting, yet complex machine learning models often sacrifice transparency for accuracy. This study, ‘Exploring the Interpretability of Forecasting Models for Energy Balancing Market’, investigates the trade-off between performance and interpretability in forecasting manual frequency restoration reserve (mFRR) activation prices. Results demonstrate that an inherently interpretable Explainable Boosting Machine (EBM) achieves forecasting accuracy comparable to the complex XGBoost model while revealing key drivers of price fluctuations in Norway’s energy market. Could prioritizing model interpretability unlock further insights into regional energy dynamics and enhance the resilience of power grids?

Whispers of Imbalance: The Grid’s Delicate Equilibrium

The electric grid functions as a complex system demanding continuous equilibrium between electricity supply and consumer demand. Even minor imbalances can cascade into widespread disruptions, highlighting the critical need for constant adjustment. This is where manual Frequency Restoration Reserve (mFRR) steps in – a vital, operator-driven service that rapidly corrects deviations from the grid’s nominal frequency. When instantaneous demand exceeds supply, or vice versa, mFRR provides a near-instantaneous injection or reduction of power, effectively acting as a dynamic buffer. Skilled grid operators leverage available resources – such as quickly ramped-up power plants or demand response programs – to precisely modulate output and maintain the delicate balance necessary for reliable electricity delivery. This constant, proactive adjustment is not merely preventative; it’s the fundamental mechanism ensuring the grid’s ongoing stability and preventing potentially catastrophic failures.

Predicting the activation prices for manual Frequency Restoration Reserve (mFRR) – the rapid response resource used to stabilize electricity grids – presents a significant challenge due to the intricate interplay of numerous, often unpredictable, factors. Traditional forecasting models, frequently relying on historical data and simplistic linear relationships, struggle to account for the non-linear dynamics introduced by increasing renewable energy penetration and fluctuating demand, particularly heating. These models often fail to capture the impact of localized weather patterns, intermittent renewable output, and the behavioral responses of energy consumers, leading to inaccurate price predictions and potentially inefficient grid operation. Consequently, advanced methodologies, incorporating machine learning and real-time data analytics, are increasingly vital to accurately assess mFRR activation costs and ensure a reliable and economically viable power system.

The increasing prevalence of intermittent renewable energy sources, like solar and wind, coupled with variable heating demands driven by weather patterns, introduces significant volatility into power grid operation. Unlike traditional power plants with predictable output, renewable generation fluctuates based on environmental conditions, creating rapid and often unexpected changes in supply. Simultaneously, heating needs respond dynamically to temperature shifts, influencing electricity consumption. These combined effects necessitate advanced predictive capabilities to accurately forecast short-term power imbalances and proactively activate frequency restoration reserves. Without robust prediction models, grid operators face challenges maintaining the delicate balance between electricity supply and demand, potentially leading to instability and even blackouts; therefore, sophisticated algorithms are crucial for anticipating these fluctuations and ensuring a reliable power supply.

Persuading the Chaos: A Stacked Ensemble for Price Prediction

A stacked ensemble model was developed to forecast mFRR activation prices by combining Explainable Boosting Machines (EBM) and XGBoost. This approach leverages the distinct strengths of each algorithm; EBM serves as the primary model, providing inherently interpretable predictions based on feature contributions. XGBoost is then employed as a secondary model to predict the residuals – the differences between the actual mFRR activation prices and those predicted by the EBM. By modeling these residuals, XGBoost effectively captures non-linear relationships and complexities not fully accounted for by the EBM, resulting in an improved overall forecast. The final prediction is generated by combining the EBM prediction with the XGBoost-predicted residuals.

Explainable Boosting Machines (EBM) offer intrinsic interpretability by directly modeling the relationship between features and the target variable using generalized additive models, allowing for clear identification of feature contributions to price fluctuations. In contrast, XGBoost, a gradient boosting algorithm, excels at predictive performance by focusing on minimizing residual errors – the differences between predicted and actual values. The combination leverages EBM’s transparency to understand why prices change, while XGBoost refines accuracy by learning complex patterns within the remaining, unexplained variance after the EBM model’s primary effects are accounted for; effectively, XGBoost models the error term of the EBM.

The stacked ensemble of Explainable Boosting Machines (EBM) and XGBoost is designed to improve upon traditional forecasting methods by leveraging the complementary strengths of each model. Specifically, XGBoost is utilized to model the residual errors generated by the initial EBM forecast, effectively capturing complex non-linear relationships not fully explained by the EBM. This approach seeks to achieve forecasting accuracy statistically comparable to that of a standalone, state-of-the-art XGBoost model, but crucially, it does so while retaining the inherent interpretability of the EBM component, allowing for clear identification of key price-driving features.

