According to a recent study by JPMorgan, bitcoin and gold are increasingly becoming crucial elements in well-balanced investment portfolios.

The increasing practice among investors, often called the “dishonoring trade,” underscores their increasing dependence on such assets as a protective measure against the erosion of value in traditional currencies, escalating prices, and political instability worldwide.

In this new phrasing, I aimed to maintain the original meaning while using more natural and conversational language that’s easier for readers to understand.

The Rise of the Debasement Trade

JPMorgan analysts, headed by Nikolaos Panigirtzoglou, underline that the strategy of investing in assets like gold and Bitcoin as a hedge against economic turbulence is not a temporary trend. This investment approach, where investors seek refuge in such assets during periods of market instability, has been growing in popularity due to a combination of factors. These include ongoing high inflation rates, escalating government debt, and heightened geopolitical conflicts that have marked global markets since the year 2022.

According to JPMorgan’s observations, gold and Bitcoin have gained significant importance in investment portfolios due to an unusual surge in funds flowing into these markets during the year 2024.

Gold’s Outperformance

Gold values have unexpectedly skyrocketed more than usual, mainly due to changes in U.S. dollar and bond yields, but experts believe it’s also because of the return of the practice known as debasement trade. This increase is largely attributed to increased gold acquisitions by central banks, investors, and other financial entities, which can encompass physical gold, ETFs, and various investment tools. This trend underscores gold’s rising appeal as a protective measure during times of economic instability.

Bitcoin’s changing role

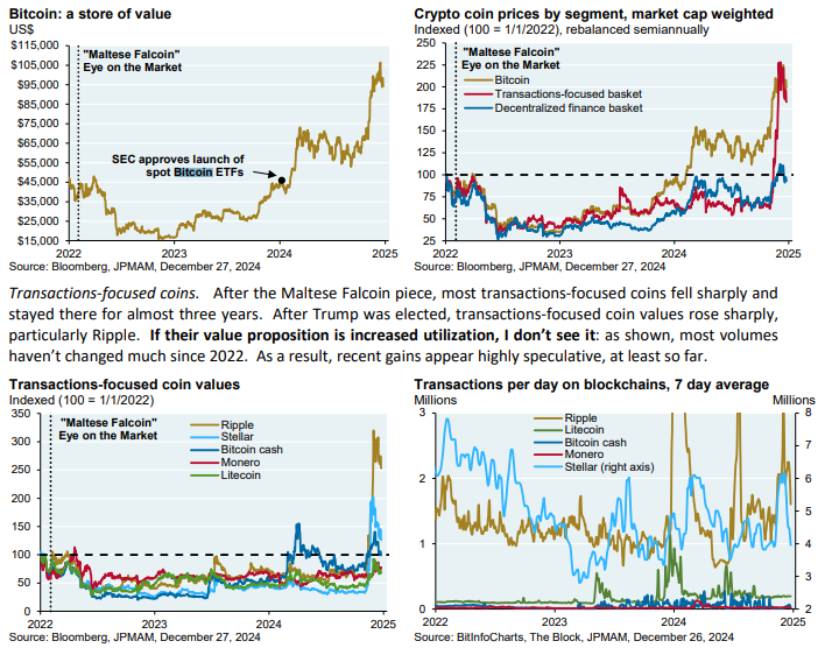

In plain terms: Bitcoin, often referred to as “digital gold,” has seen substantial investments, underlining its importance as a significant investment option. It’s predicted by JPMorgan that approximately $78 billion flowed into the cryptocurrency market in 2024. Of this sum, MicroStrategy invested about $22 billion in Bitcoin, which is nearly a third of the total investments. Additionally, there were around $27 billion poured into crypto funds due to the rising popularity of spot Bitcoin ETFs, and an additional $14 billion came from CME Bitcoin futures.

After September 2024, JPMorgan observed an increase in Bitcoin ETF investments and stated, “Investors, both retail and institutional, are employing Bitcoin as a protective measure against the potential devaluation of traditional currencies.

Institutional Adoption and Market Dynamics

The increasing integration of Bitcoin into traditional finance is being reinforced by the expanding role of conventional financial institutions. Take Morgan Stanley, for example, which now enables their financial advisors to suggest Bitcoin ETFs to their clients. Alongside this trend, fewer liquidations from notable bankruptcies such as Mt. Gox and Genesis are occurring, suggesting a maturing market.

On the other hand, analysts warn that potential cash disbursements stemming from the FTX bankruptcy, estimated for early 2025, might cause market fluctuations. Yet, these funds could potentially be channeled back into cryptocurrency investments.

Looking Ahead

As per JPMorgan’s analysis, both gold and Bitcoin serve as long-term safeguards against inflationary pressures and geopolitical turmoil, suggesting a favorable future for these assets. Experts foresee an ongoing increase in investment from institutional and retail sectors due to shifts in investor behavior patterns.

As an analyst, I anticipate that the devaluation trade will persist as a significant element in global investment strategies, so long as worries about inflation and fiscal instability remain prevalent.

In simpler terms, both Bitcoin and gold are popular choices among investors looking for a safe haven from potential devaluation of traditional currencies. These assets offer a way to protect and possibly increase one’s wealth in the long run.

Gold has a long-standing reputation, spanning centuries, for being a secure investment due to its rarity and resilience against economic upheavals. Similarly, Bitcoin, known as “digital gold,” derives advantages from having a limited supply and operating in a decentralized manner, protecting it from the inflationary effects linked to monetary policies and government interference.

In times of changing interest rates and continuous monetary expansion, these assets can provide a degree of security and variety. As investors aim to protect themselves from the devaluation of conventional currencies, the tangible appeal of gold and Bitcoin’s cutting-edge potential make them increasingly recognized as potent instruments in countering currency debasement.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Minecraft update ranked from worst to best

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Zenless Zone Zero 2.0 – release date, events, features, and anniversary rewards

2025-01-08 17:10