Shares of D-Wave Quantum (QBTS) have surged 3,600% over the past 12 months-a performance befitting the epsilon of irrational exuberance in consensus-driven markets. The stock’s ascent coincides with macro-level pragmatism and quantum phantasmagoria exiting speculative combustion chambers. Yet beneath the gavel of momentum lurk questions about relevance, scalability, and capital allocation discipline.

Drivers Behind the Rally

Public entry occurred via SPAC merger in 2022, but traction materialized in late 2024 following Alphabet’s Willow quantum chip announcement. This technological event daisy-chained investor imagination, spurring purchases across quantum infrastructure segments. Q2 revenue grew 42% YoY to $3.1 million, with institutional and enterprise clients signing on. However, revenue growth alone does not equate to operational vitality.

Operational and Financial Caveats

- Historical context: Initial hardware sales (Lockheed Martin 2011) catalyzed optimism 14 years prior, yet revenue scalability remains unproven.

- Capital burn: Operating expenses surged to $28.5M (Q2 2025) despite $3.1M revenue, with $400M raised via equity in July 2025 alone.

- Valuation dislocation: A PS ratio of 336 exceeds S&P 500’s 3.31, implying extreme forward-looking confidence.

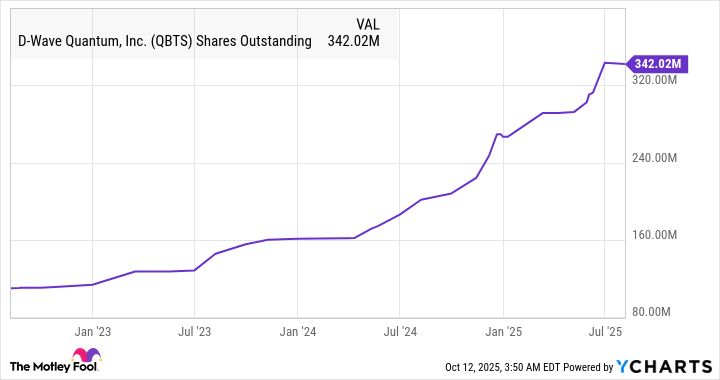

Share count proliferation since IPO mirrors the logic of jacks gambling-the more you spread the deck, the higher the entropy for early stakeholders. While R&D investment is defensible in high-risk sectors, equity dilution erodes ownership concentration and perpetuates a metastatic valuation defense mechanism.

Long-Term Outlook and Risks

Quantum commercial viability remains constrained to lab-scale topology and niche applications. The following risks justify measured skepticism:

- Limited revenue diversification beyond quantum hardware leasing;

- Dependence on technological breakthroughs over operational maturation;

- Dilutive capital structure exacerbating valuation sensitivities.

Early adopter returns may crystallize in narrow windows. However, market mechanics-the absorption of speculative premiums-typically intrinsically correct, often violently. For D-Wave, the alignment of execution velocity with capital efficiency will dictate whether it merits a place in optimized portfolios or remains a benchmark-deviant curiosity.

Investors should weigh the following: When capital expenditure exceeds revenue by over 9x, the probability of clinical success mirrors the Cheshire cat grin-impressive at a distance, but lacking a tangible base.

🔍

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- The Best Actors Who Have Played Hamlet, Ranked

- Games That Faced Bans in Countries Over Political Themes

- 9 Video Games That Reshaped Our Moral Lens

- Banks & Shadows: A 2026 Outlook

2025-10-14 05:12