As someone who has been closely watching the crypto market for years now, I must admit that the events of 2024 have been nothing short of exhilarating! The re-election of President Trump and the subsequent changes at the SEC have brought about a new era for digital assets.

2024 was a groundbreaking year in the world of cryptocurrencies, marked by numerous milestones that significantly shaped the industry. We’ve identified five key occurrences that had a profound impact on the crypto market, propelling it to new record highs.

2024 saw significant shifts in the cryptocurrency market, from the SEC’s endorsement of Bitcoin ETFs to the sensational surge of popular meme coins. Here are the top five pivotal moments that left their mark on the crypto sphere last year.

The SEC Approves Spot Bitcoin ETFs

2023’s Q4 saw Grayscale securing an unexpected court victory against the SEC over transforming its Bitcoin Trust into an Exchange-Traded Fund (ETF). This triumph sparked a wave of anticipation among asset management companies to introduce Bitcoin to institutional markets, which became a reality in January 2024.

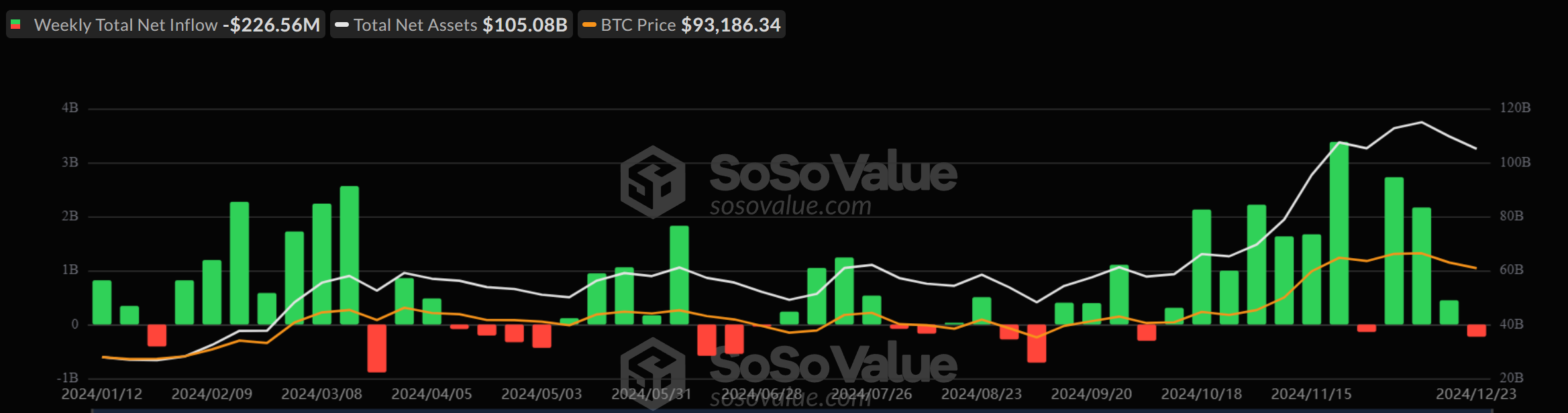

By Christmas 2024, the combined total net assets of the twelve U.S.-based Bitcoin Exchange-Traded Funds (ETFs) surpassed $105 billion, accounting for approximately 5.7% of all Bitcoins in circulation. What’s particularly noteworthy is that these Bitcoin ETFs now manage more assets than Gold ETFs. This remarkable achievement suggests the increasing institutional interest in Bitcoin, paving the way for further crypto adoption. Subsequently, Ethereum ETFs were also approved, and various other cryptocurrencies are currently under review with the Securities and Exchange Commission (SEC).

According to Forest Bai, Co-founder of Foresight Ventures, speaking with BeInCrypto, this year’s market trends have demonstrated the crucial impact that regulated financial products can have in increasing adoption. The substantial investments into existing ETFs indicate a robust appetite for controlled crypto investment vehicles. As market performance continues to favor additional assets, financial institutions are encouraged to expand their offerings. By 2025, we anticipate an array of diverse crypto ETFs entering the market.

As Bitcoin ETFs pave the way, industry experts anticipate that 2025 will present a more expansive platform, with a variety of crypto ETFs taking center stage in the retail market. Kadan Stadelmann, CTO at Komodo Platform, believes Solana ETFs may gain prominence due to Donald Trump’s earlier launch of his NFT collection on that network.

On the other hand, some professionals in the field express reservations, fearing that the growing tide of these investments might cause difficulties in maintaining sufficient liquidity.