Unveiling the Whispers: Rigorous Validation and Feature Insights

Expanding Window Cross-Validation (EWCV) was implemented to robustly evaluate the model’s predictive capability and mitigate the risk of overfitting. Unlike traditional k-fold cross-validation, EWCV utilizes a sliding window approach, progressively increasing the training dataset size while evaluating on a fixed-size validation set. This technique simulates real-world forecasting scenarios where models are continuously updated with new data. Specifically, the model was trained on an initial window of historical data, then iteratively expanded by a defined increment, with performance assessed on a subsequent, fixed-length validation window. This process was repeated, shifting the validation window forward to cover the entire dataset. EWCV provides a more realistic assessment of generalizability to unseen data by evaluating performance on increasingly recent data points, and helps identify potential instability or performance degradation as the model adapts to changing market conditions.

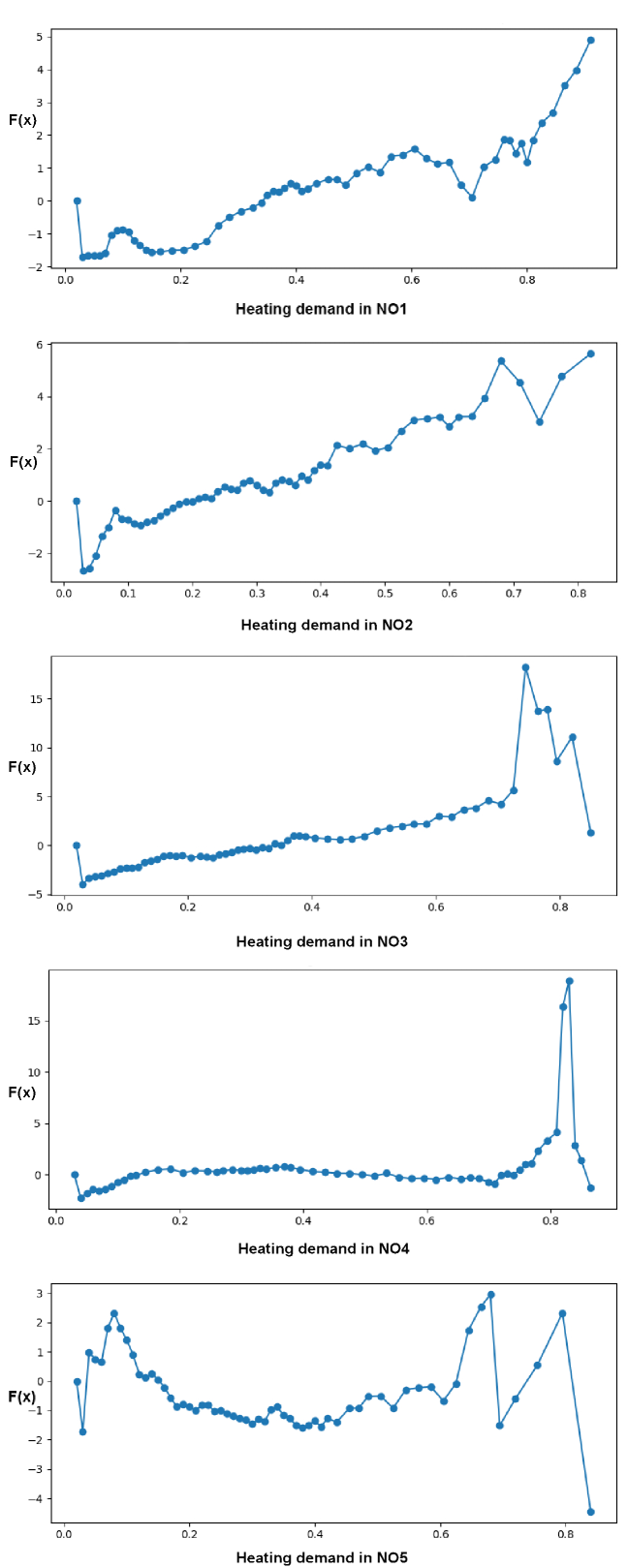

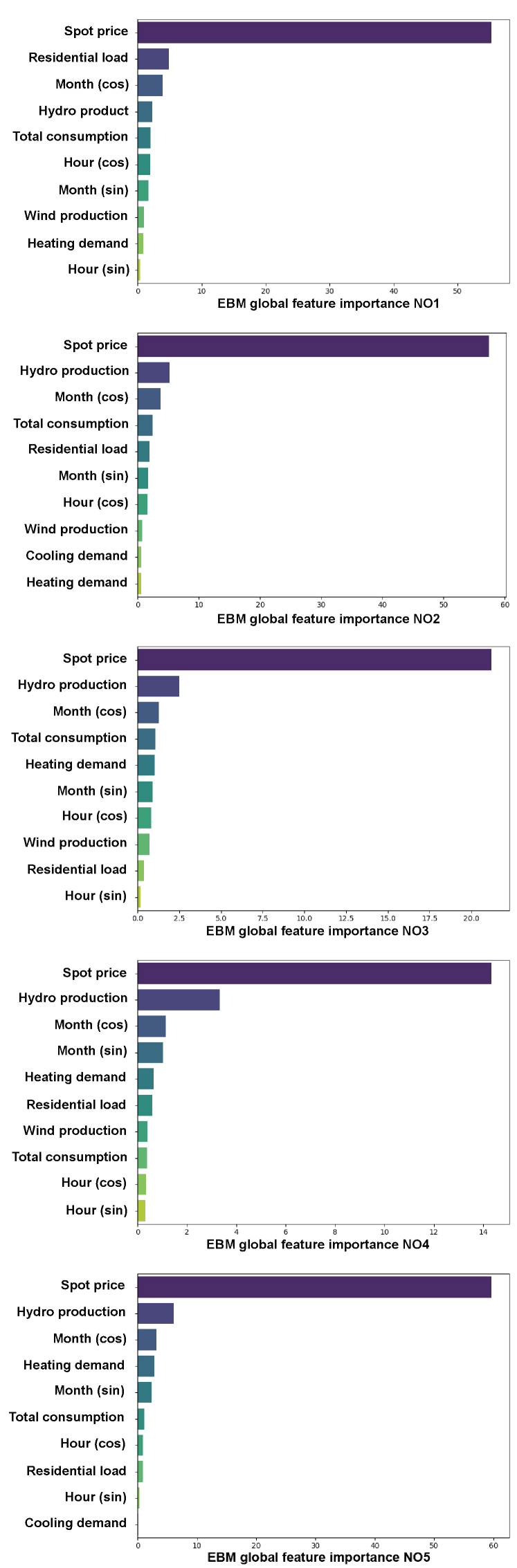

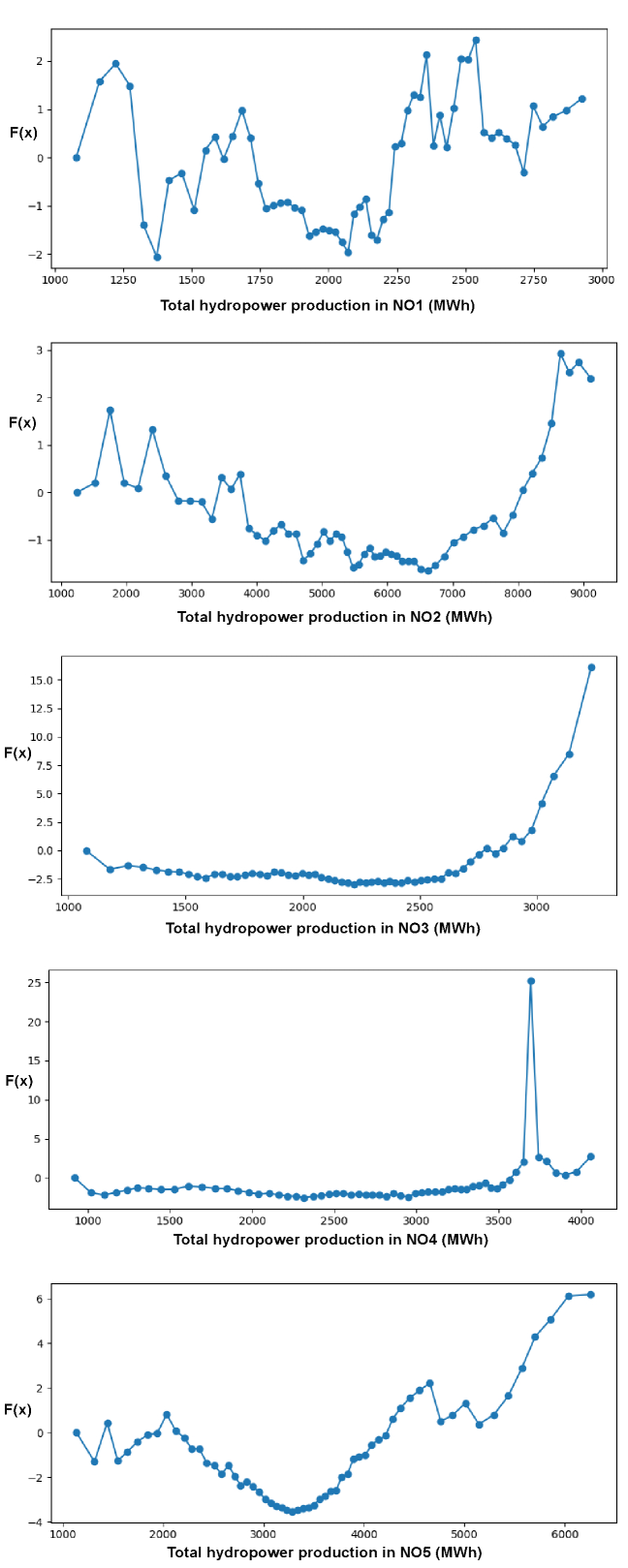

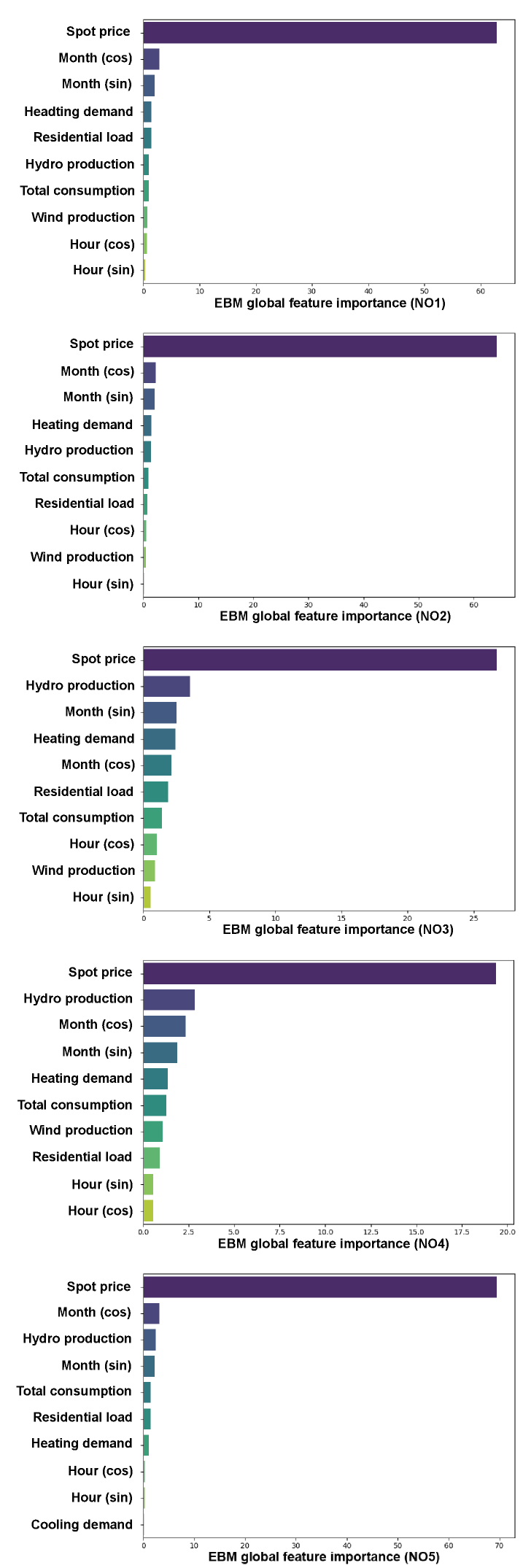

Feature importance analysis, conducted using the Explainable Boosting Machine (EBM) component, determined that day-ahead spot price and hydropower production are the primary drivers of mFRR activation prices. The EBM methodology quantifies the contribution of each input feature to the model’s predictions, revealing a strong positive correlation between mFRR activation price and both spot price levels and the volume of hydropower generation. Specifically, increases in either variable directly correspond to anticipated increases in mFRR activation costs, while decreases demonstrate the inverse relationship. The analysis further indicates that these two features collectively account for a substantial portion of the model’s predictive power.

