The prevailing enthusiasm for growth equities has, for the past three years, extended to any enterprise tangentially involved in semiconductors, data infrastructure, or cloud services. This phenomenon is, predictably, a consequence of the proliferation of generative artificial intelligence across the technology value chain.

In recent months, attention has shifted to quantum computing, with certain developers experiencing disproportionate investor interest. While companies such as Rigetti Computing and IonQ have garnered speculative attention, D-Wave Quantum has demonstrated the most substantial share price appreciation. A 211% increase in 2025, outperforming established indices and large-cap equities, warrants a more rigorous assessment.

This analysis will examine the factors driving D-Wave’s recent performance, evaluate the company’s underlying valuation, and consider the potential trajectory of the stock through the end of 2026.

D-Wave Quantum: Business Overview

D-Wave designs quantum computers utilizing annealing technology, a method leveraging superconducting qubits. This approach facilitates the convergence of qubits towards their lowest-energy state, proving useful in optimization-based tasks. Current applications are being tested in areas such as supply chain management, scheduling, manufacturing logistics, and portfolio optimization.

Sustainability of Current Trajectory

In 2025, the S&P 500 achieved a 16% gain, marking the third consecutive year of double-digit returns. Sectors demonstrating outperformance included communications services, financials, materials, industrials, utilities, and, notably, technology. D-Wave’s appeal lies in the potential for broad application across these industries, theoretically benefiting from increased investment in each.

However, such speculative momentum requires careful consideration. While current valuation metrics may appear attractive on a superficial basis, a deeper analysis reveals potential vulnerabilities.

With a share price of $28, D-Wave may initially appear undervalued. A prudent investor, however, recognizes that valuation extends beyond a simple stock price assessment.

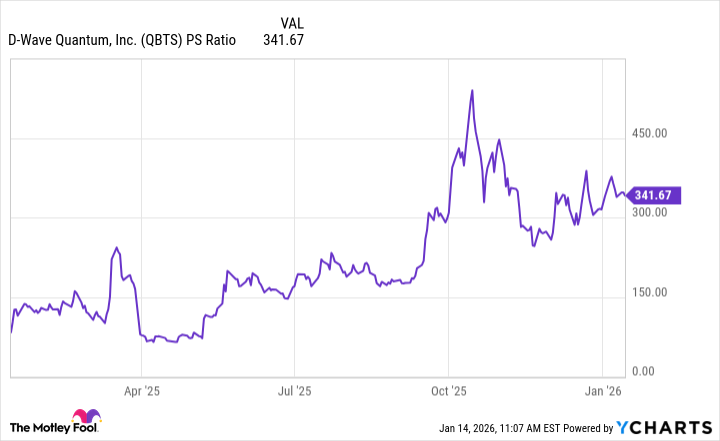

The recent surge in D-Wave’s stock price has resulted in significant valuation expansion. As of January 14th, the company’s price-to-sales (P/S) ratio stands at 342. Such a metric invites comparison to previous instances of market exuberance.

Historical Parallels and Potential Risks

The current AI-driven investment climate draws parallels to the dot-com bubble of the late 1990s and early 2000s. During that period, investors assigned substantial premiums to companies with limited revenue or profitability, prioritizing narrative over fundamentals.

Cisco Systems, a prominent infrastructure provider during the internet’s early stages, serves as a cautionary example. While Cisco benefited from the initial build-out of internet infrastructure, the subsequent market correction significantly impacted its valuation.

As capital expenditures among internet startups declined, demand for Cisco’s products diminished, resulting in an 89% decline in the company’s market capitalization.

Given D-Wave’s comparatively limited influence and the nascent stage of quantum computing, a similar reversal is plausible. It is reasonable to anticipate that investors will recognize the current limitations of the technology – specifically, the lack of commercial scale and widespread enterprise adoption.

By December 2026, D-Wave Quantum may experience a substantial correction, potentially trading at levels commensurate with early-stage, pre-revenue technology ventures.

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-18 08:52