In the words of John Patrick Mullin, CEO and Co-Founder of MANTRA, speaking to BeInCrypto, “Cryptocurrencies have their own unique cycles, and factors like retail activity, growth in DeFi, and global acceptance significantly influence price fluctuations. However, it’s important to consider the potential risk if a large amount of liquidity is channeled into conventional markets through ETFs. To ensure crypto’s long-term success, we should emphasize on creating decentralized solutions that aren’t overly dependent on external validation.

The Surge of Solana Meme Coins

2024 stands out in the minds of cryptocurrency enthusiasts as the year that saw a frenzy surrounding the Solana-based meme coin trend. Although these meme coins had been present on Solana previously, it was platforms such as Pump.fun that significantly boosted their fame.

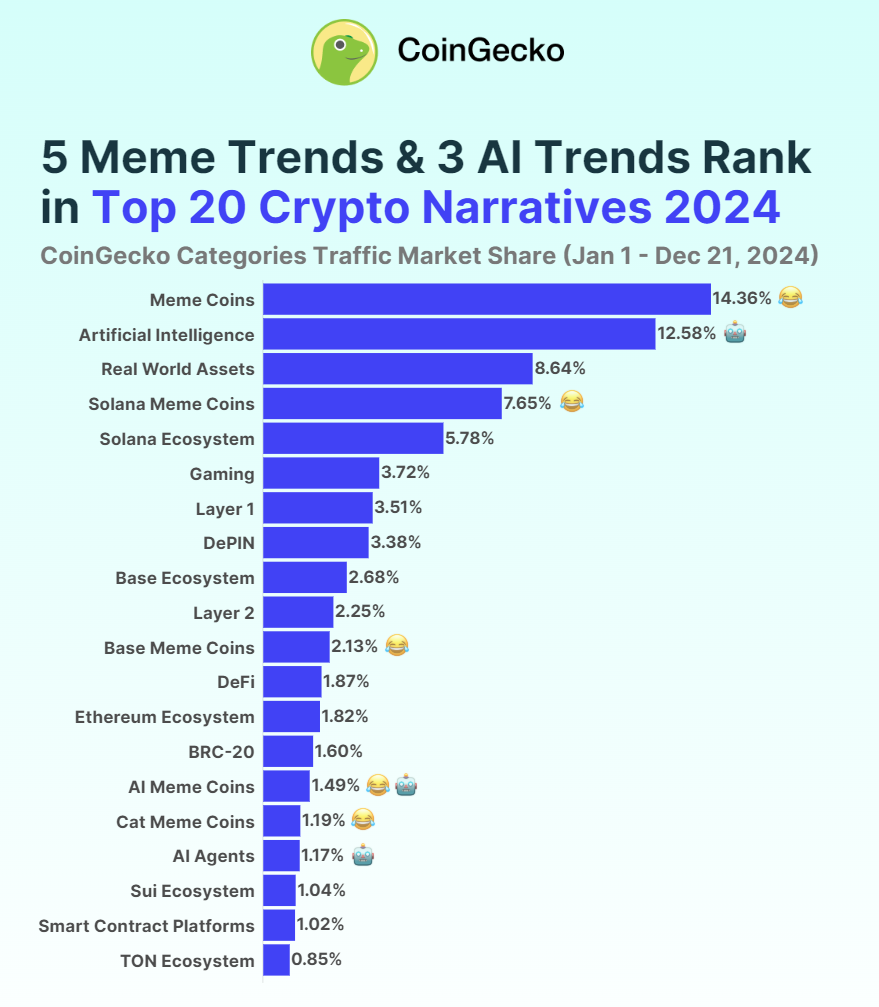

4th place among meme coins on Solana saw heightened investor attention, representing approximately 7.65% of all crypto-related conversation topics, as reported by CoinGecko.

Additionally, the combined market value of meme coins built on the Solana platform has now surpassed $16 billion. Notably, three out of the top five meme coins currently in circulation, such as Dogwifhat (WIF) and BONK, are powered by the Solana network. This year, WIF has skyrocketed by 1,100%, while BONK has seen a remarkable growth of approximately 38,000% over a two-year period.

Jonathan Schemoul, the CEO of Aleph.im and a key player in LibertAI, stated that while meme coins are currently trendy, he foresees their influence waning as we transition towards blockchain applications with genuine utility and widespread acceptance. He also mentioned that innovative technologies such as AI agents and confidential computing could steer focus towards more significant and beneficial blockchain use cases,” is a possible paraphrase of the original sentence.