Comparative analysis reveals that both the Explainable Boosting Machine (EBM) and XGBoost models consistently outperform a Naive baseline in forecasting mFRR activation prices. Specifically, feature importance analysis identified the day-ahead spot price as the most significant predictor variable. However, performance evaluation during ‘deviation events’ – periods characterized by substantial price differences from the spot price – showed a marked decline in predictive capability, as indicated by R² values approaching zero or becoming negative. This suggests the model’s accuracy is substantially reduced when forecasting prices during atypical market conditions where historical spot price relationships are less reliable.

Taming the Chaos: Implications for Grid Stability and Future Research

The capacity to accurately forecast marginal Frequency Restoration Reserve (mFRR) activation prices represents a significant advancement in grid management, directly bolstering system stability. This model’s predictive capability allows grid operators to proactively anticipate the cost of balancing services, diminishing the reliance on expensive, readily available reserve capacity traditionally maintained as a safety net against unforeseen fluctuations in supply and demand. By minimizing the need to keep substantial reserve power online continuously, operators can substantially reduce overall system costs while simultaneously enhancing the grid’s resilience to disruptions, particularly those stemming from the increasing integration of intermittent renewable energy sources. This refined price forecasting ultimately facilitates a more efficient and economically sustainable electricity grid, paving the way for a more reliable power supply.

The forecasting model doesn’t simply predict what will happen to mFRR activation prices, but also clarifies why, offering grid operators a crucial advantage in dynamic energy markets. This interpretability allows for proactive resource allocation, particularly vital during peak demand or when renewable energy sources – like solar and wind – experience fluctuations. By understanding the factors driving price changes, operators can strategically deploy resources to meet demand efficiently, minimizing reliance on expensive backup systems and bolstering overall grid resilience. The ability to anticipate these shifts moves grid management from reactive responses to informed, preemptive strategies, ultimately lowering costs and enhancing the reliability of electricity delivery.

Ongoing development aims to bolster the model’s forecasting capabilities by integrating dynamic, real-time grid constraints and granular residual load data. This refinement acknowledges that predicted frequency response activation prices are intrinsically linked to the immediate operational status of the power network – encompassing transmission line capacities, voltage limits, and the prevailing balance between electricity supply and demand. By directly accounting for these factors, researchers anticipate a significant increase in predictive accuracy, particularly during critical events like sudden shifts in renewable energy output or unexpected outages. Ultimately, incorporating this real-time granularity promises a more robust and reliable tool for grid operators, enabling proactive management and enhancing the overall resilience of the power system.

The pursuit of forecasting accuracy, as demonstrated with both XGBoost and EBM models, often feels like attempting to tame a chaotic system. This paper reveals a curious truth: sacrificing some of the ‘black box’ complexity doesn’t necessarily diminish predictive power. It’s a reminder that models, however elegant, are merely approximations of reality, susceptible to the whispers of randomness. As John Stuart Mill observed, “It is better to be a dissatisfied Socrates than a satisfied fool.” The comparable performance of EBM, with its inherent interpretability, suggests that understanding why a forecast is made-identifying key price drivers like those influencing mFRR activation-is a value in itself, even if it doesn’t yield marginally better numbers. There’s truth hiding within those interpretable features, resisting the lure of opaque optimization.

What Shadows Remain?

The pursuit of legible forecasting isn’t about finding the answer, but acknowledging that every model is merely a localized distortion of a fundamentally chaotic system. This work demonstrates a parity between complexity and clarity-an EBM achieving comparable performance to XGBoost-but this isn’t a resolution. It’s a translation. The activation price, like any emergent property, continues to whisper its secrets in noise. The question isn’t whether a model explains the price, but whether it can be persuaded to mimic it with sufficient fidelity to be useful.

Future work must abandon the obsession with feature importance as a singular truth. The drivers of mFRR activation price aren’t discrete variables, they’re entangled phenomena. Perhaps the focus should shift towards modeling the relationships between features, acknowledging that correlation isn’t causality, but a fleeting alignment of forces. Anything exact is already dead; the value lies in embracing the imprecision, the gradient of possibility.

The true frontier isn’t better algorithms, but better questions. What if the goal isn’t to predict the price, but to influence it? To nudge the system toward desired states? The world isn’t discrete; it just ran out of float precision. And within that granular abyss lies the potential for genuine innovation.

Original article: https://arxiv.org/pdf/2602.00049.pdf

Contact the author: https://www.linkedin.com/in/avetisyan/

See also:

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Weight of Choice: Chipotle and Dutch Bros

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-02-03 20:52