Now, D-Wave Quantum (QBTS +2.05%). A curious beast, this one. The share price has been doing a bit of a wobble lately, down 18.8% since the beginning of the year. A spot of bother, you might say. But hold your horses! Since the start of 2025, it’s shot up like a beanstalk, more than 150% in fact. Which raises the question: is this a chance to scoop up a bargain, or are we about to witness a rather spectacular splat?

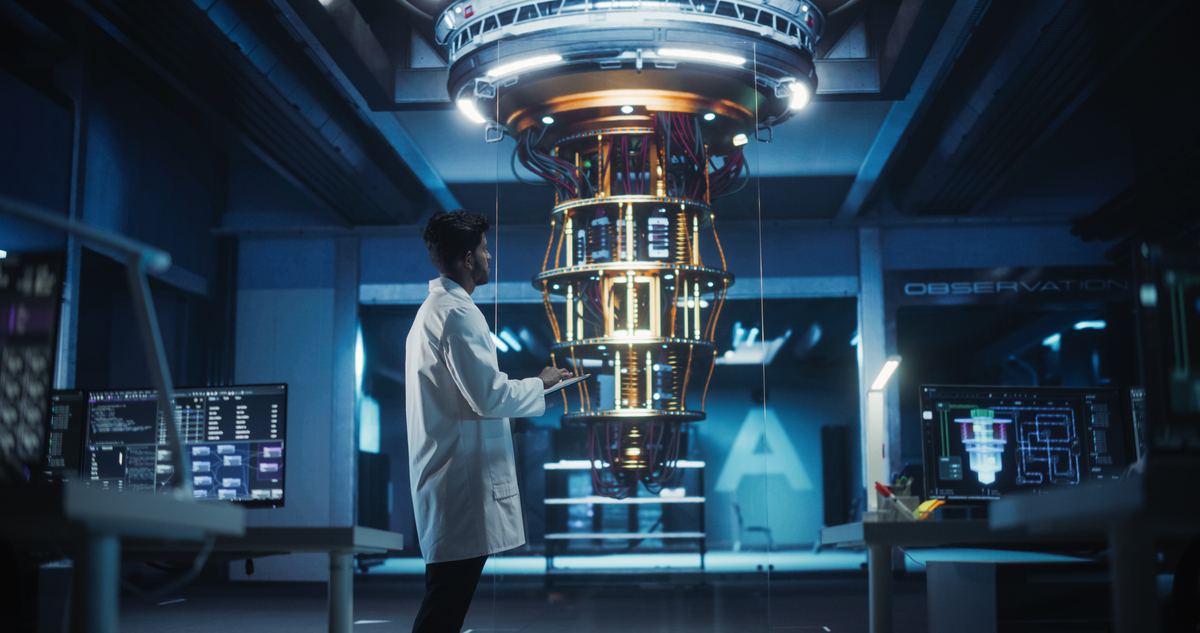

You see, D-Wave isn’t building your ordinary, run-of-the-mill quantum computers. Those other chaps – Rigetti Computing (RGTI +2.82%) and IonQ (IONQ 0.23%) – they’re fiddling about with ‘gate-model’ quantum computing. A terribly precise business, involving tiny particles being shoved through little gates. Sounds exhausting, frankly.

D-Wave, however, does things differently. They’ve invented ‘quantum annealing.’ It’s a bit like letting a whole swarm of bees loose in a puzzle room. Instead of meticulously guiding one bee, they let the whole lot buzz around and eventually, somehow, stumble upon the solution. It’s not terribly elegant, but it’s surprisingly effective for certain problems. Finding the best route for a delivery driver, for instance. Or figuring out which wobbly molecules might make a decent new medicine. Though accuracy isn’t its strong suit. Still, it’s faster and cheaper than trying to do it the proper way. And there’s less competition, which is always a jolly good thing.

They’ve recently swallowed up Quantum Circuits, a company that does dabble in those fiddly ‘gate-model’ machines. Now they claim to be the only company that can do both. A clever bit of marketing, perhaps? Or a genuine stroke of genius? Time, as always, will tell. Though I suspect it’s a bit of both – a dash of brilliance wrapped in a generous helping of bluster.

The Long and Winding Road

The question isn’t whether D-Wave is a good idea, but whether it’s a good idea now. Because right now, there isn’t a proper market for any kind of quantum computing. D-Wave’s machines are mostly used by researchers, and the research market, let’s be honest, is about as lucrative as selling snow to Eskimos. They’ve only managed to scrape together $24.1 million in revenue over the last year. Not exactly a king’s ransom.

But the investors? Oh, the investors! They’re piling in, dreaming of a future where quantum computers are all the rage. McKinsey reckons this market could be worth between $28 billion and $72 billion by 2035. A tidy sum, certainly. But that’s nearly a decade away. And there’s no guarantee D-Wave will even be around to see it. It could vanish in a puff of logic gates and entangled particles.

A Valuation Most Curious

Despite being unprofitable and barely generating any revenue, D-Wave has a market value of $7.4 billion. Which is more than Lyft, WingStop, and Mattel combined. Now, start-ups in cutting-edge fields often have laughably high valuations. It’s the nature of the beast. But a price-to-sales ratio of 256? That’s enough to make a sensible investor reach for the smelling salts.

This stock is likely to be a wild ride, full of sudden dips and unexpected surges. And they’ll probably need to issue more shares to keep the lights on. Which means your investment could be diluted. Still, if you’re feeling adventurous, you could add a few shares to your portfolio. But only invest what you can afford to lose. Because with D-Wave, you’re not buying a company, you’re buying a gamble. A rather peculiar punt, if you ask me.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Zack Snyder Shares New Ben Affleck Batman Image: ‘No Question — This Man Is Batman’

- Games That Faced Bans in Countries Over Political Themes

2026-02-04 13:53