As a researcher, I’ve noticed an intriguing trend: the increased popularity of meme coins has propelled Solana to become the second-largest blockchain, just behind Ethereum. The network’s value locked (TVL) soared beyond $8.6 billion, with SOL hitting a new peak of $263 in November, marking an all-time high for this cryptocurrency.

It seems that one reason behind Solana’s popularity among meme coin creators in 2024 could be attributed to its strengths in scalability and accessibility. Platforms such as Pump.fun have made it straightforward for users to effortlessly launch tokens, simplifying the process of creating and deploying a meme coin.

2024 solidified Solana’s rule over the meme coin sector, but 2025 could witness a shift towards diversification as AI meme coins gain momentum. As tech companies like ai16z and Crew AI unveil open-source platforms for self-governing AI agents, the creation of AI-driven tokens has become easier than before. This development might motivate projects to explore alternative blockchains, such as Sui, which, due to its quick transactions and low costs, is a suitable fit for AI meme coins. According to Hisham Khan, CEO & Co-founder of Atoma, this was shared with BeInCrypto.

Furthermore, Solana’s affordable transaction costs have encouraged a broad user base, merging humor with financial potential. This dynamic environment has spurred the rapid expansion of meme coins on Solana in 2024.

In a recent interview with BeInCrypto, Matt O’Connor, one of the co-founders of Legion, remarked that there’s a shift happening – from the rapid trend of memes to a focus on substance, from temporary price fluctuations and deceptive practices to long-term projects with genuine utility, and widespread community acceptance.

Donald Trump’s Election Victory

While crypto is all about decentralization, the political influence in the industry is undeniable due to the regulatory factor. Donald Trump’s election victory in 2024 has significantly impacted the cryptocurrency industry, ushering in a period of optimism and growth.

His administration’s supportive attitude towards cryptocurrency has instigated a series of significant advancements, well ahead of when his presidency officially starts.

After Donald Trump’s victory, the cryptocurrency market experienced a significant growth of approximately $1 trillion, as investors perceived less stringent regulation would follow. This surge allowed Bitcoin to reach unprecedented highs and eventually surpassed the $100,000 mark.

Nevertheless, the legal action brought forth by the Securities and Exchange Commission (SEC) against Ripple‘s XRP had a significant effect, stagnating it for almost four years. Following Donald Trump’s election win and his pledge to reorganize the SEC, XRP soared to a six-year peak.

If the United States persists in relaxing its restrictions, it might spark a chain reaction worldwide. Notably, countries such as China and Russia may not immediately embrace cryptocurrencies, but they are likely to pay close attention—particularly as tokenized assets and blockchain technology grow increasingly vital to international finance—according to John Patrick Mullin, CEO and Co-Founder of MANTRA.

1) A positive stance by the authorities is drawing in institutional investors to the market, lending credibility to digital assets. The selection of pro-cryptocurrency figures like Paul Atkins, David Sacks, and Elon Musk by Trump suggests a move towards more accommodating cryptocurrency regulations.

Moreover, during his campaign, Trump hinted at the establishment of a national Bitcoin reserve, an ambition that seems to be shared by his fellow Republican senators. These talks underscore a dedication to incorporating cryptocurrencies within our country’s financial infrastructure.

Maksym Sakharov, co-founder of WeFi, shared with BeInCrypto that the proposed strategy for a Bitcoin reserve is exceptionally bold on a large economic scale. The incoming President has also revealed intentions to phase out the drive for a Central Bank Digital Currency (CBDC), while expressing support for policies that will strengthen individual ownership of cryptocurrencies. Sakharov noted that influential figures in the crypto sector have a strong connection with the president, which could be crucial in helping the new administration fulfill its commitments regarding cryptocurrencies.

1) Policies favorable to cryptocurrency have sparked a surge in its use worldwide. It’s worth noting that the number of young adults (aged 18-25) using crypto has increased by an impressive 683%, suggesting a growing fascination with this technology among younger generations.

Crypto-based exchange-traded products have been receiving significant investments in European markets too, suggesting a broadly positive outlook on the sector’s growth potential.

Forest Bai, Co-founder of Foresight Ventures, stated that a change in the U.S.’s stance on cryptocurrency could lead to increased legitimacy and wider acceptance globally, possibly establishing a model for other regions to emulate. Notably, Hong Kong has arisen as a crucial entry point for China’s crypto market and innovation. The pro-crypto attitude of Hong Kong is clear—it introduced Ethereum ETFs before the U.S., underscoring its receptiveness towards digital assets.

