Bitcoin: The New Gold Rush? 💰🚀

Ah, the tale of Bitcoin! From the shadows of cypherpunks to the bustling markets of retail traders, and now, even the grand halls of nation-states! Once a mere whisper among the wise, it has transformed into a roaring lion that no one can ignore. 🦁

//bravenewcoin.com/wp-content/uploads/2025/01/BNC-Jan-30-15.jpg”/>

And now, a twist in the tale! Czech National Bank Governor Aleš Michl has announced a daring plan to invest in Bitcoin, aiming to diversify the bank’s reserves. If the board gives a nod, a whopping 5% of its €140 billion reserves could be allocated to Bitcoin! This would mark the Czech Republic as the first Western central bank to officially embrace the crypto revolution. Talk about making history! 📜

With this bold move, the Czech Republic would be adding approximately 74,851.49 Bitcoins to its national reserves. That’s a lot of digital gold! 🪙

With Trump in Office, the Bitcoin Arms Race Kicks-Off

As Trump teases the idea of Bitcoin as a strategic reserve asset, nations are scrambling like kids in a candy store. The Czech Republic is the first to jump on this bandwagon, eager to seize the early mover advantage. This audacious proposal signals the dawn of a new financial era, where nation-states are no longer mere spectators but active players in the Bitcoin game. The global financial landscape is set to revolve around this digital gold, with Bitcoin at the helm of reserve strategies and geopolitical power plays. 🌍

And so it begins! Which nation will be the first to pull the trigger and buy Bitcoin? 🤔

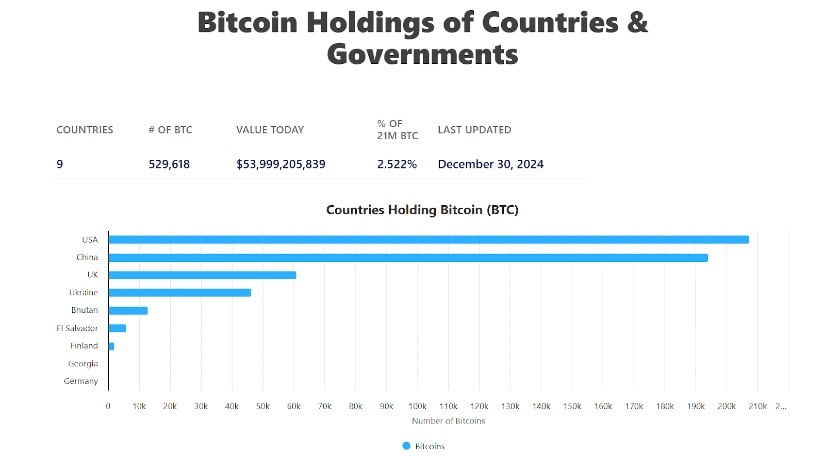

Recent data reveals that government-held Bitcoin reserves have surpassed 529,000 BTC, with the United States, China, and the UK leading the charge. Now, with the Czech Republic stepping into the fray, the pressure is mounting on other nations to secure their slice of the pie before it’s too late. With Bitcoin hovering around the $100K mark, federal reserves are taking notice, and national acquisitions could unleash a tidal wave of demand. 🌊

This shift could propel Bitcoin’s price to dizzying heights, solidifying its status as a geopolitical asset. With Trump’s administration likely to accelerate adoption, the question is no longer if Bitcoin will be integrated into institutional and sovereign reserves, but when. ⏳

Bitcoin Game Theory for Nation States

Ah, the game theory of nation-states and Bitcoin! It’s a thrilling chess match where those who act first will gain a significant advantage, while the hesitant will be left in the dust. Let’s break it down:

1. First-Mover Advantage in a Fixed-Supply Asset

Bitcoin, with its hard cap of 21 million coins, is a scarce treasure. As more nations jump on the Bitcoin bandwagon, demand will soar while supply remains fixed. Early adopters will accumulate Bitcoin at a fraction of the future price, while latecomers will be left to pay through the nose! 💸

- The first countries to hoard Bitcoin will do so at a bargain

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

2025-01-30 15:22