D-Wave Quantum (QBTS +2.82%)—a name whispered amongst those who chase the horizon of technological possibility. It possesses a market capitalization of some ten billion dollars, a sum not inconsiderable, yet still dwarfed by the established behemoths. It is precisely this relative youth, this untamed potential, that draws the gaze of speculators, those ever hopeful of witnessing a prodigious flowering.

A smaller vine, one might observe, has greater liberty to climb, to reach for heights denied to the ancient oak. Yet, the field of quantum computation is not a garden of assured yields. The competition is fierce, the obstacles numerous. To speak of millionaire-making potential, however, requires a more sober assessment, a reckoning with probabilities and the cold logic of the market.

A Divergent Path in the Quantum Landscape

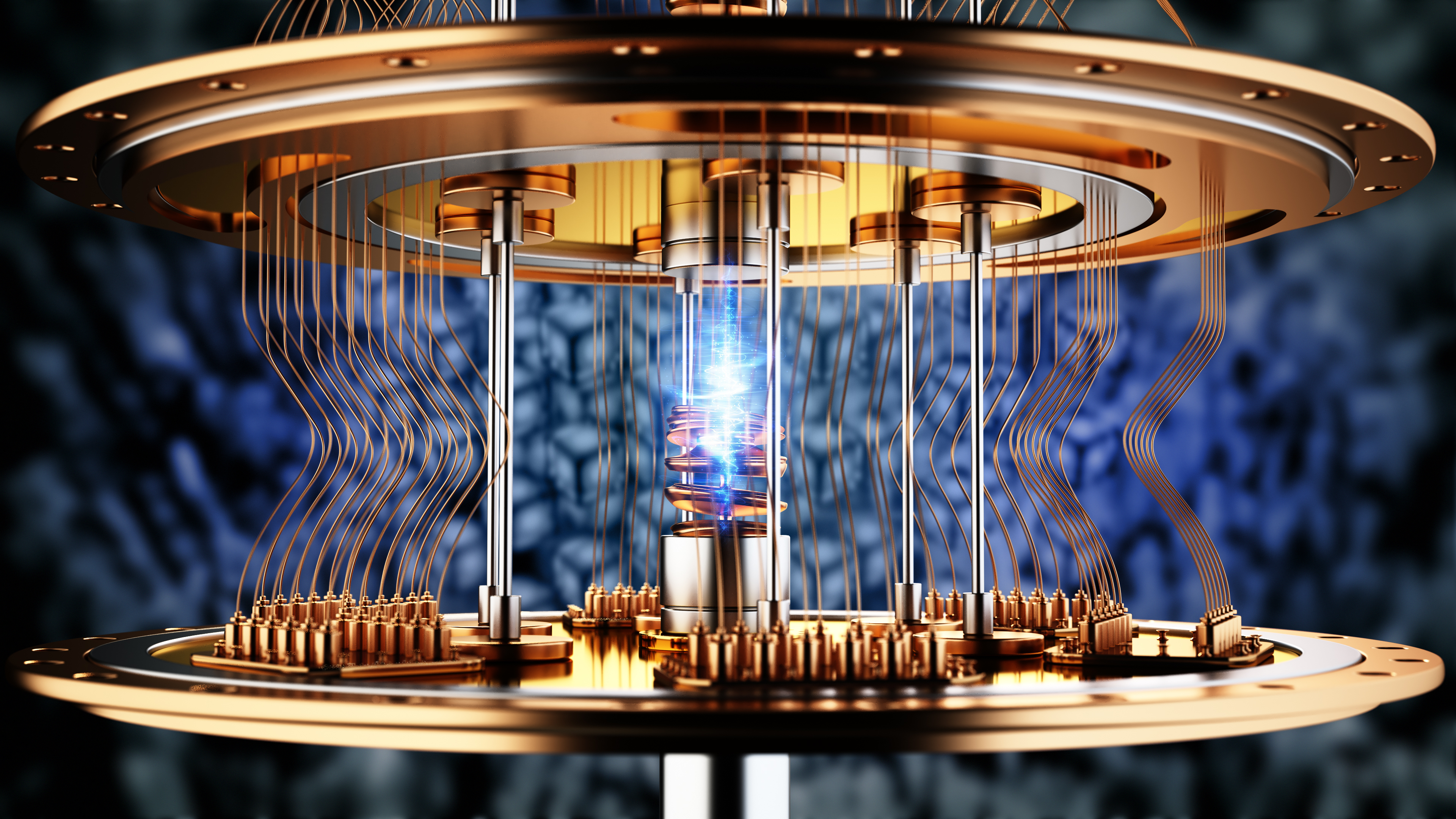

Quantum computing, in its essence, is a departure from the familiar. The traditional bit, constrained to the binary of zero or one, gives way to the qubit, a creature of superposition, capable of existing in a multitude of states simultaneously. This allows for a parallel exploration of possibilities, a branching of calculations that renders certain problems—those of logistics, artificial intelligence, the modeling of capricious weather—suddenly tractable. It is a seductive vision, promising to unlock solutions long deemed unattainable.

Yet, discerning the true leaders in this nascent field is a task fraught with difficulty. One often turns to the pronouncements of governing agencies, to the projects they champion, as a guide. DARPA, that tireless engine of innovation within the American military, has recently concluded a phase of selections, casting aside several contenders, including the well-regarded Rigetti Computing. D-Wave, however, was not among those tested, nor did it submit a proposal.

This absence, it appears, is not a matter of oversight, but of deliberate strategy. D-Wave has chosen a different path, eschewing the pursuit of a universal, general-purpose quantum computer. Instead, it focuses on quantum annealing, a technique designed to find the lowest energy state within a system, representing the optimal solution. The military’s requirements lie elsewhere, and D-Wave, with a certain pragmatism, has refrained from entering a contest where its strengths would not be fully utilized. It seeks to excel in areas where optimization is paramount—manufacturing logistics, the training of artificial intelligence—a more circumscribed, yet potentially fruitful, endeavor.