With continuous advancements in the sector, it’s highly probable that sustained backing from top government officials will significantly influence where this industry is headed.

Bitcoin Reached $100,000

2024 saw what many anticipated to be the most significant and noteworthy occurrence: Bitcoin surpassing $100,000. This milestone was psychologically important for Bitcoin and the broader crypto community, symbolizing its growth into a mature financial asset. This significant number instilled increased confidence in both institutional and individual investors, reflecting their faith in Bitcoin’s potential.

For companies like MicroStrategy, which always championed a Bitcoin-first strategy, this was an assertion of their projections. This is reflected in MSTR’s stock performance and its recent inclusion in the Nasdaq-100.

Moreover, following the achievement of the $100,000 mark, an increasing number of governments are contemplating the notion of holding Bitcoins in reserve, acknowledging its role as a store of value. This shift in attitude is observed not only in countries that were initially favorable to crypto, but also in those traditionally skeptical, such as Russia and Japan.

Companies such as Amazon may also be considering investments in Bitcoin, hinting at a possible incorporation of digital currencies into their operational structures. This growing curiosity from prominent businesses might catalyze broader acceptance and progress within the cryptocurrency sphere.

“While this historic milestone demonstrated how policy shifts catalyze institutional adoption, recent pullbacks remind us that even Trump’s pro-crypto stance was quickly priced in after the initial rally. Key financial hubs around the world are already recalibrating their approaches. However, market volatility will likely persist amid macro-economic uncertainty, particularly given the Fed’s unclear rate cut timeline for 2025,” OKX Global CCO, Lennix Lai told BeInCrypto.

To put it simply, hitting $100,000 gave Bitcoin more credibility and prompted a wider acceptance, not just among the general public but also in private businesses. Yet, it’s crucial to remember that its volatility, influenced by broader economic instability, remains significant.

Gary Genslar’s Resignation

As a researcher, I’ve found that Gary Gensler’s tenure at the Securities and Exchange Commission (SEC) presented some hurdles for the cryptocurrency sector within the United States. Now, with President Trump’s re-election, there appears to be a substantial transformation taking place within the SEC, which could potentially impact the crypto industry significantly.

In November, Gary Gensler stepped down from his role as the Chair of the Securities and Exchange Commission (SEC). Known for his tough stance on regulations, Gensler has been a point of contention within the cryptocurrency sector.

According to Sander Gortjes, CEO of HELLO Labs, Gensler’s policy was quite rigid, but it remains uncertain if we will move towards an equally extreme stance. However, there is already noticeable progress in striving for a balanced approach and action from the SEC, as suggested by Gortjes to BeInCrypto.

In the time he served, Gensler argued that a majority of cryptocurrency tokens fall under the category of unregistered securities, thereby requiring adherence to existing securities regulations. This stance resulted in regulatory actions against significant crypto exchanges like Binance and Coinbase for functioning without proper registration.

Critics contend that Gensler’s approach to regulation through enforcement has fostered an atmosphere of doubt and stifled creativity in the cryptocurrency sector. On the other hand, Trump has chosen Paul Atkins as his successor, who is well-known for championing digital assets over a long period.

To achieve greater regulatory certainty in the cryptocurrency sector, several key factors must align: global regulators must coordinate their approaches, markets must develop fully, and institutions need to be adequately prepared. Enacting more favorable crypto regulations may attract institutional investors, but it’s essential to keep in mind that cryptocurrencies will continue exhibiting volatility – with Bitcoin experiencing fluctuations of up to 10-15%, and even larger swings in smaller tokens – regardless of the regulatory landscape, as stated by OKX Global CCO, Lennix Lai.

In the eyes of cryptocurrency enthusiasts, this shift is seen as a chance for a more industry-friendly regulatory climate. They believe that the incoming government may enact policies that foster growth within the crypto sector.

Maksym Sakharov of WeFi stated to BeInCrypto that Gary Gensler is not responsible for initiating the crypto regulatory actions by the U.S. SEC, but he has expanded these enforcement efforts more than his predecessors did. In this context, Paul Atkins suggests that innovators in the market might find it simpler and potentially more beneficial to engage with the regulator.

In essence, during his time at the SEC, Gensler took a firm approach towards regulating cryptocurrencies, which often created tension with those in the industry who viewed his regulations as barriers to innovation and expansion.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Minecraft update ranked from worst to best

2024-12-25 19:37