On multiple occasions, Bitcoin has surpassed the significant threshold of $100,000, an event many had eagerly awaited. However, Changpeng Zhao, the head of Binance, playfully dismissed this milestone as “boring.” Despite his casual comment, it raises a more profound question: what lies ahead for Bitcoin?

Reaching $100K for Bitcoin signifies more than just a predicted price level. It symbolizes increased interest from both institutional and individual investors in the top cryptocurrency. While enthusiasts rejoice, analysts are meticulously examining data to determine whether Bitcoin’s growth is sustainable or if a significant correction might be imminent soon.

On January 3rd, 2025, I confidently expressed my belief that “2025 will be the year of ‘send it'” – a term frequently used within the crypto community to express excitement about significant price surges. This optimistic stance is in harmony with the broader industry sentiment suggesting that the upcoming year could witness extraordinary growth in cryptocurrencies.

Bitcoin Breaks Key Support Level — Bad Sign?

Bitcoin has recently seen a substantial drop, falling below an important level of resistance that has left many investors and experts worried. A chart, posted by cryptocurrency analyst “Crypto Planet Calls,” provides a clear visualization of this downtrend. This chart displays the Bitcoin/TetherUS perpetual contract on a 4-hour scale from Binance, with the current price standing at $96,275.6, representing a decrease of 0.16%.

The expert points out an important barrier of support ranging roughly from $97,000 to $98,000 that Bitcoin recently surpassed. This area served as a fortress before, hindering any further drops and serving as a foundation for potential price increases. Yet, the recent fall below this threshold indicates a change in market opinion, leaning more towards pessimism.

Bitcoin has now crossed below, further confirming the bearish outlook. The analyst’s tweet:

Bitcoin is falling below its support level, a potentially negative development. It might be wise for everyone to set stop loss orders on their long trades.

Using stop-loss orders on long trades is an advisable safety step, taken to limit possible losses if the market unexpectedly takes a downward turn.

Bull vs Bear: Bitcoin’s Next Battleground

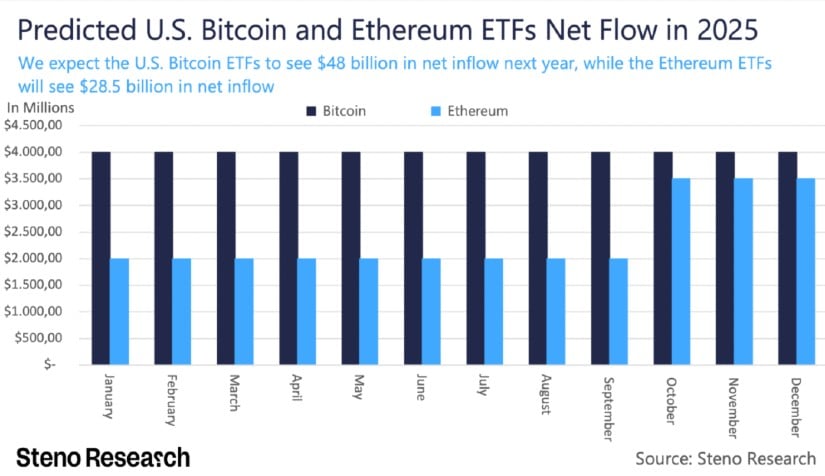

The trend of institutional adoption is increasing significantly as vast amounts of money are being invested into Bitcoin and Ethereum-centric exchange-traded funds. Companies that keep Bitcoin in their reserves are experiencing a surge in demand for their stocks. Notably, countries like the United States are considering the potential advantages of incorporating Bitcoin into their national reserves.

Amidst current trends, Steno Research predicts an outstanding year for cryptocurrencies in 2025. Their predictions place Bitcoin’s value at around $150,000 and Ethereum at approximately $8,000. This forecast mirrors the increasing enthusiasm among investors.

Based on historical trends, Bitcoin’s current surge might persist until a significant adjustment or an extended period of stabilization occurs. As resistance levels approach, the fight between buyers and sellers is expected to intensify in the region of $110,000 to $120,000.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-01-08 16:04