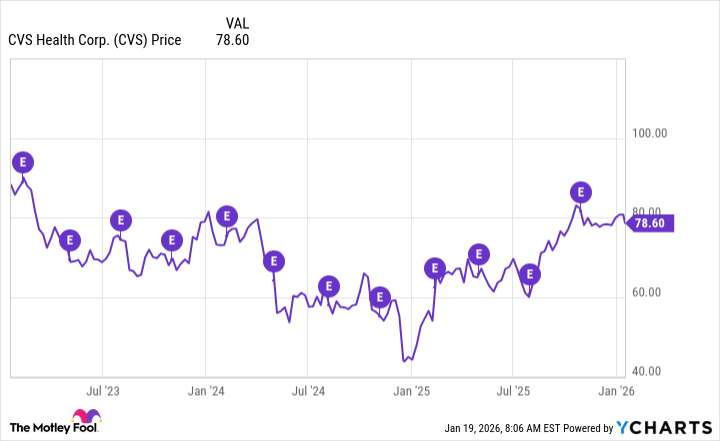

Now, CVS Health, that’s a name that rings a bell, don’t it? Last year, they had a bit of a frolic, share price climbin’ like a monkey up a greased pole – a good 77% leap, if you please. But a year before that? Well, let’s just say it was lookin’ a bit peaked, fallin’ faster than a politician’s promise. Seems they’ve righted the ship, or at least patched a few holes, with a new captain, Mr. David Joyner, takin’ the helm back in October of ’24. A fella can’t help but wonder if a change in leadership can truly turn the tide, but the early returns are…encouraging, shall we say.

Come February the tenth, they’ll be holdin’ a confab to talk over the latest reckonin’ for the fourth quarter. A bit of a showin’ of hands, if you will, to see which way the wind’s blowin’ for the year ahead. The question, then, is this: should a body go and buy a piece of CVS Health before they spill the beans, or is it wiser to sit tight and watch the cards fall?

How CVS Health Shares Dance After Earnings

Now, CVS ain’t usually one for wild swings after reportin’ its numbers. It don’t typically go jumpin’ and hollerin’ like a hound dog after a rabbit. More often, the real action happens in the quiet times, betwixt and between those quarterly pronouncements. And unless somethin’ truly unexpected turns up in the fourth quarter, I reckon that won’t change this time either. It’s a steady sort of company, not given to fits of exuberance or despair.

Last time they reported, back in October, they beat expectations, and even sweetened the pot with a bit of forward guidance. A solid showin’, to be sure, lookin’ to trim the fat and shutter the underperformers, all in the name of strengthenin’ the bottom line. But, confound it, the share price barely blinked. It’s been sittin’ pretty steady ever since. A healthcare stock that don’t usually cause a commotion? A big jump on earnings day is the exception, not the rule.

A Nickel’s Worth of Valuation

Anytime a company’s headin’ into earnings season, a prudent man ought to consider the price. Is it tradin’ at a premium, inflated like a balloon? That sets a high bar, and makes it difficult to rise, even with a strong performance. It’s like askin’ a mule to jump over a fence it ain’t got the legs for.

Right now, CVS Health is tradin’ at a forward price-to-earnings multiple of 11. A modest number, I say. The average stock on the S&P 500 is tradin’ at over 22. Despite a good rally last year, the valuation ain’t become unsustainable. In fact, a case could be made that there’s still some room to run, especially if they keep performin’ well. It’s a reasonable price for a reasonable company, and that’s a rare thing these days.

How they do in the fourth quarter, and what they say about the year ahead, could be a good sign of whether things are indeed lookin’ brighter for CVS. With a low earnings multiple, expectations don’t seem all that high, which is good news for a body lookin’ to buy before the report. It’s like findin’ a good horse at a bargain price – a rare opportunity indeed.

Is CVS Health a Worthy Investment Today?

CVS has been doin’ alright in recent quarters. They’ve got a diverse operation – pharmacy benefits, health insurance, and, of course, the retail pharmacy business. It all adds up to a well-balanced healthcare investment, the kind a body could hold onto for the long haul. It ain’t gonna make you rich overnight, but it’s a steady earner, like a good piece of farmland.

But, barring some grand surprise on earnings day, it don’t seem likely that the share price will go jumpin’ and hollerin’. And for that reason, there ain’t much point in rushin’ out to buy shares before then. It’s a good buy, to be sure, but there’s no harm in waitin’ to see what the fourth quarter brings, and what management has to say about the year ahead. It’s like waitin’ for the dust to settle before countin’ your chickens.

There’s no need to be hasty, friend. A prudent investor always takes the time to consider all the facts before makin’ a move. And in this case, a little patience might just be the wisest course of action.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-22 00:15