So, D-Wave Quantum. (QBTS 14.45%). Honestly, the stock’s been on a ride. A ridiculous ride. Up 250%? In this market? It’s like people suddenly decided physics was a good investment. And then it came down. Of course it came down. Everything comes down. It’s just…the whole thing feels…off. Like someone’s playing a very expensive practical joke.

They’ve been busy, sure. Busy moving their headquarters from California to Florida. Florida! What is that even about? Is there some sort of quantum computing tax break I’m not aware of? And don’t even get me started on the logistics. Moving a company…it’s a nightmare. Boxes, paperwork, people complaining about the coffee…it’s just…a lot.

Now the stock’s down over 50% from its October peak, and now everyone wants to take a “serious look.” It’s always after the fact, isn’t it? Like waiting for the traffic jam to clear before deciding to drive.

Key Accomplishments? More Like Mild Distractions

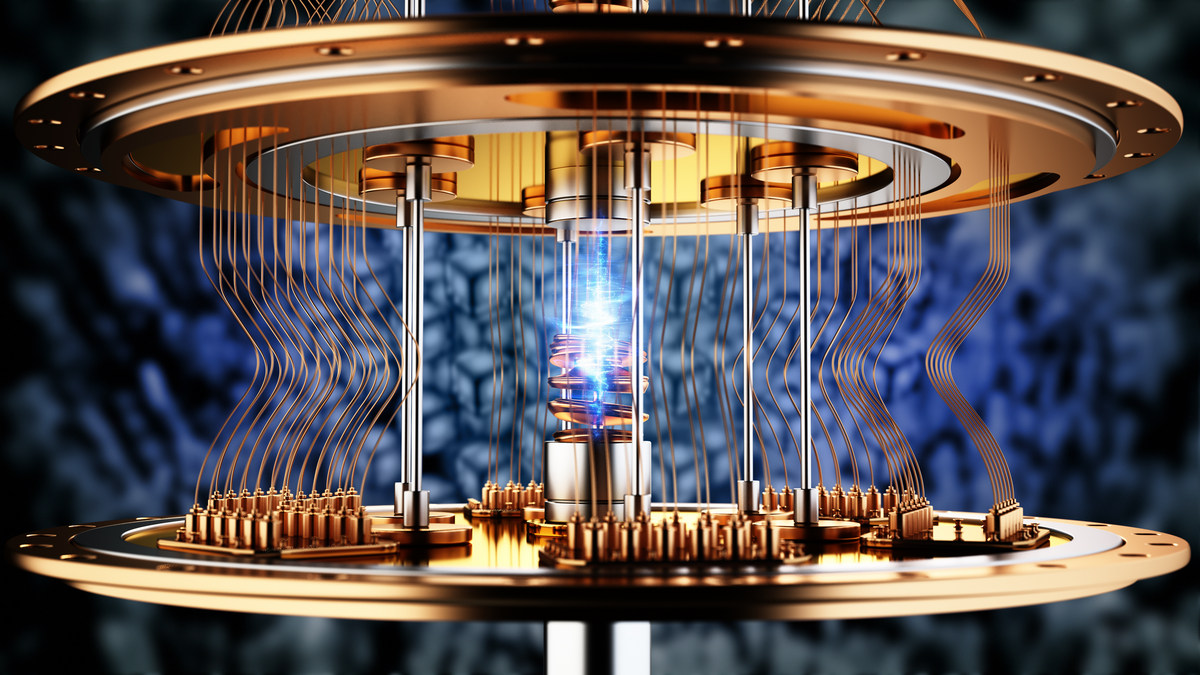

They acquired Quantum Circuits. Okay. Two quantum companies merging. Sounds impressive. But it’s like combining two different kinds of broken washing machines. You still have broken washing machines. Apparently, these companies do different things. One uses superconducting gates, the other…annealing. Annealing! It sounds like something you do to metal. Or a really stale bagel. And they’re boasting about being the “only dual-platform quantum computing company?” What does that even mean? It feels like marketing jargon designed to confuse people. Which, frankly, it is.

Then they sold a quantum computer to Florida Atlantic University for $20 million. Twenty million dollars! For a computer! It’s obscene. And now they’re collaborating with the school? It feels…convenient. Like a backroom deal. “We’ll give you a fancy computer, you give us…what? Good weather? Access to early bird specials?”

Oh, and they landed a $10 million contract. A two-year contract. That’s…something. It’s not exactly world domination, but it’s a start. Though, let’s be honest, it’s probably just a proof of concept. Like testing the waters before diving into a pool of money.

The Financial Situation: A Quantum Leap of Faith

Here’s the thing: they’ve barely made any money. $21.8 million in revenue after all that hype? That’s less than I spend on dry cleaning in a year. And operating expenses of $84.1 million? Where does it all go? Consultants? Coffee? The sheer audacity of it all is…remarkable. They lost $65.5 million! It’s a black hole of money. A quantum black hole, if you will.

These recent deals are…encouraging, I guess. But they need to accelerate revenue growth. Dramatically. Or cut costs. Or both. Otherwise, this whole thing is going to collapse under its own weight. It’s like building a house of cards on a trampoline.

Should You Buy D-Wave? Let Me Ask You This…

The stock is down, yes. But it’s still overvalued. Look at that price-to-sales ratio. It’s astronomical. It’s like paying $100 for a cup of coffee. It’s just…wrong. It’s a fundamental violation of economic principles.

The smart thing to do is wait. Wait for the price to come down further. Or wait for their next earnings report to justify this ridiculous valuation. For now, only investors with a very high risk tolerance – and a complete disregard for common sense – should even think about buying D-Wave stock. Honestly, it’s just…a headache. A very expensive, quantum headache.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- The Best Actors Who Have Played Hamlet, Ranked

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

2026-02-06 01:32