The market, as always, is performing its little jig, reaching heights that would make a seasoned acrobat blush. The S&P 500, puffed up with optimism, seems determined to defy gravity. But, as any student of financial history knows, what goes up must eventually contemplate a downward stroll. Ray Dalio, a gentleman who has made a considerable study of these cyclical affairs, suggests a certain…unrest beneath the surface. He speaks of a “bearish force,” a phrase as ominous as it is vague. It’s a bit like a fortune teller warning of impending doom without specifying whether it involves a broken teacup or a stock market crash. Still, one ought to listen. Especially when the fellow has a rather impressive collection of yachts.

The Capital War: A New Sort of Game

Mr. Dalio proposes a “capital war.” Not with cannons and cavalry, mind you, but with money itself. A far more subtle, and infinitely more profitable, form of conflict. Sanctions, asset freezes, capital controls – these are the weapons of choice in this peculiar contest. It’s a bit like a game of chess, only the pieces are billions of dollars and the board is the global economy. The Americans and the Chinese, it seems, are particularly fond of this game. Each side attempting to outmaneuver the other, all while pretending it’s simply a matter of “national security.” The naiveté is almost touching.

How This Affects the Stock Market: A Delicate Balancing Act

The United States government, a prodigious consumer of borrowed funds, runs a deficit that would make even the most reckless spendthrift blush. To finance this extravagance, it sells Treasury bonds. Traditionally, foreign investors, eager to park their wealth in a seemingly safe haven, have been happy to oblige. But now, these same investors are growing cautious. They fear that their assets might one day be seized, frozen, or otherwise inconvenienced. This creates a rather delicate situation. The government faces a choice: offer higher interest rates to entice investors, or…well, resort to more creative accounting.

- Higher Yields: This is the honest approach, albeit a painful one. Higher interest rates make borrowing more expensive, slowing down economic growth. It’s like applying the brakes to a speeding train. Effective, but hardly enjoyable.

- Currency “Debasement” : A more…imaginative solution. Simply print more money. It’s a bit like diluting a fine wine. It doesn’t improve the quality, but it does increase the quantity. The dollar’s value erodes, of course, but that’s a problem for future generations.

The government, naturally, will attempt a combination of both. A bit of this, a bit of that. A delicate balancing act, performed on a tightrope strung across a chasm of debt. And the stock market? Well, it’s rather like a passenger on that tightrope. Holding on for dear life.

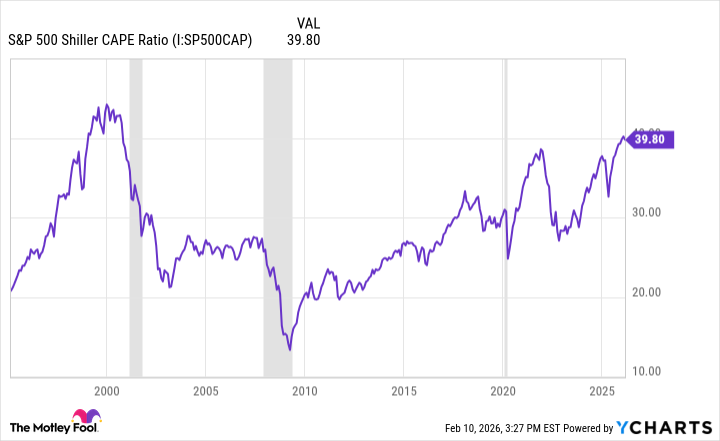

The CAPE Ratio: A Historical Curiosity

The Cyclically Adjusted Price-to-Earnings (CAPE) ratio. A rather grand name for a simple calculation. It compares stock prices to average earnings over the past decade, adjusted for inflation. Think of it as a smoothed-out version of a traditional P/E ratio. It’s not a perfect indicator, of course. No indicator is. But it does provide a useful historical perspective. And currently, the S&P 500’s CAPE ratio is hovering near historic highs, just shy of 40. It last reached these levels in 1999, during the dot-com bubble. A coincidence? Perhaps. But history, as any good historian knows, has a habit of rhyming.

Now, one shouldn’t mistake a high CAPE ratio for an immediate sign of a bubble. That would be far too simplistic. But it is a cause for concern, especially when coupled with the current reliance on cheap debt and the artificial intelligence boom. If Dalio’s warnings prove accurate, that boom could quickly turn to bust.

The Takeaway: A Word to the Wise

So, what should investors do? First, examine your portfolio. Are you heavily invested in companies that rely on cheap debt to fuel their growth? If so, consider diversifying. Second, keep a little cash on hand. A rainy day fund, as it were. And finally, focus on investing in companies with strong competitive advantages and healthy cash flows. Companies that can fund their growth from operations, rather than borrowed money. These are the companies that will weather the storm and continue to compound your wealth over the long term. The long game, after all, is always the most rewarding.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Games That Faced Bans in Countries Over Political Themes

- Top 20 Educational Video Games

- The Most Anticipated Anime of 2026

- Most Famous Richards in the World

2026-02-15 00:22