Ah, the once-mighty bonds, now languishing in the depths of financial despair, while bitcoin pirouettes to dizzying heights! Financial advisors, those modern-day alchemists, are now whispering sweet nothings about tossing bonds into the abyss and embracing the shimmering allure of crypto. Who knew the future of finance would resemble a high-stakes game of musical chairs? 🎶💰

Abra’s Barhydt Predicts Crypto Will Replace Classic 60/40 Asset Allocation

Behold the ancient wisdom of the “60/40” portfolio, a relic of yesteryears, now teetering on the brink of extinction, much like the dodo bird. Bill Barhydt, the illustrious CEO of Abra, a crypto wealth management platform, recently divulged this revelation to TopMob in an interview that could only be described as a financial soap opera.

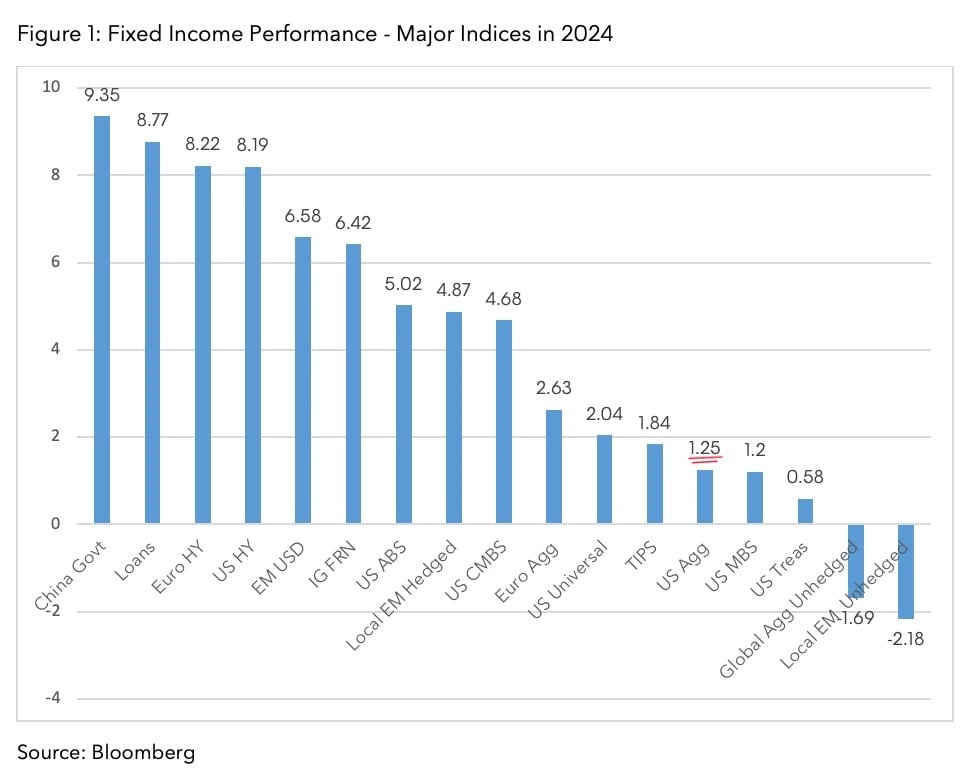

“Currently, the traditional model at a wealth advisor is the 60-40 model,” Barhydt mused, with a twinkle in his eye. “And we all know how well the ‘40’ has fared,” he quipped, casting a sardonic glance at the dismal bond market performance that has left many investors clutching their pearls. Bloomberg’s U.S. Aggregate Bond Index returned a meager 1.25% in 2024, and an even more disheartening negative 0.05% over the past five years. Talk about a financial faceplant! 🤦♂️

Barhydt, a man of many hats—CIA operative, NASA enthusiast, Goldman Sachs wizard, and a Netscape aficionado—initially birthed Abra as a humble bitcoin remittance app. The company, like a chameleon, underwent several transformations before settling into the plush realm of crypto wealth management.

“That’s the beauty of being ahead of the curve,” Barhydt remarked, with a hint of mischief. “The market has a way of guiding you, if only you’re attuned to its whispers.”

At the 7th Annual Vision Conference in Arlington, Texas, Barhydt didn’t just grace the stage with his presence; he also lent an ear to the investment advisor community’s musings on crypto. This gathering, orchestrated by the Digital Assets Council of Financial Professionals (DACFP), typically draws a crowd of eager advisors, some of whom might even be wearing their best “I love crypto” T-shirts.

“The atmosphere has undergone a radical metamorphosis,” Barhydt observed, reflecting on the conference’s evolution. “Five years ago, I was met with skepticism and derision—‘magic Internet money nonsense,’ they said. Now, it’s a chorus of ‘Hey, we need to offer this to our clients!’” Who knew crypto could be the life of the party? 🎉

Barhydt recounted how Ric Edelman, the TradFi advisor turned crypto zealot and founder of DACFP, boldly declared the demise of the 60/40 model. “The allocation model you’re familiar with—stocks and bonds—must now be replaced by one featuring stocks, crypto, and bonds,” Edelman proclaimed, as if announcing the arrival of a new era. “The correct allocation now is to place 70% to 100% of the client’s portfolio into stocks and crypto, with no more than 30% in bonds, and potentially zero in debt securities.” Talk about a financial revolution! 🚀

With a veritable flood of new business on the horizon, Abra is positioning itself as the go-to sanctuary for advisors seeking crypto exposure for their clients’ portfolios. The company offers not just spot crypto, but also borrowing, lending, yield, and a cornucopia of other services. It’s like a buffet for the financially adventurous!

“If you’re on zero [allocation], now is the time to get off zero,” Barhydt declared, with the fervor of a preacher at a revival. “Bitcoin represents the best economic opportunity of our lifetime.” So, dear reader, are you ready to dive into the crypto rabbit hole? 🐇💸

Read More

2025-06-14 12:57