As a seasoned crypto investor with a decade-long journey under my belt, I must say that the NFT market of 2024 was a rollercoaster ride for me. Having witnessed the dizzying heights of the NFT boom in 2021 and 2022, I couldn’t help but feel a pang of nostalgia as the total sales figure for 2024 clocked in at just $8.83 billion – a meager 1.1% increase from the previous year.

However, it wasn’t all gloom and doom. Ethereum and Bitcoin continued their dominance in the NFT space, each registering impressive volumes of $3.1 billion. The rise of Bitcoin-based NFTs added an interesting dynamic to the competitive landscape, keeping me on my toes.

The market faced its fair share of struggles throughout the year, with sales volumes hitting a seven-month low in September. But the fourth quarter brought an unexpected recovery that had me rubbing my hands together in anticipation. The surge was primarily driven by Ethereum-based collections, which generated $482 million in December alone – a figure that made me reminisce about the old days when I would have been giddy with excitement at such numbers.

I am optimistic about the future of NFTs, as interest and innovation remain strong. The integration of NFTs into diverse sectors like fashion and gaming is intriguing, and I can’t wait to see what new use cases will emerge in the years to come. While the market isn’t without its challenges, such as legal disputes and regulatory uncertainties, I believe that it is resilient and poised for long-term growth.

In the spirit of transparency, let me share a lighthearted moment: as I watched my portfolio recover in December, I couldn’t help but think to myself, “It seems I may have to start saving up for a vacation again!” After all, who doesn’t love a good beach getaway after a year of crypto rollercoaster rides?

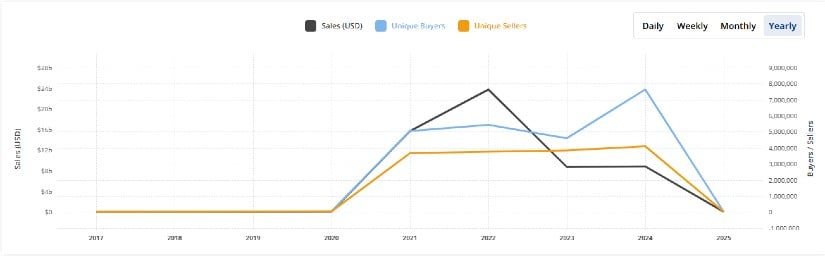

As an analyst, I observed that the non-fungible token (NFT) market experienced a modest recovery in 2024, culminating in a total sales volume of approximately $8.83 billion, representing a slight upward trend of 1.1% compared to the previous year’s figure of $8.7 billion, as reported by CryptoSlam.

Although this current data shows an upward trajectory, it’s important to note that the surge in NFT sales observed in 2021 and 2022 dwarfs this figure, with transactions amounting to a staggering $15.7 billion and $23.7 billion respectively during those years.

In my study as a researcher in 2024, it was found that Ethereum and Bitcoin dominated the Non-Fungible Token (NFT) sales market, each recording a staggering $3.1 billion in volume. Interestingly, Solana took the third spot with $1.4 billion. Notably, Ethereum retained its position as the all-time leader in NFT sales, boasting an impressive total of $44.9 billion. Solana and Bitcoin trailed behind with respective totals of $6.1 billion and $4.9 billion. Despite Ethereum’s ongoing dominance, the emergence of Bitcoin-based NFTs has introduced an intriguing competitive edge to the market landscape.

Market Struggles and a Late-Year Recovery

2024 saw some significant challenges for the NFT market, particularly during the first three quarters. After a continuous seven-month drop, sales reached their lowest point of $303 million in September. However, an unforeseen rebound occurred in the final quarter. Sales in October climbed by 18%, reaching $353 million. This positive trend persisted into November, which recorded a six-month high of $562 million in sales. The year concluded with a robust performance in December, boasting $877 million in sales – the fifth-highest monthly figure for that year.

In December, a significant increase was primarily fueled by Ethereum-centric collections, amassing approximately $482 million in sales. Bitcoin NFTs followed closely with around $172 million, while Solana-based collections contributed about $100 million. Notably, popular collections like Pudgy Penguins led the market with a staggering $115 million in sales for the month alone. Additional renowned collections such as Azuki, CryptoPunks, Doodles, and Bored Ape Yacht Club cumulatively added an additional $141 million to the total monthly earnings.

Industry Optimism and Evolving Trends

Despite not yet reaching previous peaks, enthusiasm and creativity within this field continue to thrive. As per Animoca Brands Chairman Yat Siu’s assertion, the sector appears to be on a prolonged journey, with NFT trading volumes potentially hitting billions every month once the broader cryptocurrency markets fully mature.

A fresh configuration is taking shape in the rapidly evolving NFT market as various trends emerge. The merging of traditional sectors like fashion and gaming expands the possibilities for NFTs even more. High-end brands and tech startups are now providing “hybrid” products that blend physical and digital ownership, a concept known as phygital. In the gaming sector, big companies are incorporating NFTs into their systems, though consumer responses have been varied.

Challenges and Legal Disputes

In simple terms, the world of Non-Fungible Tokens (NFTs) isn’t free from difficulties. As more organizations delve into blockchain-based initiatives, legal disagreements have become increasingly frequent. For example, sports organizations such as the NFL Players Association have encountered problems with NFT projects, underscoring the potential risks in this rapidly changing marketplace.

2024 saw a modest rebound for NFTs, but they’re still not close to their old peaks. Yet, the incorporation of NFTs across various fields and the rebuilding of investor trust indicate a robust industry on a path toward lasting expansion. As innovative applications continue to surface, NFTs remain a fluid and developing part of the Web3 landscape.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2025-01-02 16:20