On a dreary Wednesday, when the clouds hung low and the air was thick with the scent of disappointment, Evgeny Gaevoy, the ever-astute founder of Wintermute, took it upon himself to slice through the fog surrounding the crypto industry. With a candidness that could cut glass, he stated, as if reading the mood of a beleaguered nation, that this once-vibrant world had tripped over its own ambitions, leaving little more than speculation dancing in the limelight.

Gaevoy Takes Aim at Stablecoins, Perpetual Exchanges, and Token Shenanigans

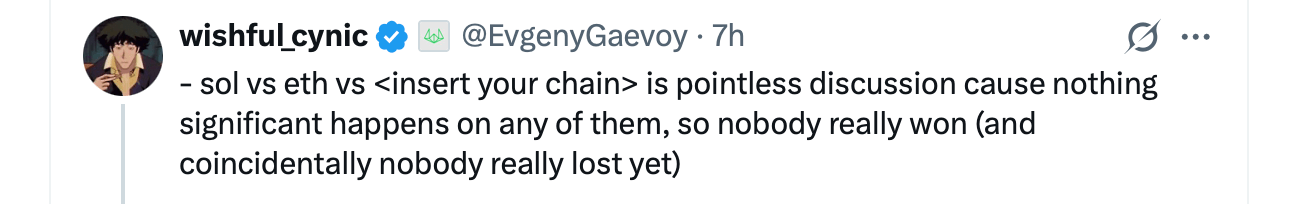

In a thread that could only be described as a modern-day manifesto, Gaevoy expressed his exasperation with the ongoing tug-of-war between blockchains. It seemed to him, and likely to anyone with a passing interest, that these debates were akin to arguing whether one shade of gray was better than another. In the end, none had managed to pull a rabbit out of the hat worthy of applause.

He turned his gaze toward the so-called stablecoins, which he labeled a narrow success. They were like a bandage on a festering wound, providing no genuine change to the industry’s underlying structure. In Gaevoy’s eyes, stablecoins merely replaced one set of centralized gatekeepers with another, albeit ones that were considerably more efficient at counting their coins.

His sharpest barbs were reserved for the decentralized perpetual futures platforms, which he likened to an old dog trying to learn new tricks but failing spectacularly. “I don’t think anything built on blockchains is scaling,” he quipped, as if declaring that even the best intentions would crumble under pressure. “It’s very far from obvious,” he continued, that these platforms could ever hope to measure up to the well-oiled machinery of traditional market infrastructure.

In a moment of almost poetic clarity, he contrasted the wild west of crypto with the sober risk management model employed by the Chicago Mercantile Exchange (CME), where risk was spread like butter on warm toast, ensuring that no single entity bore the brunt of a bad day.

When asked about the decentralized derivatives platform Hyperliquid, Gaevoy chuckled dryly, “The CME risk engine is decentralized in practice, via prime brokers, and scales beautifully.” Meanwhile, he noted with a grimace that current crypto designs were struggling to juggle liquidations, automatic deleveraging, and insurance funds-a circus act that was all too easily doomed to fail.

Yet, beyond the crumbling infrastructure, Gaevoy lamented the erosion of crypto’s original philosophy. He observed that Bitcoin, once the beacon of hope and decentralization, had become merely a pawn in the endless game of price fixation, where the only mantra seemed to be “number go up.” This fixation, he argued, had swept across the sector like a tide, washing away the cypherpunk ideals that once inspired the faithful.

Gaevoy pointed a finger at Ethereum co-founder Vitalik Buterin, a rare breed still clinging to first principles, suggesting that too many influential voices had traded foundational goals for the fleeting approval of institutional validation-like a child seeking validation from a parent only to be disappointed.

Token economics also came under his scathing critique. He dismissed buybacks, lockups, and other common design choices as mere smoke and mirrors, while noting that skepticism towards airdrops might just be the rare point of consensus amidst the chaos.

Despite his biting remarks, Gaevoy held on to a flicker of cautious optimism. He suggested that perhaps the lack of fervent political or speculative enthusiasm would sift out the short-term players, leaving behind those committed to building something of substance. When a fellow user pressed him for the source of his optimism, he replied, with a wry smile, “wishful cynic, it’s in the name.”

His words resonated like a warning bell among industry veterans, who felt the creeping unease as technical ambition and ideological clarity succumbed to a wave of financial engineering and narrative cycles, all while crypto continued to draw in capital and attention, like a moth to a flame.

FAQ ❓

- Who is Evgeny Gaevoy?

Evgeny Gaevoy is the founder and CEO of crypto market-making firm Wintermute. - What did Gaevoy criticize in his X thread?

He criticized blockchain scaling limits, stablecoins, perpetual exchanges, and current token design practices, as if they were all wearing clown suits at a funeral. - Why did Gaevoy compare crypto to CME?

He argued that CME’s distributed risk model scales more effectively than current onchain risk engines, like comparing a well-trained horse to a stubborn mule. - Is Gaevoy bearish on crypto overall?

While critical, he said he remains cautiously optimistic as speculative participants exit the market, like weeds being pulled from a garden.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Best Actors Who Have Played Hamlet, Ranked

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-02-05 03:47