So, everyone’s chasing the shiny object that is Artificial Intelligence, are they? Honestly. It’s a bit like building a magnificent, self-driving car and then forgetting to install brakes. Cybersecurity, the actual need in this increasingly digital mess, has been rather politely sidelined. Which, if you ask me, is just… classic. We’re all so busy imagining robots taking over that we’re ignoring the fact that actual, flesh-and-blood (and very bored) hackers are already having a field day. It’s a lucrative business, this vulnerability. And I suspect, a rather satisfying one for the perpetrators.

Two companies are attempting to capitalize on our collective digital negligence: CrowdStrike and SentinelOne. Both are, let’s be frank, trying to sell us a digital security blanket. And honestly, who am I to judge? I’m currently debating whether to invest in a panic room for my apartment. It’s a rational response to the times, I assure you.

AI-Powered Security: A Bit of Tech Magic (and a Lot of Marketing)

Both CrowdStrike and SentinelOne operate on the same principle: AI agents sniffing around for anything that looks remotely suspicious. It’s like having a digital guard dog, constantly monitoring for intruders. When it spots something, it shuts things down. Sounds simple, doesn’t it? It’s remarkably effective, apparently. Which is comforting, until you realize just how many potential vulnerabilities there are. It’s a never-ending game of digital whack-a-mole, really.

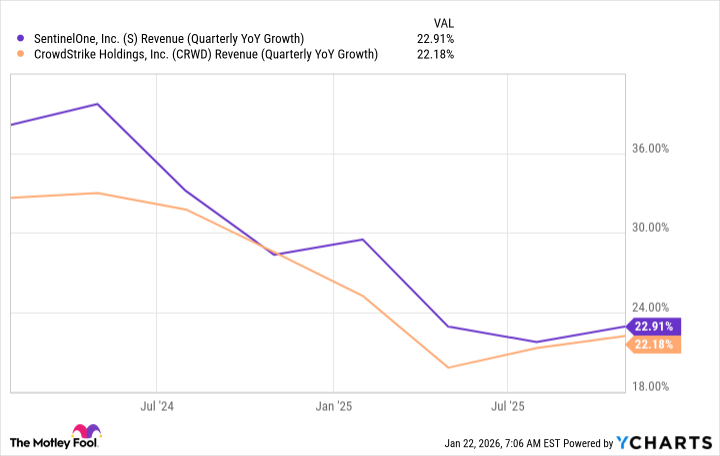

Growth rates are, predictably, slowing down. Everyone’s throwing money at generative AI, and security gets… overlooked. Which, again, feels a bit short-sighted. Still, 20% growth isn’t exactly a tragedy. It’s enough to keep the shareholders happy, at least for now. And isn’t that what really matters?

The cybersecurity market is expected to double in the next few years. CrowdStrike thinks it’ll hit $140 billion by 2026, then balloon to $300 billion by 2030. Ambitious, certainly. But let’s be real, in this digital age, those numbers aren’t exactly unbelievable. It’s a captive market, essentially. We need this stuff, whether we like it or not. And that, my friends, is a beautiful thing for investors.

There’s room for multiple winners, because, let’s face it, digital security is complex. It’s not a one-size-fits-all solution. But why am I even considering both CrowdStrike and SentinelOne? Well, because I’m a sucker for a good gamble. And because diversification is, allegedly, a smart move. Don’t judge me.

Investment Styles: The Leader and the… Hopeful

CrowdStrike is the established player, the reigning champion. Nearly $4.6 billion in revenue over the past year. SentinelOne? A respectable $956 million. It’s not a competition, really. It’s a… gentle nudge towards acknowledging who’s actually winning. SentinelOne will likely remain in its shadow, a persistent underdog. Which, honestly, I find rather endearing.

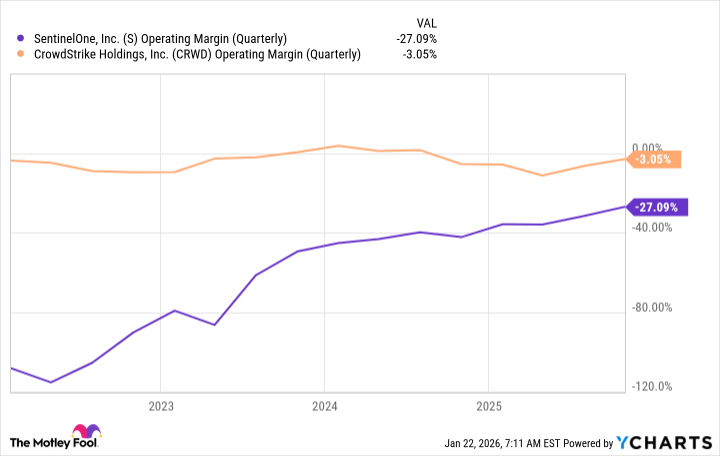

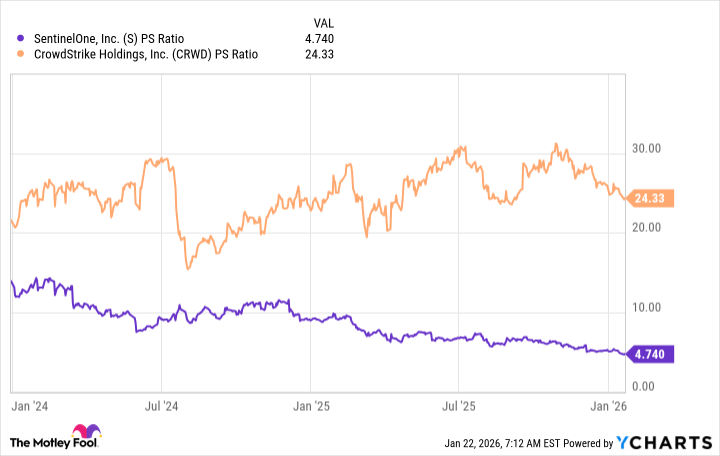

CrowdStrike is consistently profitable, or at least hovering around it. SentinelOne is… still working on that. The market is skeptical, naturally. And that skepticism is reflected in the price. It trades at a massive discount to CrowdStrike. Which, from a purely cynical perspective, is rather appealing. A little bit of risk for a potentially significant reward.

SentinelOne trades below five times sales. Cheap. Alarmingly cheap. It’s a software stock with long-term growth potential, trading at a bargain price. It’s almost… too good to be true. But I’m willing to take the risk. What’s the worst that could happen? (Don’t answer that.)

CrowdStrike, on the other hand, is not cheap. Twenty-four times sales. It’s a premium valuation, justified by its position as the best-in-class investment in the cybersecurity sector. It’s the safe bet. The sensible choice. Which, let’s be honest, is rarely the most exciting. But sometimes, sensible is good enough.

Both stocks make sense for the long term. Cybersecurity isn’t going anywhere. In fact, it’s only going to become more important as AI-assisted attackers become more sophisticated. It’s a grim thought, but a potentially profitable one.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-01-25 22:23