Indeed, D-Wave is already collaborating with manufacturers of considerable renown—Volkswagen and Toyota among them—implementing hybrid quantum solutions to refine their operations. It is a subtle approach, a quiet revolution unfolding within the established order. And should these efforts bear fruit, should D-Wave succeed in solving these intricate problems, the rewards could be substantial. But to speak of a guaranteed path to wealth, to a swift and effortless ascent to millionaire status, would be a disservice to the complexities of the market.

The Limits of Exponential Growth

To transform a modest investment into a fortune requires not merely growth, but exponential growth. A sum of, say, nine hundred and ninety-nine thousand dollars might, in a favorable scenario, swell to a million within a day or two. But such fleeting gains are not the object of a serious investor. The true measure lies in the potential for a hundredfold return, a transformation that would truly elevate a stock to the ranks of the exceptional.

For D-Wave to achieve such a feat, its market capitalization would need to swell to a trillion dollars. A daunting prospect, to say the least. Consider Taiwan Semiconductor Manufacturing, a titan of the industry, currently valued at one point seven trillion dollars. Its annual revenue? Some one hundred and fifteen billion dollars. McKinsey & Company, in its projections, estimates the total quantum computing market could reach between twenty-eight and seventy-two billion dollars by the year 2035.

Thus, even at the most optimistic estimates, D-Wave would need to capture a significant portion of this burgeoning market, perhaps an unrealistic share. Given its nuanced approach, its focus on specialized applications rather than a broad, universal solution, I harbor some skepticism that it can achieve the results investors might desire. While I fully expect D-Wave to deliver commendable returns should it succeed, to suggest it alone can pave the path to untold wealth would be a romantic indulgence, a departure from the sober realities of investment. It is a promising bloom, certainly, but one that must be viewed with a discerning eye, lest one be swept away by the allure of the speculative horizon.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Why Nio Stock Skyrocketed Today

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- The Weight of First Steps

- Opendoor’s Stock Takes a Nose Dive (Again)

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

2026-01-16 19:22